Global Industrial Automation Oil & Gas Market Size, Share, and COVID-19 Impact Analysis, By Component (HMI, Industrial PC, Industrial Robots, Control Valves, Process Analyzer, Field Instruments, Vibration Monitoring, Others), By Process (Upstream, Midstream, Downstream), By Solution (MES, PLC, DCS, PAM, SCADA, Functional Safety, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Information & TechnologyGlobal Industrial Automation Oil & Gas Market Insights Forecasts to 2032

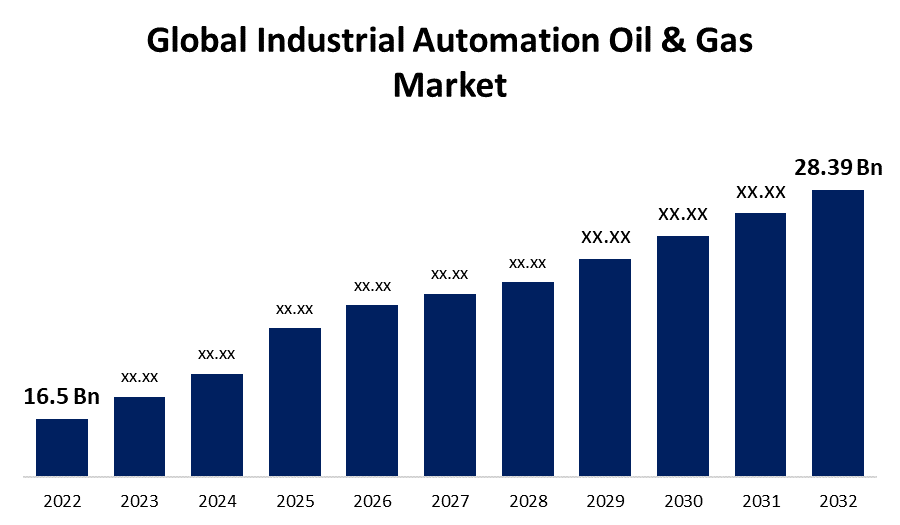

- The Global Industrial Automation Oil & Gas Market Size was valued at USD 16.5 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.5% from 2022 to 2032

- The Worldwide Industrial Automation Oil & Gas Market Size is expected to reach USD 28.39 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Industrial Automation Oil & Gas Market Size is expected to reach USD 28.39 Billion by 2032, at a CAGR of 5.5% during the forecast period 2022 to 2032.

In the oil and gas industry, industrial automation for oil and gas, often known as oilfield automation, implies an increasing assortment of processes, many of which involve digital technologies, that can help oil and gas companies compete more effectively in international markets. Oil and gas automation frequently employs Internet of Things (IoT) sensors, predictive and autonomous technologies to boost production, and expert networks/use of artificial intelligence (AI) to address shortcomings caused by a skilled workforce shortage. Oil and gas automation offers a wide range of commercial advantages, including lower costs, a more connected firm, and increased efficiency and productivity. AI and digital technologies provide reductions in expenses by eliminating certain human labor and improving the safety and accuracy of existing personnel-driven processes. Automation in the oil and gas industry saves time, provides greater flexibility in operations, and decreases workplace fatalities and serious injuries. Interconnected, automated systems facilitate data delivery and increase enterprise-wide productivity. While certain industries are more ready for automation than others, the leading possibilities for oil and gas automation are drilling, production operations, equipment control, supply chain and logistical management, safety, and sales & marketing. The industrial automation oil and gas market is an essential market that integrates the capabilities of automation technology with the complicated and crucial processes of the oil and gas industry.

Global Industrial Automation Oil & Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 16.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.5% |

| 2032 Value Projection: | USD 28.39 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Process, By Solution, By Region |

| Companies covered:: | Siemens AG, General Electric, Rockwell Automation, Schneider Electric, Mitsubishi Electric Corp., Honeywell International, Yokogawa Electric Corp., ABB Ltd., Sigit Inc., Endress+Hauser, Eaton Corp., KUKA, Hitachi, Ltd., VEGA Grieshaber KG, Tyco International Ltd., Baker Hughes Inc., FANUC CORPORATION, Omron Corporation And other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The implementation and utilization of automation technology and solutions within the oil and gas sector is referred to as the industrial automation oil and gas market. The industrial automation oil and gas market has grown significantly throughout the projection period owing to a wide range of factors such as increased energy consumption, a renewed emphasis on productivity, and the requirement for reliable and sustainable operations. Furthermore, the oil and gas business is distinguished by its complicated operations, exorbitant investments, hazardous working conditions, and severe regulatory standards. These challenges demand the implementation of automation technologies in order to improve processes, lower operational costs, assure safety, and uphold legal compliance.

The industrial automation oil and gas market includes a diverse range of automation solutions and innovations that are systematically deployed at various stages of the oil and gas exploration process, production, refining, transportation, and much more. This market's technologies for automation enable continuous tracking, supervision, evaluation, and optimization of processes, resulting in increased efficiency and better decision-making solutions. The growing digitalization of commercial entities, as well as the need for more sustainable and effective operations, has increased demand for products and services in the industrial automation oil and gas industry. The adoption of modern technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) are anticipated to have a critical role in the marketplace for process optimization and predictive maintenance. Furthermore, as the need for energy grows and the emphasis moves toward sustainable and efficient operations, automation will definitely play an increasingly significant role in the oil and gas sector's development.

Market Segmentation

By Component Insights

The control valves segment is dominating the market with the largest revenue share over the forecast period.

On the basis of component, the global industrial automation oil & gas market is segmented into the HMI, industrial PC, industrial robots, control valves, process analyzer, field instruments, vibration monitoring, and others. Among these, the control valves segment is dominating the market with the largest revenue share of 43.6% over the forecast period. In the oil and gas industry, control valves regulate the flow or pressure of a fluid. Their critical role in guaranteeing operational efficiency and safety at nearly all phases of oil and gas operations has rendered them necessary. Various types of control valves, such as butterfly, ball, and gate valves, are employed depending on the individual requirements. Their use is essential in the refining, transport, and distribution processes.

By Process Insights

The downstream segment is expected to hold the largest share of the global industrial automation oil & gas market during the forecast period.

Based on the process, the global industrial automation oil & gas market is classified into upstream, midstream, and downstream. Among these, the quality assurance & inspection segment is expected to hold the largest share of the global industrial automation oil & gas market during the forecast period. The complexity of refining operations, the large number of refineries globally, and the high capital and operational costs required in refining and petrochemical production all contribute to its dominance. In this market, advanced automation systems such as process control systems, sensors, and advanced analytics are critical to ensuring efficient and safe operations. Automation helps in the downstream segment with process optimization, quality control, inventory management, and demand forecasting, among other functions.

By Solution Insights

The DCS segment accounted for the largest revenue share of more than 35.7% over the forecast period.

On the basis of solution, the global industrial automation oil & gas market is segmented into MES, PLC, DCS, PAM, SCADA, functional safety, and others. Among these, the DCS segment is dominating the market with the largest revenue share of 35.7% over the forecast period, primarily because of its widespread use in numerous oil and gas operations, particularly in refining and petrochemical plants. DCS systems have become essential in controlling sophisticated procedures across major facilities, making them indispensable in industries with complex operations like oil refining and gas processing. It combines the control, monitoring, and automation of various equipment and systems. DCS regulates refining processes, monitors pipelines, and coordinates complicated operations such as blending and batch processing in the oil and gas industry. They make it easier to manage large operations, maximize throughput, and maintain safety requirements by allowing for centralized monitoring of scattered activities.

Regional Insights

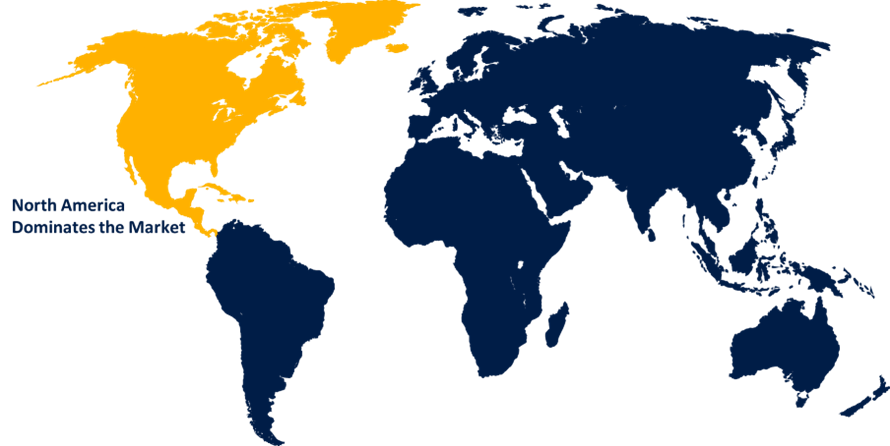

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. The oil and gas revolution, staggering infrastructure, technical improvements, and the region's commitment to adopt modern technology for efficiency and safety are all factors leading to this dominance. North America has a robust oil and gas industry, mostly comprised of the United States and Canada, with a considerable move toward unconventional energy sources such as shale gas and oil deposits. Automation has been essential in enhancing shale extraction methods. Furthermore, strict safety and regulations regarding the environment promote the deployment of automation technology in order to guarantee conformity and reduce liabilities. In the oil and gas industry, North America is well-known for embracing advanced automation technologies such as AI, machine learning, and data analytics.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. The Asia Pacific region offers diversity, with countries producing and consuming major quantities of oil and gas. Growing industrial development in the region needs higher energy consumption, spurring investments in oil and gas automation systems. Countries with large populations and rising energy demands, such as India and China, are pushing the need for better oil and gas operations. The region's growing nations' expansion means a greater need for energy systems and refining capacity, driving the demand for increasingly automated solutions. Automation technologies are essential for guaranteeing safe and efficient operations in potentially hazardous offshore environments.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. Europe's oil and gas industry is firmly established with a particular emphasis on modern automation solutions to facilitate onshore and offshore applications. Many European countries are shifting to alternative energy sources, but oil and gas continue to play an important role in the energy balance. Automation improves the efficiency of currently operating infrastructure. European oil and gas businesses frequently use integrated operations techniques to reduce procedures, boost collaboration, and make better decisions.

List of Key Market Players

- Siemens AG

- General Electric

- Rockwell Automation

- Schneider Electric

- Mitsubishi Electric Corp.

- Honeywell International

- Yokogawa Electric Corp.

- ABB Ltd.

- Sigit Inc.

- Endress+Hauser

- Eaton Corp.

- KUKA

- Hitachi, Ltd.

- VEGA Grieshaber KG

- Tyco International Ltd.

- Baker Hughes Inc.

- FANUC CORPORATION

- Omron Corporation

Key Market Developments

- On March 2023, Tata Consultancy Services (TCS) has announced the release of its 5G-enabled solution, TCS Cognitive Plant Operations Adviser for the Microsoft Azure Private Mobile Edge Computing (PMEC) platform, to assist companies in industries such as manufacturing and oil and gas in harnessing AI and machine learning to make them more intelligent, agile, and resilient.

- On June 2022, Honeywell and Anchorage Investments Ltd. have signed a Memorandum of Understanding (MoU) that will allow Honeywell's latest industrial autonomous technologies to be installed at the state-of-the-art Anchor Benitoite Petrochemicals Complex, which will be built in Egypt's Suez Canal Economic Zone. The firms will initiate preliminary discussions under the terms of the MoU in order to designate Process Solutions (HPS) as the facility's Integrated Main Automation Contractor (IMAC).

- On July 2022, Sensia, a joint venture of Rockwell Automation and Schlumberger, is the leading automation expert in oil and gas production, transportation, and processing. The cloud-native solution provides a scalable, integrated platform for oil and gas firms to implement digital projects. Instead of developing a customized digital platform, selecting and mixing solutions from many sources can save time, money, and effort.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Industrial Automation Oil & Gas Market based on the below-mentioned segments:

Industrial Automation Oil & Gas Market, Component Analysis

- HMI

- Industrial PC

- Industrial Robots

- Control Valves

- Process Analyzer

- Field Instruments

- Vibration Monitoring

- Others

Industrial Automation Oil & Gas Market, Process Analysis

- Upstream

- Midstream

- Downstream

Industrial Automation Oil & Gas Market, Solution Analysis

- MES (Manufacturing Execution System)

- PLC (Programmable Logic Controller)

- DCS (Distribution Control System)

- PAM (Process Automation Management)

- SCADA (Supervisory Control and Data Acquisition)

- Functional Safety

- Others

Industrial Automation Oil & Gas Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

Rest of Middle East & Africa

Need help to buy this report?