Global Inventory Tags Market Size By Label Type (Plastic, Paper, Metal), By Printing Technology (Digital Printing, Flexography, Lithography, Screen Printing), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 - 2032

Industry: Semiconductors & ElectronicsGlobal Inventory Tags Market Size Insights Forecasts to 2032

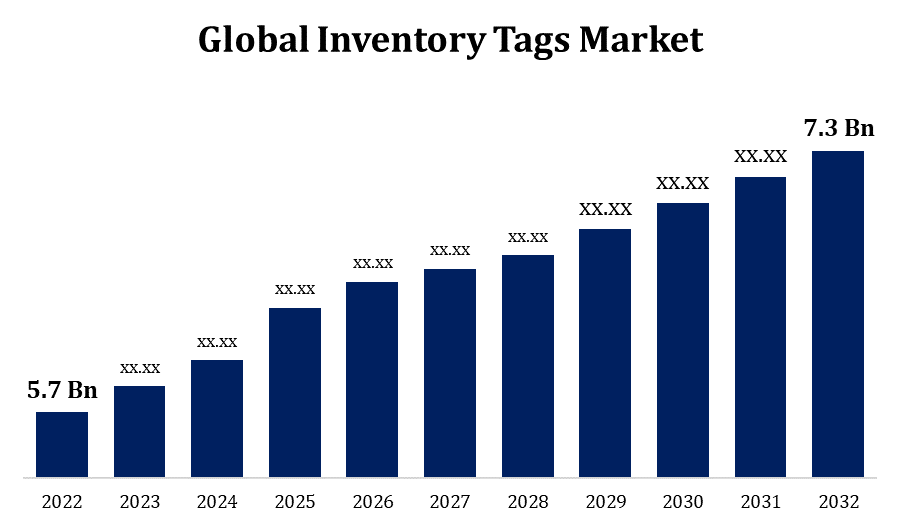

- The Global Inventory Tags Market Size was valued at USD 5.7 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.2% from 2022 to 2032

- The Worldwide Inventory Tags Market Size is expected to reach USD 7.3 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Inventory Tags Market Size is expected to reach USD 7.3 Billion by 2032, at a CAGR of 4.2% during the forecast period 2022 to 2032.

Inventory tags are essential for keeping track of things and properly managing stock. The inventory tags industry has Grown to offer a variety of options, ranging from traditional barcode tags to RFID tags. Barcode tags are inexpensive and extensively used, whereas RFID tags offer real-time tracking and automation. Specialty tags for certain industries, such as robust tags for outdoor use or tamper-evident tags for security, are also available on the market. Several factors impact the growth of the inventory tags market, including the increasing requirement for efficient inventory management, the increased adoption of automation technologies, and the rise of e-commerce. Demand for enhanced inventory tagging systems is increasing as firms look for improved supply chain visibility and efficient operations.

Inventory Tags Market Value Chain Analysis

Companies at this stage develop, manufacture, and customise inventory tags based on client requirements. Traditional barcode tags, RFID tags, and other speciality tags are all included. Tags are made and supplied to merchants, wholesalers, or end-users. This stage entails overseeing the logistics of delivering the tags to various points throughout the supply chain. Businesses in various industries buy and use inventory tags to meet their specific demands. This could range from retail outlets tracking products with barcode tags to manufacturing plants tracking inventory in real time with RFID tags. For comprehensive inventory management, several organisations link inventory tags with software systems. Tags are integrated with ERP (Enterprise Resource Planning) systems, WMS (Warehouse Management Systems), or other applicable applications at this level. Tags are attached to items, equipment, or assets in order to track them. This step entails using the tags in day-to-day activities, such as scanning barcode tags during checkouts or using RFID tags for automated tracking.

Inventory Tags Market Opportunity Analysis

As technology progresses, more complex technologies may be included into inventory tags. Combining RFID and IoT (Internet of Things), for example, can provide real-time, granular data on the location and status of inventory goods. With a rising emphasis on sustainability, there is an opportunity to create environmentally friendly inventory tags. This might include using recycled materials, reducing waste during the manufacturing process, or even looking into biodegradable tags. Creating user-friendly mobile applications that interact with inventory tags can improve accessibility and convenience of use. This could include mobile-accessible services such as real-time tracking, inventory alerts, and analytics. Offering complete training and support services to organisations who employ inventory tags can be a lucrative opportunity.

Global Inventory Tags Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.7 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.2% |

| 2032 Value Projection: | USD 7.3 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Printing Technology, By Region, By Geographic Scope . |

| Companies covered:: | Cenveo Inc., Smartrac N.V., Avery Dennison Corporation, Hewlett-Packard Company, Checkpoint Systems Inc., Alien Technology Inc., Tyco International Plc, 3M Company, Brady Corporation, Zebra Technologies Corporation, and |

| Growth Drivers: | Growing need for automatic identification |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Inventory Tags Market Dynamics

Growing need for automatic identification

Inventory goods may be tracked in real time throughout the supply chain thanks to automatic identification. This real-time visibility is critical for businesses to make educated decisions, optimise stock levels, and respond quickly to demand changes. Identification process automation lowers the requirement for manual labour in operations such as data entry and inventory counting. This reduces labour expenses while also allowing people to focus on more strategic and value-added activities. From collecting and storing goods to order fulfilment, automatic identification streamlines several operational operations. This efficiency results in overall operational optimisation and shorter lead times. Automatic identification technologies work in tandem with digital technologies like the Internet of Things (IoT) and cloud computing.

Restraints & Challenges

Advanced inventory tagging systems, particularly RFID technology, can be costly to implement. Due to budget limits, small and medium-sized businesses may experience difficulties in adopting these technologies. With the increasing reliance on digital technology, it is critical to ensure the security of data held on inventory tags. Businesses have difficulties in safeguarding sensitive information from potential cyber threats and unauthorised access. The lack of uniform standards for inventory labelling might cause interoperability issues. Different industries and countries may utilise different tagging methods, making it difficult to interchange information across supply chains. Businesses with complicated worldwide supply chains may have difficulties in standardising inventory tagging practises across different countries and meeting various regulatory requirements.

Regional Forecasts

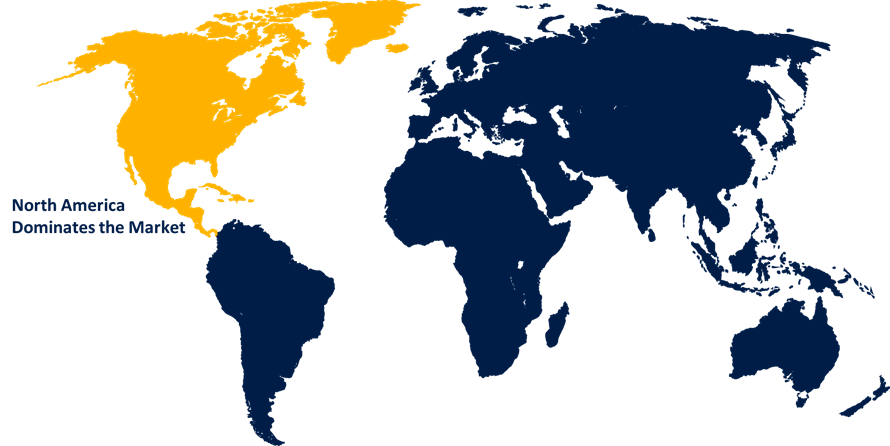

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Inventory Tags Market from 2023 to 2032. RFID technology is increasingly being used for inventory management by North American firms. RFID tags provide real-time tracking, resulting in increased efficiency and accuracy in supply chain processes. The continuing expansion of e-commerce in North America has increased the demand for effective inventory tracking and management. Inventory tags are critical in the e-commerce industry for assuring accurate order fulfilment and timely deliveries. North American businesses are combining inventory tags with IoT and cloud computing technology to acquire real-time data and analytics. This integration improves supply chain insight and decision-making skills. Businesses in North America are investing heavily in technology to modernise their operations. To remain competitive, cut expenses, and enhance overall efficiency, modern inventory tagging technologies must be implemented.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia Pacific region is rapidly industrialising and urbanising, which is increasing need for efficient inventory management solutions. This trend is driving the use of sophisticated inventory tags in a variety of industries. The inventory tags market is being pushed by Asia Pacific's thriving e-commerce sector, which is being led by a growing middle class and improved internet access. Inventory management is critical to meeting the demands of online customers. Emerging markets in Asia Pacific, including China, India, and Southeast Asian nations, are rapidly adopting technology. Adoption of advanced inventory tagging technology to improve supply chain visibility and efficiency is one example. Asia Pacific is a cross-border commercial hub, so effective logistics are critical.

Segmentation Analysis

Insights by Label Type

Plastic segment accounted for the largest market share over the forecast period 2023 to 2032. Plastic tags are water, chemical, and UV radiation resistant. Because of this resistance, they are appropriate for industries like as manufacturing, construction, and logistics, where exposure to various environmental conditions is prevalent. Plastic tags are frequently less expensive than alternative materials, especially when durability and endurance are considered. Because of their low cost, they are an appealing option for organisations searching for a dependable and cost-effective solution. Plastic tags can be used for a variety of purposes. Their adaptability makes them applicable to varied industry demands, whether for asset tracking, inventory management, or product labelling.

Insights by Printing Technology

Digital Printing segment accounted for the largest market share over the forecast period 2023 to 2032. High-resolution and detailed printing is possible with digital printing technology, enabling for the manufacture of visually appealing and useful inventory tags. This is especially true for tags that contain barcodes, QR codes, and other identification information. Digital printing is economical for short to medium print runs. Traditional printing processes may have higher setup expenses, making digital printing more cost effective for firms who need less quantities of customised tags. By enabling on-demand printing, digital printing reduces waste. Unlike traditional printing technologies, which may necessitate enormous print runs, digital printing allows firms to produce only what they need at a given moment, avoiding excess inventory and waste. Colour accuracy and uniformity are ensured by digital printing technology throughout the print run.

Recent Market Developments

- In May 2022, HID Global, a global leader in trusted identity solutions, has acquired Vizinex RFID.

Competitive Landscape

Major players in the market

- Cenveo Inc.

- Smartrac N.V.

- Avery Dennison Corporation

- Hewlett-Packard Company

- Checkpoint Systems Inc.

- Alien Technology Inc.

- Tyco International Plc

- 3M Company

- Brady Corporation

- Zebra Technologies Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Inventory Tags Market, Label Type Analysis

- Plastic

- Paper

- Metal

Inventory Tags Market, Printing Technology Analysis

- Digital Printing

- Flexography

- Lithography

- Screen Printing

Inventory Tags Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?