Global Industrial Pumps Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Centrifugal Pump, Positive Displacement Pump, and Others), By Application (Oil & Gas, Chemicals, Construction, Power Generation, Water & Wastewater, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal Industrial Pumps Market Insights Forecasts to 2032

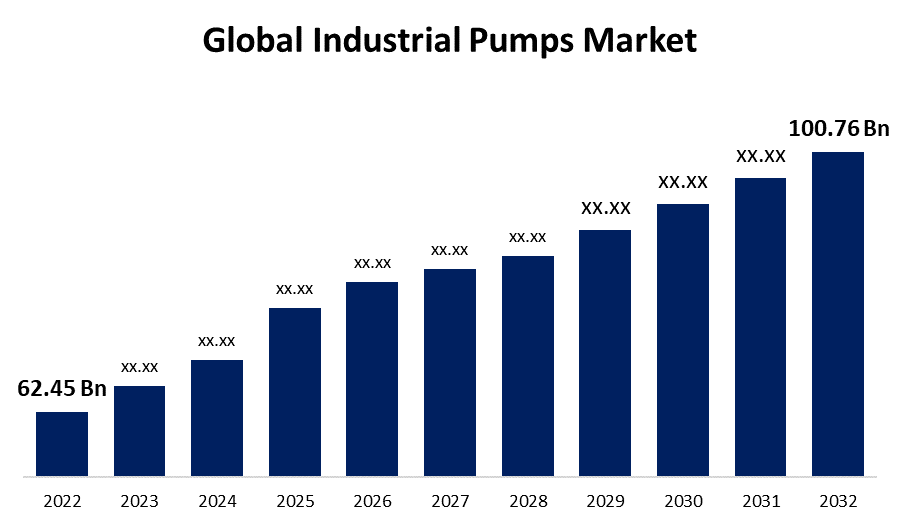

- The Industrial Pumps Market Size was valued at USD 62.45 Billion in 2022.

- The Market is Growing at a CAGR of 4.9% from 2022 to 2032

- The Worldwide Industrial Pumps Market Size is expected to reach USD 100.76 Billion by 2032

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Industrial Pumps Market Size is Expected to reach USD 100.76 Billion by 2032, at a CAGR of 4.9% during the forecast period 2022 to 2032.

Market Overview

Industrial pumps are essential equipment used in various sectors, including manufacturing, oil and gas, chemical processing, water treatment, and more. These pumps are designed to move fluids or gases by converting mechanical energy into hydraulic energy. They play a crucial role in transferring liquids, boosting pressure, and circulating fluids within industrial processes. Industrial pumps come in different types, such as centrifugal pumps, positive displacement pumps, and reciprocating pumps, each suited for specific applications. They vary in size, capacity, and power, offering flexibility for diverse industrial needs. With advancements in technology, modern industrial pumps are becoming more efficient, durable, and capable of handling challenging environments. Their reliability and performance contribute significantly to the smooth operation and productivity of industrial systems worldwide.

Report Coverage

This research report categorizes the market for industrial pumps market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial pumps market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the industrial pumps market.

Global Industrial Pumps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 62.45 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.9% |

| 2032 Value Projection: | USD 100.76 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application, By Region. |

| Companies covered:: | Grundfos Holding A/S, Xylem, Ingersoll-Rand, Flowserve Corporation, SPZ Flow, KSB SE &Co. KGaA, Sulzer Ltd., Pentair, Iwaki Co. Ltd., ITT, INC., Schlumberger Limited, EBARA International Corporation, The Weir Group PLC, Vaughan Company, HERMETIC-Pumpen GmbH. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industrial pumps market is influenced by several drivers that shape its growth and demand. The industrial expansion and infrastructure development in emerging economies fuel the demand for pumps across various sectors. Additionally, the growing global population and urbanization drive the need for water and wastewater treatment facilities, thereby increasing the demand for industrial pumps. Moreover, the rising focus on energy efficiency and sustainability promotes the adoption of advanced and eco-friendly pump technologies. The exploration and production activities in the oil and gas sector, along with the expansion of the chemical processing industry, also drive the demand for industrial pumps. Furthermore, investments in renewable energy sources such as wind and solar power contribute to the growth of the market as these sectors require pumps for fluid transfer and circulation. Overall, factors like economic growth, urbanization, environmental concerns, and industry expansion play significant roles in driving the industrial pumps market.

Restraining Factors

The industrial pumps market also faces certain restraints that can impede its growth. The high initial cost of industrial pumps and the associated installation expenses can be a deterrent for small and medium-sized enterprises. Additionally, the maintenance and operational costs of pumps, including energy consumption and repair services, can pose financial challenges for end-users. Moreover, fluctuations in raw material prices, such as metals and polymers used in pump manufacturing, can impact the overall cost of pumps. Furthermore, the availability of alternative technologies or solutions, such as air-operated pumps or compressed air systems, may present a substitute for certain applications, affecting the demand for industrial pumps. These restraints highlight the need for cost-effective and efficient pump solutions to overcome the challenges faced by the industrial pumps market.

Market Segmentation

- In 2022, the centrifugal pump segment accounted for around 64.3% market share

On the basis of the product type, the global industrial pumps market is segmented into centrifugal pump, positive displacement pump, and others. Centrifugal pumps have emerged as the dominant force in the industrial pumps market, capturing the highest revenue share. Several factors contribute to their market dominance. The centrifugal pumps offer a wide range of advantages, including high efficiency, ease of operation, and robust construction. They are suitable for various applications, such as water supply, chemical processing, oil and gas, and power generation. The versatility of centrifugal pumps allows them to handle different fluids, temperatures, and pressures, making them a preferred choice across industries. Additionally, advancements in pump design and technology have further improved the performance and reliability of centrifugal pumps. Their ability to handle large flow rates and deliver consistent pressure has solidified their position as the go-to choice for many industrial applications, contributing to their highest revenue share in the market.

- In 2022, the water & wastewater segment dominated with more than 21.8% market share

Based on the type of application, the global industrial pumps market is segmented into oil & gas, chemicals, construction, power generation, water & wastewater, and others. Water and wastewater treatment have emerged as significant contributors to the revenue share in the industrial pumps market. This can be attributed to several factors. The increasing global focus on water conservation and environmental sustainability has led to the expansion of water and wastewater treatment facilities. With growing population and urbanization, the demand for clean water supply and efficient wastewater management has intensified. Industrial pumps play a crucial role in these processes by transferring and circulating fluids, boosting pressure, and facilitating filtration and purification. Additionally, stringent regulations and quality standards for water and wastewater treatment further drive the demand for reliable and efficient pump solutions. The continuous advancements in pump technologies, such as improved energy efficiency and reduced maintenance requirements, have also supported the growth of this segment. Overall, the water and wastewater treatment sector's significance in ensuring sustainable water management has positioned it as a key contributor to the revenue share in the industrial pumps market.

Regional Segment Analysis of the Industrial Pumps Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

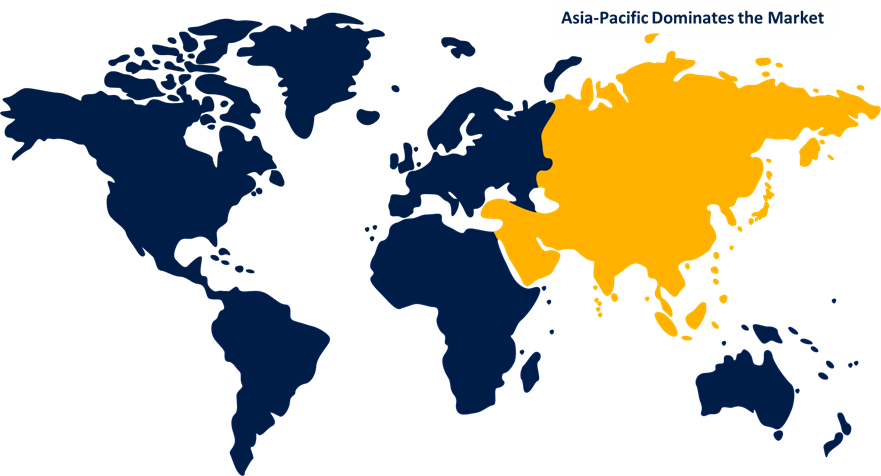

Asia-Pacific dominated the market with more than 47.3% revenue share in 2022.

Get more details on this report -

Based on region, the Asia-Pacific region has emerged as a dominant player in the industrial pumps market, holding the largest market share. Several factors contribute to this significant market presence. The region's rapid industrialization and urbanization have led to increased demand for industrial pumps in sectors such as manufacturing, construction, and infrastructure development. Additionally, the growing population and expanding middle class in countries like China and India drive the need for water supply, wastewater treatment, and other industrial processes that rely on pumps. Furthermore, supportive government initiatives and investments in sectors like oil and gas, chemicals, and power generation further stimulate the demand for industrial pumps in the region. Moreover, the presence of key pump manufacturers in countries like China, Japan, and South Korea enhances the market competitiveness and availability of a wide range of pump solutions. These factors combined establish the Asia-Pacific region as a major player in the industrial pumps market.

Recent Developments

In February 2023, CVS Engineering, a German manufacturer that specializes in industrial vacuum pumps and blowers for mobile applications in transport, particularly tanker trucks, has been acquired by Atlas Copco. As a result, CVS Engineering now becomes part of the industrial vacuum division within Atlas Copco's vacuum technique business area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global industrial pumps market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Grundfos Holding A/S

- Xylem

- Ingersoll-Rand

- Flowserve Corporation

- SPZ Flow

- KSB SE &Co. KGaA

- Sulzer Ltd.

- Pentair

- Iwaki Co. Ltd.

- ITT, INC.

- Schlumberger Limited

- EBARA International Corporation

- The Weir Group PLC

- Vaughan Company

- HERMETIC-Pumpen GmbH

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global industrial pumps market based on the below-mentioned segments:

Industrial Pumps Market, By Product Type

- Centrifugal Pump

- Positive Displacement Pump

- Others

Industrial Pumps Market, By Application

- Oil & Gas

- Chemicals

- Construction

- Power Generation

- Water & Wastewater

- Others

Industrial Pumps Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?