Global Industrial Barrier Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Bollards, Safety Fences, Safety Gates, Guardrails, Barriers for Machinery, and Others), By Function (Active Barriers and Passive Barriers), By Access Control Device (Biometric Systems, Perimeter Security Systems & Alarms, Token & Reader Function, Turnstile, and Others), By Material (Metal and Non-metal), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Industrial Barrier Systems Market Insights Forecasts to 2032

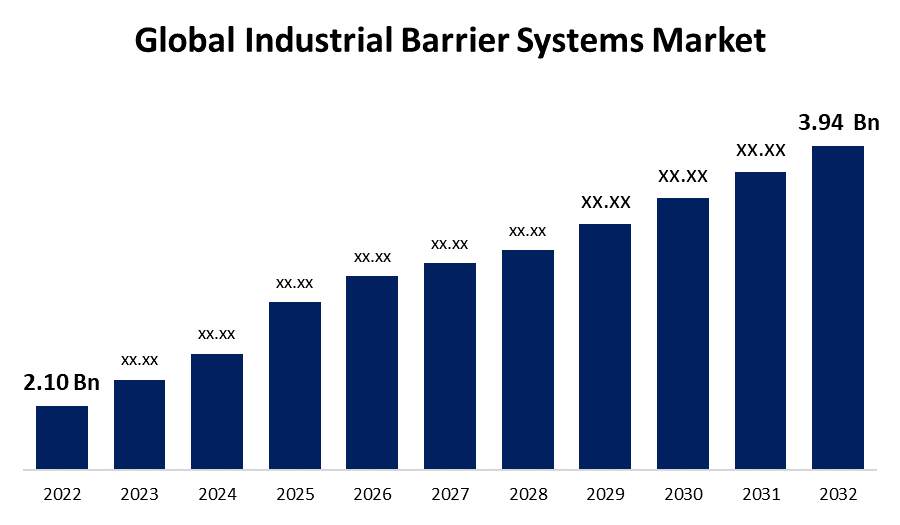

- The Industrial barrier systems Market Size was valued at USD 2.10 Billion in 2022.

- The Market Size is growing at a CAGR of 6.5% from 2022 to 2032.

- The worldwide industrial barrier systems Market Size is expected to reach USD 3.94 Billion by 2032.

- Asia-Pacific is expected to grow fastest during the forecast period.

Get more details on this report -

The Global Industrial Barrier Systems Market Size is expected to reach USD 3.94 Billion by 2032, at a CAGR of 6.5% during the forecast period 2022 to 2032.

Market Overview

Industrial barrier systems are essential components of safety and security in various industrial settings. These systems encompass a wide range of physical barriers designed to protect workers, equipment, and infrastructure from potential hazards and unauthorized access. Common types of industrial barriers include guardrails, bollards, fencing, and safety netting, each serving specific purposes. Guardrails provide fall protection for workers on elevated platforms, while bollards safeguard critical infrastructure by preventing vehicular collisions. Fencing and safety netting enhance perimeter security and protect against debris or objects falling from heights. Industrial barrier systems are crucial in industries such as manufacturing, construction, logistics, and warehousing, where safety and asset protection are paramount. As industrial environments continue to evolve, the development and implementation of innovative barrier systems remain crucial to ensure the well-being of personnel and the preservation of valuable assets.

Report Coverage

This research report categorizes the market for industrial barrier systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial barrier systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the industrial barrier systems market.

Global Industrial Barrier Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.10 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.5% |

| 2032 Value Projection: | USD 3.94 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Type, By Function, By Access Control Device, By Material, By Region |

| Companies covered:: | A-Safe, BOPLAN, Ritehite, Fabenco by Tractel, Lindsay Corporation, Valmont Industries Inc., Betafence, Gramm Barriers, Hill & Smith PLC, CAI Safety Systems, Inc., Kirchdorfer Industries, Tata Steel, Arbus, Avon Barrier Corporation Ltd., and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industrial barrier systems market is influenced by several key drivers, reflecting the growing importance of safety and security in various industrial sectors. First and foremost, stringent regulatory mandates and safety standards play a significant role. Governments and industry bodies worldwide are continually tightening regulations related to workplace safety, leading industries to invest in robust barrier systems to comply with these standards and avoid legal repercussions. The increasing focus on workplace safety and accident prevention drives the demand for industrial barrier systems. Companies are recognizing the importance of protecting their workforce and assets, resulting in a proactive approach to safety measures. This shift in mindset fosters the adoption of advanced barrier systems to minimize accidents and injuries. The rise of automation and advanced manufacturing technologies also fuels the growth of the industrial barrier systems market. As industries increasingly automate their operations, there's a greater need to safeguard both human workers and expensive equipment. This drives investments in innovative barrier systems that can adapt to evolving production environments. Moreover, the growth of e-commerce and logistics sectors contributes significantly to the market's expansion. With the increasing volume of goods being transported and handled, the need for robust barrier systems to manage traffic flow and protect workers and infrastructure within distribution centers and warehouses becomes paramount. Additionally, urbanization and infrastructure development projects worldwide create a demand for industrial barrier systems. Construction and infrastructure companies require reliable barrier solutions to ensure the safety of workers and the public in busy urban environments. Overall, the growing awareness of security threats, including terrorism and vandalism, drives the adoption of industrial barrier systems for perimeter security. This applies not only to critical infrastructure but also to commercial and industrial facilities seeking to protect their premises from potential threats.

Restraining Factors

The industrial barrier systems market faces several restraints that can impede its growth. Cost considerations remain a prominent restraint, as the installation of high-quality barrier systems can be expensive, particularly for smaller businesses. Additionally, the market's growth may be hindered by economic downturns and budget constraints, which can lead to deferred investments in safety and security infrastructure. Resistance to change within traditional industries and the perceived disruption of existing processes can also slow the adoption of advanced barrier systems. Finally, the market may face challenges related to regulatory complexities and varying standards across different regions, which can create barriers to entry and expansion.

Market Segmentation

- In 2022, the barriers for machinery segment accounted for around 30.5% market share

On the basis of the type, the global industrial barrier systems market is segmented into bollards, safety fences, safety gates, guardrails, barriers for machinery, and others. The machinery segment's dominance in the industrial barrier systems market is attributed to several factors. Machinery and equipment within industries pose significant safety risks, necessitating robust protective measures. Barriers are crucial in preventing accidents involving heavy machinery, such as collisions, falls, and equipment-related injuries. Moreover, the increasing adoption of automated and mechanized processes in various industries has amplified the demand for barriers to ensure the safety of both workers and expensive equipment. Consequently, the machinery segment has secured the largest market share due to its critical role in safeguarding industrial operations and personnel.

- The passive barriers segment held the largest market with more than 67.3% revenue share in 2022

Based on the function, the global industrial barrier systems market is segmented into active barriers and passive barriers. The passive barriers segment has secured the largest market share in the industrial barrier systems market due to its versatility and widespread applicability. Passive barriers include solutions like guardrails, safety netting, and fencing, which provide continuous, non-invasive protection in various industrial settings. These barriers are favored for their effectiveness in preventing accidents, controlling access, and enhancing perimeter security while requiring minimal maintenance. The reliability, cost-effectiveness, and ease of installation of passive barriers have made them the preferred choice across industries, contributing to their dominant market share.

- The biometric systems segment is anticipated to grow at a CAGR of around 6.8% during the forecast period

Based on the access control device, the global industrial barrier systems market is segmented into biometric systems, perimeter security systems & alarms, token & reader functions, turnstile, and others. The biometric systems segment is poised for significant growth during the forecast period. This growth is driven by the increasing demand for advanced security solutions across various industries. Biometric systems, which use unique physiological or behavioral traits for authentication, offer a high level of security and accuracy. With rising concerns about data breaches and unauthorized access, organizations are increasingly adopting biometric systems for access control and identity verification, contributing to the segment's strong growth prospects in the coming years.

- The metal segment held the largest market with more than 52.5% revenue share in 2022

Based on the material, the global industrial barrier systems market is segmented into metal and non-metal. The dominance of the metal segment in the industrial barrier systems market can be attributed to the superior strength, durability, and versatility of metal materials. Metal barriers, such as steel guardrails and bollards, are renowned for their ability to withstand heavy impacts, making them ideal for protecting against vehicular collisions and other potential hazards. Their longevity and resistance to corrosion ensure a longer service life, reducing maintenance costs. These qualities, combined with the diverse range of applications in industrial settings, have propelled the metal segment to hold the largest revenue share in the market.

Regional Segment Analysis of the Industrial Barrier Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 32.6% revenue share in 2022.

Get more details on this report -

Based on region, North America commands a substantial share of the industrial barrier systems market due to several factors. The region's robust industrial and manufacturing sectors, coupled with stringent safety regulations, drive the demand for advanced barrier systems. Moreover, the presence of numerous logistics and warehousing facilities, including e-commerce giants, fuels the need for efficient traffic management and worker protection. Additionally, North America's commitment to infrastructure development projects, combined with growing concerns about security threats, bolsters the market.

Asia-Pacific region is projected to emerge as the fastest-growing region in the Industrial Barrier Systems Market over the forecast period. This growth is primarily driven by the region's booming industrial and manufacturing sectors, rapid urbanization, and infrastructure development. As businesses expand and upgrade their facilities, there's an increasing need for advanced safety and security measures, including barrier systems. Additionally, the rising awareness of workplace safety and stringent regulatory frameworks contribute to the heightened demand.

Recent Developments

In June 2023, Ritehite introduced RiteLoad, a new generation dock leveller with innovative controlling systems, strengthened structure, and better design that prioritised safety. The optimised plateau construction and telescopic lip guiding provide stability and longevity, allowing for a ten-year warranty on the construction and steelwork.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global industrial barrier systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- A-Safe

- BOPLAN

- Ritehite

- Fabenco by Tractel

- Lindsay Corporation

- Valmont Industries Inc.

- Betafence

- Gramm Barriers

- Hill & Smith PLC

- CAI Safety Systems, Inc.

- Kirchdorfer Industries

- Tata Steel

- Arbus

- Avon Barrier Corporation Ltd.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global industrial barrier systems market based on the below-mentioned segments:

Industrial Barrier Systems Market, By Type

- Bollards

- Safety Fences

- Safety Gates

- Guardrails

- Barriers for Machinery

- Others

Industrial Barrier Systems Market, By Function

- Active Barriers

- Passive Barriers

Industrial Barrier Systems Market, By Access Control Device

- Biometric Systems

- Perimeter Security Systems & Alarms

- Token & Reader Function

- Turnstile

- Others

Industrial Barrier Systems Market, By Material

- Metal

- Non-metal

Industrial Barrier Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?