Indian Pharmaceutical Market Size, Share, and COVID-19 Impact Analysis, By Molecule Type (Biologics & Biosimilars and Conventional Drugs), By Product (Branded and Generics), By Disease (Cardiovascular diseases, Cancer, Diabetes, Infectious diseases, Neurological disorders, Respiratory diseases, and Others), and Indian Pharmaceutical Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareIndian Pharmaceutical Market Insights Forecasts to 2035

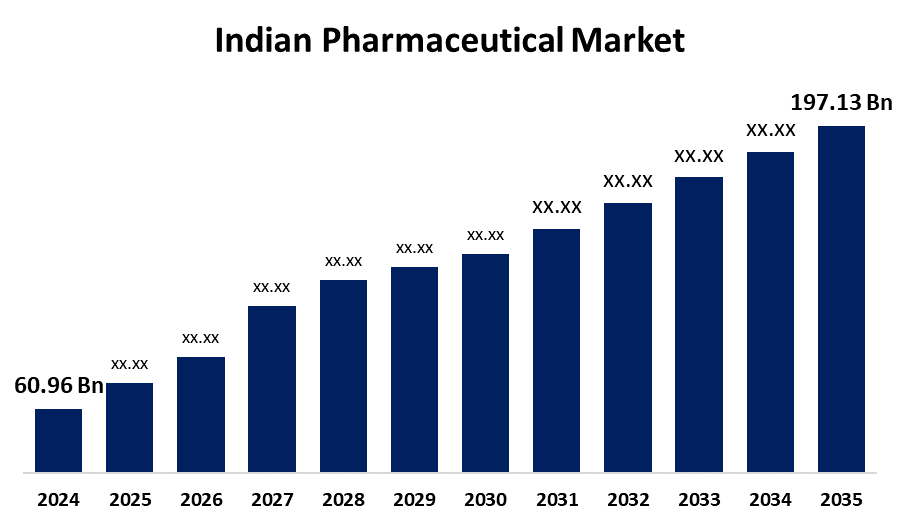

- The Indian Pharmaceutical Market Size was estimated at USD 60.96 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.26% from 2025 to 2035

- The Indian Pharmaceutical Market Size is Expected to Reach USD 197.13 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Indian Pharmaceutical Market Size is anticipated to reach USD 197.13 Billion by 2035. The Indian pharmaceutical market is fueled by innovations in precision medicine and biologics. Strategic investments and rising adoption of advanced therapies are reshaping care delivery for complex diseases.

Market Overview

The industry is devoted to the study, creation, manufacturing, and distribution of drugs and treatments for the management, prevention, and treatment of illnesses and ailments. Prescription pharmaceuticals, generic medications, over-the-counter (OTC) medications, and biologics are all included.

The combination of tailored medicine and cutting-edge technologies, the pharmaceutical industry is changing quickly. Modern applications include gene treatments, mRNA vaccines, and biologics in addition to conventional medications. Clinical trials are being optimized and drug development accelerated through the use of AI and machine learning. Mobile health apps and remote monitoring are examples of digital health tools that improve patient involvement and treatment compliance. Customized medication formulations and implants are becoming possible with 3D printing. These developments are changing the healthcare sector to provide more accurate, effective, and patient-focused solutions.

Report Coverage

This research report categorizes the market for Indian pharmaceutical market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Indian pharmaceutical market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Indian pharmaceutical market.

Indian Pharmaceutical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 60.96 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.26% |

| 2035 Value Projection: | USD 197.13 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 223 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Molecule Type, By Product |

| Companies covered:: | Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Cipla Ltd., Aurobindo Pharma Ltd., Lupin Ltd., Zydus Lifesciences Ltd., Torrent Pharmaceuticals Ltd., Biocon Ltd., Alkem Laboratories Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market growth is driven by the advancements in precision medicine, gene treatments, and biologics. Complex illness care is changing as a result of FDA approvals for innovative treatments, including CAR-T and RNA-based therapies. Treatment paradigms are changing as a result of the increased need for efficient and tailored medicines, particularly in immunology and oncology. Growing use of innovative therapies is highlighted by rising healthcare spending, especially in clinics. Supply chain resilience is being improved by strategic investments, such as financing for domestic API manufacturing. All things considered, the healthcare sector is moving toward more individualized, easily accessible, and significant solutions.

Restraining Factors

Profitability and innovation are impacted by high expenses, regulatory barriers, and patent losses. Operational efficiency is further strained by supply chain weaknesses and pricing demands. Resolving these problems is critical to guaranteeing future development and universal access to necessary medications.

Market Segmentation

The Indian pharmaceutical market share is classified into molecule type, product, and disease.

- The conventional drugs segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Indian pharmaceutical market is segmented by molecule type into biologics & biosimilars and conventional drugs. Among these, the conventional drugs segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the excellent oral bioavailability, consistent pharmacokinetics, and well-established production method. Their broad use is further facilitated by their many therapeutic applications, long and established history of successful clinical use, and patent expirations that allow for generic competition. Furthermore, tiny compounds frequently have superior membrane penetration, which makes it possible to target intracellular circuits and strengthens their place in drug development pipelines.

- The branded segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Indian pharmaceutical market is segmented by product into branded and generics. Among these, the branded segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to the exclusivity and innovation, which are patented medications that are sold under proprietary names that address important medical issues like cancer, rare diseases, and chronic illnesses. The significant investment they make in R&D, regulatory clearances, and the value they provide in raising treatment standards are reflected in their premium pricing.

- The cancer segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Indian pharmaceutical market is segmented by disease into cardiovascular diseases, cancer, diabetes, infectious diseases, neurological disorders, respiratory diseases, and others. Among these, the cancer segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the need for cutting-edge therapies and diagnostics, which is being greatly fueled by the rising incidence of cancer. Early detection and ongoing innovation are improving patient outcomes and driving market expansion. As a result, oncology continues to be a prominent and quickly changing area of the pharmaceutical sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Indian pharmaceutical market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Cipla Ltd.

- Aurobindo Pharma Ltd.

- Lupin Ltd.

- Zydus Lifesciences Ltd.

- Torrent Pharmaceuticals Ltd.

- Biocon Ltd.

- Alkem Laboratories Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Freudenberg reinforced its commitment to India's burgeoning pharmaceutical sector at CPhI and PMEC India by introducing a new line of innovative, high-performance solutions for crucial healthcare applications.

Market Segment

This study forecasts revenue at Indian, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Indian pharmaceutical market based on the below-mentioned segments:

Indian Pharmaceutical Market, By Molecule Type

- Biologics & Biosimilars

- Conventional Drugs

Indian Pharmaceutical Market, By Product

- Branded

- Generics

Indian Pharmaceutical Market, By Disease

- Cardiovascular diseases

- Cancer

- Diabetes

- Infectious diseases

- Neurological disorders

- Respiratory diseases

- Others

Need help to buy this report?