Global Industrial Valves Market Size, Share, and COVID-19 Impact Analysis, By Type (Butterfly Valve, Ball Valve, Globe Valve, Gate Valve, Plug Valve, and Others), By Product (Quarter-turn Valve, Multi-turn Valve, and Others), By Application (Energy & Power, Water & Wastewater Management, Chemicals, Oil & Gas, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Construction & ManufacturingGlobal Industrial Valves Market Insights Forecasts to 2032

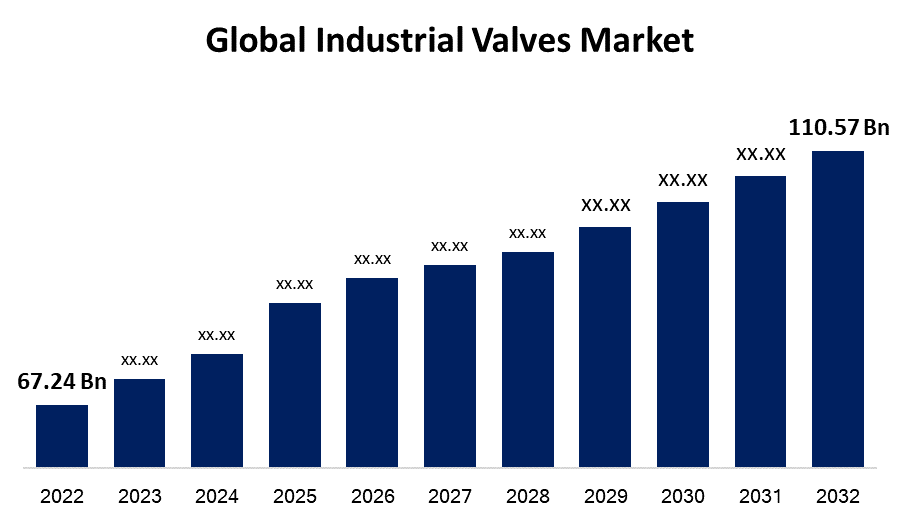

- The Industrial valves Market Size was valued at USD 67.24 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.1% from 2022 to 2032

- The Worldwide industrial valves Market Size is expected to reach USD 110.57 Billion by 2032

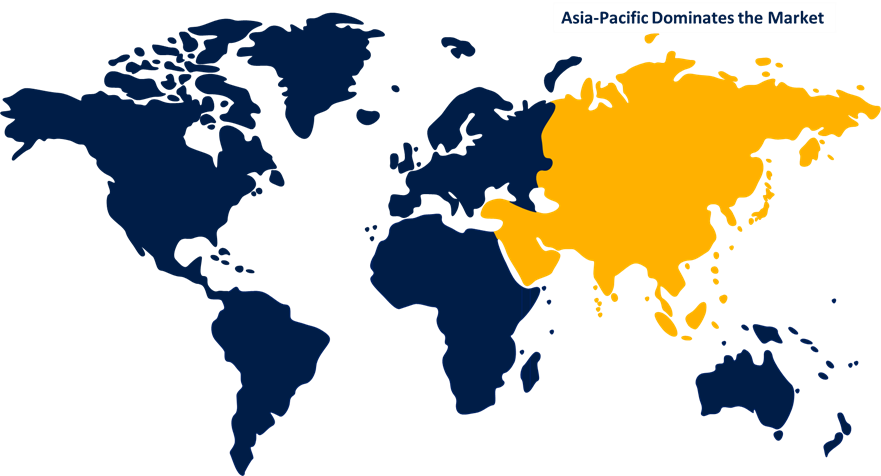

- Asia-Pacific is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global industrial valves Market Size is expected to reach USD 110.57 Billion by 2032, at a CAGR of 5.1% during the forecast period 2022 to 2032.

Market Overview

Global Industrial Valves refer to mechanical devices used to control, regulate, and direct the flow of fluids (liquids, gases, or slurries) within industrial processes. They play a crucial role in various industries, including oil and gas, power generation, water and wastewater treatment, chemical processing, and manufacturing. Industrial valves are designed to withstand high pressure, temperature, and corrosive environments, ensuring efficient and safe operation. The global industrial valves market has experienced significant growth due to increasing industrialization, infrastructure development, and the demand for energy and water resources. Key players in the market offer a wide range of valve types, such as ball valves, gate valves, butterfly valves, globe valves, and check valves, catering to diverse industrial needs. Ongoing technological advancements, such as smart valves and digital control systems, are further enhancing valve performance and efficiency.

Report Coverage

This research report categorizes the market for industrial valves market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial valves market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the industrial valves market.

Global Industrial Valves Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 67.24 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.1% |

| 2032 Value Projection: | USD 110.57 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Product, By Application, By Region |

| Companies covered:: | Alfa Lava, AVK Holding AS, CIRCOR International Inc, Crane Co, Curtiss-Wright Corporation, Danfoss AS, Zhejiang Dunan Valve Co. Ltd, Emerson Electric Co, Flowserve Corporation, Baker Hughes, Georg Fischer Ltd, Hitachi Ltd, Honeywell International Inc, KITZ Corporation, KLINGER Group, Mueller Water Products Inc, NIBCO Inc, Okano Valve Mfg. Co. Ltd, Saint-Gobain, Schlumberger Limited |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industrial valves market is driven by several factors that contribute to its growth and demand. Rapid industrialization and infrastructure development globally is major drivers. The expansion of industries such as oil and gas, power generation, and chemical processing necessitates the use of industrial valves to control fluid flow. Additionally, the increasing demand for energy resources and water management solutions fuels market growth. Moreover, stringent safety regulations and the need for enhanced operational efficiency drive the adoption of advanced valve technologies. Technological advancements like smart valves and digital control systems improve valve performance and enable remote monitoring and control. Furthermore, the growing focus on sustainability and environmental concerns leads to the development of eco-friendly valve solutions, further propelling the market growth. Overall, these drivers create a favorable environment for the expansion of the industrial valves market.

Restraining Factors

The industrial valves market also faces certain restraints that can impact its growth. The economic fluctuations and uncertainties in different regions can hinder market expansion as industries may reduce their investments in new projects. Additionally, the high costs associated with the installation, maintenance, and repair of industrial valves can pose a challenge for some industries, particularly small and medium-sized enterprises. Moreover, the market is highly competitive, leading to pricing pressures for manufacturers. Furthermore, the availability of alternative technologies and solutions, such as pneumatic and electric actuators, may restrict the demand for traditional industrial valves. These restraints require market players to innovate and adapt to changing customer preferences and market dynamics.

Market Segmentation

- The plug valve segment is expected to grow at a CAGR of around 5.7% during the forecast period

On the basis of the type, the global industrial valves market is segmented into butterfly valve, ball valve, globe valve, gate valve, plug valve, and others. The plug valve segment is anticipated to witness substantial growth during the forecast period. Several factors contribute to this projection. The plug valves offer advantages such as compact size, minimal leakage, and ease of operation, making them suitable for various industries. They find extensive applications in oil and gas, chemical processing, and water treatment, among others. Additionally, the increasing demand for plug valves in pipeline systems and fluid control operations further drives their growth. Moreover, technological advancements in plug valve designs, such as improved sealing mechanisms and materials, enhance their performance and reliability. Furthermore, the expansion of infrastructure projects and the rising focus on energy exploration and production activities create opportunities for plug valves. These factors collectively contribute to the expected growth of the plug valve segment in the forecast period.

- In 2022, the energy & power segment dominated with more than 43.7% in 2022

Based on the type of application, the global industrial valves market is segmented into energy & power, water & wastewater management, chemicals, oil & gas, and others. The energy and power segment has emerged as the leading market share holder in the industrial valves industry. Several factors contribute to the segment's dominance. The increasing global demand for energy and power drives the need for efficient and reliable valve solutions. Industrial valves are extensively used in power generation plants, including thermal, nuclear, and renewable energy facilities. Moreover, the ongoing expansion of energy infrastructure and the need to upgrade existing power plants further boost the demand for industrial valves in this segment. Additionally, the implementation of stringent regulations for energy efficiency and emissions control drives the adoption of advanced valve technologies. Furthermore, the growing focus on renewable energy sources, such as wind and solar, also requires the deployment of industrial valves for efficient energy conversion and distribution. These factors collectively establish the energy and power segment as the largest market share holder in the industrial valves industry.

Regional Segment Analysis of the Industrial Valves Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 48.5% revenue share in 2022.

Get more details on this report -

Based on region, Asia-Pacific has emerged as a dominant force in the global industrial valves market. The region's dominance can be attributed to several key factors. Asia-Pacific is witnessing rapid industrialization and urbanization, leading to increased demand for industrial valves across various sectors such as oil and gas, power generation, and manufacturing. Additionally, the region's strong presence in industries like chemical processing, water and wastewater treatment, and pharmaceuticals further fuels the demand for industrial valves. Moreover, the rising population and infrastructural development in countries like China and India are driving market growth. Furthermore, favorable government policies, increasing investments in infrastructure projects, and technological advancements in the region contribute to its dominance. With its robust industrial landscape and growing demand, Asia-Pacific is expected to maintain its market dominance in the foreseeable future.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global industrial valves market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Alfa Laval

- AVK Holding AS

- CIRCOR International Inc.

- Crane Co.

- Curtiss-Wright Corporation

- Danfoss AS

- Zhejiang Dunan Valve Co. Ltd.

- Emerson Electric Co.

- Flowserve Corporation

- Baker Hughes

- Georg Fischer Ltd.

- Hitachi Ltd.

- Honeywell International Inc.

- KITZ Corporation

- KLINGER Group

- Mueller Water Products Inc.

- NIBCO Inc.

- Okano Valve Mfg. Co. Ltd.

- Saint-Gobain

- Schlumberger Limited

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, James Walker unveiled the Supagraf HT valve stem seal designed specifically for managing molten salt media. This seal is capable of enduring extremely high temperatures in conjunction with chemically aggressive and corrosive substances like molten salts. It operates under highly demanding conditions, making it suitable for use in valves, process equipment, and products involved in sealing applications exposed to such challenging environments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global industrial valves market based on the below-mentioned segments:

Industrial Valves Market, By Type

- Butterfly Valve

- Ball Valve

- Globe Valve

- Gate Valve

- Plug Valve

- Others

Industrial Valves Market, By Product

- Quarter-turn Valve

- Multi-turn Valve

- Others

Industrial Valves Market, By Application

- Energy & Power

- Water & Wastewater Management

- Chemicals

- Oil & Gas

- Others

Industrial Valves Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?