Global Insulation Products Market Size, Share, and COVID-19 Impact Analysis, By Type (Stone Wool, Glass Wool, Fiberglass, EPS, XPS, CMS Fibers, Calcium Silicate, Aerogel, Cellulose, PIR, Polyurethane Foam, Flexible Elastomeric Foam, Phenolic Foam, Others), By Industry Verticals (Construction, Industrial, HVAC & OEM, Automotive & Transportation, Appliances, Furniture, Oil & Gas, Packaging, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Construction & ManufacturingGlobal Insulation Products Market Insights Forecasts to 2032

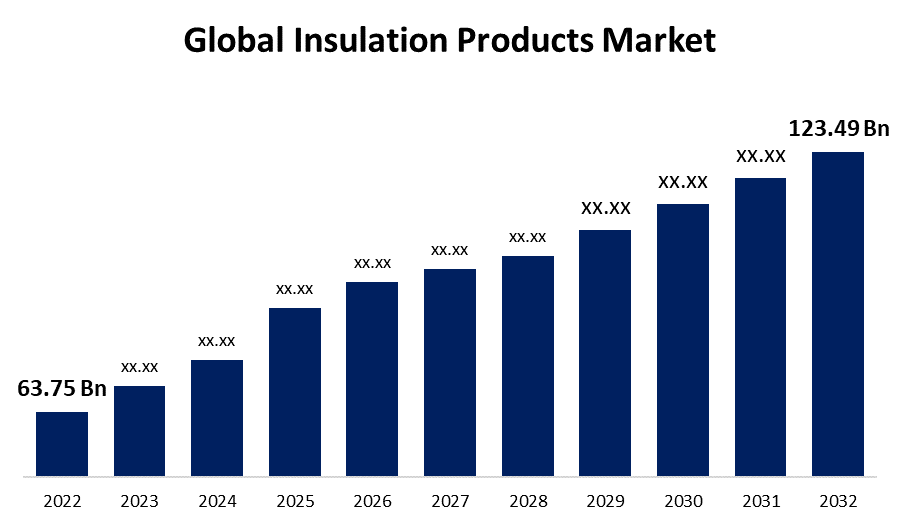

- The Global Insulation Products Market Size was valued at USD 63.75 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.8% from 2022 to 2032

- The Worldwide Insulation Products Market Size is expected to reach USD 123.49 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Insulation Products Market Size is expected to reach USD 123.49 Billion by 2032, at a CAGR of 6.8% during the forecast period 2022 to 2032.

Insulation products or materials are non-conducting components intended to separate everything from its surroundings and keep it in its normal state of functioning. Insulation materials are employed in the construction industry to prevent noise, electricity, and heat from passing through the interior or exterior of electrical appliances and building materials. Thermal, electrical, and acoustic insulation are the three main types of insulation materials sector in general. The suitable deployment of high-quality insulation materials is an essential component of an effective insulation system. Mineral fibers and plastic foams are the two primary categories of insulating materials. Mineral wools, such as glass wool and stone wool, are used in mineral fibers. Plastic foams such as expanded polystyrene (EPS), extruded polystyrene (XPS), polyurethane (PU), polyisocyanurate (PIR), cellulose, aerogels, and others are also used. Insulating products made from these components are utilized in the building and construction industries, as well as in heating, ventilation, and air conditioning activities. Insulation is a critical technique for reducing the use of electricity in buildings and preventing heat gain/loss. It works as a heat flow barrier and is crucial for maintaining homes warm in the winter and cool in the summer.

The major key players in the Global Insulation Product Market include Huntsman Corporation, Rockwool International A/S, Cellofoam International, Recticel, Saint-Gobain ISOVER, Owens Corning Corp., Rogers Corporation, Knauf Insulation, DuPont, BASF, Evonik, and many others. The leading players in the insulation products market have used several tactics to consolidate their product portfolios, radiate their reach in the marketplace, and improve their prospects for future growth.

For instance, on May 2023, Solvay has introduced KetaSpire® KT-857, a novel polyetheretherketone (PEEK) extrusion compound specifically intended for copper magnet wire insulation in electric motors. The shift by OEMs toward higher density batteries and electric powertrains operating at 800V or higher to solve consumer range anxiety drove the creation of the custom-engineered insulating material. Solvay's new magnet wire PEEK insulating material not only improves adhesion in a faster and more cost-effective monolayer process, but it also has key sustainability benefits.

Global Insulation Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 63.75 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.8% |

| 2032 Value Projection: | USD 123.49 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Industry, By Region |

| Companies covered:: | Soprema Group, Huntsman Corporation, Rockwool International A/S, Cellofoam International, Recticel, Saint-Gobain ISOVER, Owens Corning Corp., Rogers Corporation, Knauf Insulation, DuPont, BASF, Evonik, China Jushi Co. Ltd., Covestro AG, Armacell International S.A., Atlas Roofing Corporation, Cellofoam North America, Inc., GAF Materials Corporation |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Insulation products have recently gained popularity in the building and construction industries all around the world. Over the projection period, the increasing momentum of developing energy-efficient buildings has driven up demand for insulation products. Expanding in the transportation and consumer end-use industries drives increased demand for insulation products. The growing recognition of acoustic insulation in architecture and construction applications also represents a key trend for the global insulation products market. Furthermore, the rising demand for cost-effective products and equipment, acoustic insulation in partitions, and technological advancements in HVAC equipment in the construction industry are driving the market for insulation products. Steady advancement in the automotive sector has resulted in the widespread usage of insulating materials in automobiles for thermal, acoustic, and electric insulation. Acoustic insulation is in high demand due to the growing popularity and use of automobile electronic devices.

The demand for higher infrastructure has been fueled by rising industrialization and rapid urbanization in developing nations like China and India, as well as the Philippines, Malaysia, Thailand, and Indonesia. Additionally, an emerging end-use shift predicted to fuel industrial expansion is the rise in demand for environmentally friendly homes as a result of urbanization and population increase. Further, technological developments in thermal insulation, such as vacuum insulation panels, and R&D initiatives to promote transparent thermal insulation are expected to open up new avenues for industrial development. Moreover, the rise in global warming and significant climate changes over the past several decades has increased the requirement for thermal insulators in residential, non-residential, and industrial buildings in order to conserve energy as well as provide comfort to inhabitants.

Restraining Factors

However, increasing raw material costs and stringent environmental laws are expected to constrain expansion in the worldwide insulation products market over the forecast period. For instance, since products based on crude oil, such as polyurethane foams and polystyrene foams, are produced and used, changes in the price and supply of crude oil are an important factor. The accessibility of raw oil-based products such as polymers and elastomers are determined by various nations' import as well as manufacturing scenarios. Furthermore, raw material prices are heavily influenced by logistics (manufacturing site), labor costs, trading costs, and customs. As a result, these variables have an impact on the future development of the insulation products market.

Market Segmentation

By Type Insights

The glass wool segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global insulation products market is segmented into the stone wool, glass wool, fiberglass, EPS, XPS, CMS fibers, calcium silicate, aerogel, cellulose, PIR, polyurethane foam, flexible elastomeric foam, phenolic foam, and others. Among these, the glass wool segment is dominating the market with the largest revenue share of 38.6% over the forecast period. The increased demand from the building and construction sectors for insulation solutions with good thermal insulation and sound absorption capabilities might be ascribed to the development in general. Glass wool is a sand-based insulating material with thermal and acoustic qualities that include lightweight and exceptional tensile strength. Removable blankets are a byproduct of glass wool and are ideal for covering turbines, pumps, heat exchangers, tanks, expansion joints, valves, flanges, and other uneven surfaces that generate heat in industrial settings.

By Industry Verticals Insights

The construction segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of industry verticals, the global insulation products market is segmented into construction, industrial, HVAC & OEM, automotive & transportation, appliances, furniture, oil & gas, packaging, and others. Among these, the construction segment is dominating the market with the largest revenue share of 57.2% over the forecast period. This is due to an increase in the prevalence of insulation-intensive structures in urban areas compared to rural areas. In the building sector, insulation is utilized to mitigate the demand for electricity. The global expansion in the development of commercial offices, data centers, warehouses, institutional buildings, and special economic zones is driving up demand for insulation products. Thermal, electric, or acoustic insulation is commonly used in commercial and other construction, as is electric insulation for lines and cables, among other things. In addition, manufacturers' increased attention to designing, producing, and marketing insulation for a wide range of applications in construction industries is likely to boost the insulation products market during the forecast duration.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 39.7% market share over the forecast period. This can be ascribed to expanding crude oil production in China and India's economies, as well as rising worries over considerable energy waste, as well as increased demand for materials used in refurbishment and remodeling. Furthermore, the region's rapid growth rate, backed by large investments across industries such as construction, building materials, and automotive, is likely to strengthen the insulation products market dominance throughout the projection period.

North America, on the other hand, is predicted to develop the fastest throughout the projection period, owing to strong demand from the oil and gas, manufacturing, metal and mining, electricity, and other industries with high operating temperatures. Additionally, business organizations in this region are working on lowering losses in order to increase performance through continual inspections. Moreover, the application of these products is expanding in developed North American countries for retrofitting reasons in order to meet environmental authorities 'zero-energy-buildings' standards.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. Also, through continuous inspections, business groups in this region are aiming to reduce losses in order to improve performance. In addition, the utilization of these items is becoming more common in developed European countries for remodeling purposes in order to meet environmental authorities zero-energy-buildings regulations.

List of Key Market Players

- Soprema Group

- Huntsman Corporation

- Rockwool International A/S

- Cellofoam International

- Recticel

- Saint-Gobain ISOVER

- Owens Corning Corp.

- Rogers Corporation

- Knauf Insulation

- DuPont

- BASF

- Evonik

- China Jushi Co. Ltd.

- Covestro AG

- Armacell International S.A.

- Atlas Roofing Corporation

- Cellofoam North America, Inc.

- GAF Materials Corporation

Key Market Developments

- On March 2023, Shin-Etsu Chemical Co., Ltd. has created a novel silicone molding rubber (the "KE-5641-U") that is ideal as an insulating wrapping material for high-voltage wire used in autos. With this new product's high resist voltage features, exceptional insulation performance is ensured even when the high-voltage cable's insulation system covering layers are made thinner. Furthermore, the thinness of the covering layers improves the flexibility of the cable while also resulting in a thinner diameter and lighter weight high-voltage cable.

- On March 2023, Anchor Insulation Co., Inc. has been acquired by Installed Building Products, Inc., an industry-leading installer of insulation and associated construction products. Anchor Insulation's branches in Rhode Island, Connecticut, and Massachusetts serve residential, business, and industrial customers throughout the Northeast.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Insulation Products Market based on the below-mentioned segments:

Insulation Products Market, Type Analysis

- Stone Wool

- Glass Wool

- Fiberglass

- EPS

- XPS

- CMS Fibers

- Calcium Silicate

- Aerogel

- Cellulose

- PIR

- Polyurethane Foam

- Flexible Elastomeric Foam

- Phenolic Foam

- Others

Insulation Products Market, Industry Verticals Analysis

- Construction

- Industrial

- HVAC & OEM

- Automotive & Transportation

- Appliances

- Furniture

- Oil & Gas

- Packaging

- Others

Insulation Products Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?