India Water Treatment Systems Market Size, Share, and COVID-19 Impact Analysis, By Technology (Water Softeners, Filtration Systems, Disinfection Systems, RO Systems, Distillation Systems, Others), By Installation (POU, POE), By Application (Residential, Commercial, Industrial, Others), and India Water Treatment Systems Market Insights Forecast to 2033

Industry: Chemicals & MaterialsIndia Water Treatment Systems Market Insights Forecasts to 2033

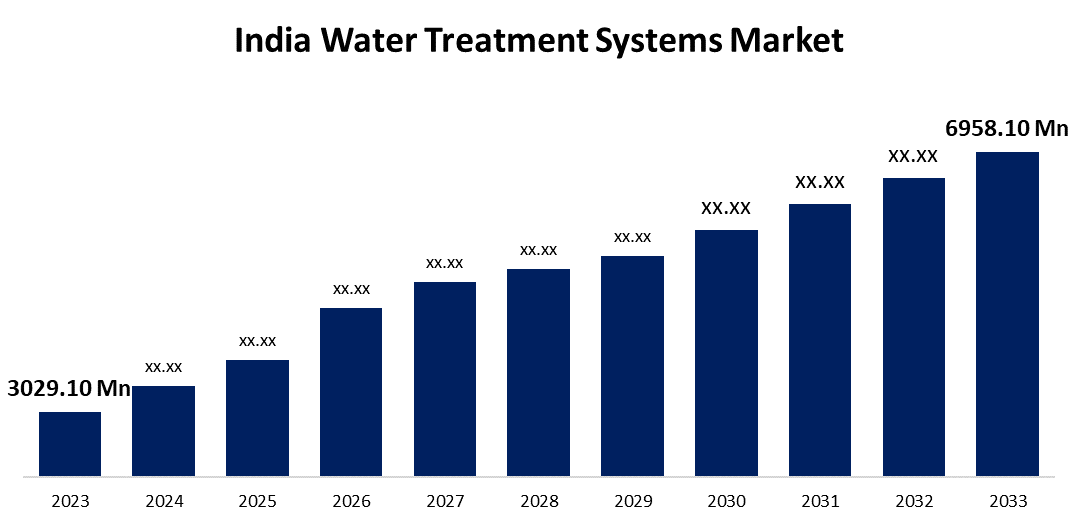

- The India Water Treatment Systems Market Size was valued at USD 3029.10 Million in 2023

- The Market Size is Growing at a CAGR of 8.67% from 2023 to 2033.

- The India Water Treatment Systems Market Size is Expected to Reach USD 6958.10 Million by 2033.

Get more details on this report -

The India Water Treatment Systems Market size is expected to reach USD 6958.10 Million by 2033, at a CAGR of 8.67% during the forecast period 2023 to 2033.

Market Overview

To help prevent disease transmission, water treatment systems clean wastewater and process drinking water. Drinking water may be treated at the source, in homes or other distribution points, or at a central processing facility before being distributed to customers. The majority of water in India is treated at centralized facilities. One of the most serious public health concerns in India with limited water supplies is the spread of pathogen-caused waterborne diseases. Since it is less expensive, developing countries frequently use a single treatment method, such as chlorination, which only partially removes all contaminants, including heavy metals. Solar disinfection, which uses UV light from the sun, and sand filters are also popular in India because they are simple to use and maintain. On the other hand, India's population continues to grow, accompanied by rapid urbanization. Cities face increased water demand, wastewater generation, and water quality management challenges. As more people move to cities, there is an increased demand for water treatment systems to meet urban water supply and sanitation requirements. Also, clean water campaigns run by various environmental organizations raise awareness of the benefits of drinking and using clean water for health in India. Implementing point-of-use water treatment systems can help prevent water-borne illnesses and improve the quality of the water that people consume daily. As awareness of water-borne diseases grows, so does demand for these systems in India.

Report Coverage

This research report categorizes the market for the India water treatment systems market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India water treatment systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India water treatment systems market.

India Water Treatment Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3029.10 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.67% |

| 2033 Value Projection: | USD 6958.10 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Installation, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Veolia India Private Limited, Thermax Limited, VA Tech Wabag Ltd, DuPont Specialty Products India Pvt. Ltd, Toshiba Water Solutions Private Limited, Xylem Water Solutions India Pvt. Ltd., Ion Exchange India Ltd, 3M India Limited, KENT RO Systems Ltd, ZeroB, Eureka Forbes Limited, Voltas Limited and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid pace of industrialization and urbanization in India is a significant driver of the water treatment systems market. As the country's economy grows and its cities expand, the demand for clean and safe water has increased across all sectors. In addition, municipalities are increasingly investing in modern water treatment systems to fulfill the growing demand for clean water and effectively treat wastewater. The combination of industrialization and urbanization drives the growth of India's water treatment systems market. Government initiatives and regulations play an important role in driving the growth of India's water treatment systems market, and various schemes and programs have been launched to promote water conservation, efficient water use, and the implementation of advanced water treatment technologies. The alignment of government policies with sustainable water management practices is a major driver of growth in India's water treatment systems market.

Restraining Factors

One of the major obstacles facing the India water treatment systems market is the existing infrastructure gaps and accessibility issues, and the lack of proper infrastructure poses a barrier to the effective implementation of such systems. Affordability remains a significant barrier to the widespread adoption of water treatment systems in India. Furthermore, the cost of operating and maintaining water treatment facilities represents an ongoing challenge. This becomes a critical issue for industries and municipalities with limited budgets, hampering their ability to consistently invest in the most advanced and efficient water treatment technologies.

Market Segment

- In 2023, the RO systems segment accounted for the largest revenue share over the forecast period.

Based on technology, the India water treatment systems market is segmented into water softeners, filtration systems, disinfection systems, RO systems, distillation systems, and others. Among these, the RO systems segment has the largest revenue share over the forecast period. Reverse osmosis (RO) is a water purification process that uses a semi-permeable membrane to remove ions, molecules, and larger particles from water, resulting in purified water. RO systems are used in residential settings to purify drinking water, as well as industrial processes, agriculture, and municipal water treatment projects. The primary reason for RO systems is the growing concern about water quality. Consumers, industries, and municipalities use RO systems to address contaminants like dissolved salts, heavy metals, and microbiological impurities. In addition, technological advancements have resulted in the development of smart RO systems that include real-time monitoring, mobile app integration, and IoT connectivity. These innovations improve the user experience and increase the efficiency of the purification process.

- In 2023, the POU segment is witnessing the largest growth over the forecast period.

Based on installation, the India water treatment systems market is segmented into POU and POE. Among these, the POU segment is witnessing largest growth over the forecast period. POU systems are essential for treating water in underdeveloped areas because they are simple to use, inexpensive, low-maintenance, and grid-independent. These systems are extremely useful in medical settings, especially when dealing with patients who have weakened immune systems. The market for point-of-use water treatment systems is expected to expand drastically over the forecast period due to a variety of factors such as rising water contamination, growing population, increased awareness of the benefits of water treatment, and technological advancements in the water treatment sector.

- In 2023, the residential segment is witnessing significant growth over the forecast period.

Based on application, the India water treatment systems market is residential, commercial, industrial, and others. Among these, the residential segment is witnessing significant growth over the forecast period. Domestic water purifiers, particularly Reverse Osmosis (RO) systems, are commonly used in Indian households to remove contaminants such as dissolved salts, heavy metals, and microorganisms from tap water. Growing health consciousness, increased awareness of waterborne diseases, and concerns about the quality of municipal water supply all contribute to the demand for domestic water purifiers. Urbanization and a growing middle-class population help to drive the adoption of these systems. Technological advancements have resulted in the development of smart water purifiers that include IoT connectivity, real-time monitoring, and mobile app integration. These purifiers improve user experience and convenience. The growing consumer preference for smart home technologies, combined with a desire for real-time water quality information, is driving the adoption of technologically advanced and connected water purifiers in the residential market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India water treatment systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Veolia India Private Limited

- Thermax Limited

- VA Tech Wabag Ltd

- DuPont Specialty Products India Pvt. Ltd

- Toshiba Water Solutions Private Limited

- Xylem Water Solutions India Pvt. Ltd.

- Ion Exchange India Ltd

- 3M India Limited

- KENT RO Systems Ltd

- ZeroB

- Eureka Forbes Limited

- Voltas Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In April 2023, VA Tech Wabag acquired IDE Technologies, a global leader in water treatment technology.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the India water treatment systems market based on the below-mentioned segments:

India Water Treatment Systems Market, By Technology

- Water Softeners

- Filtration System

- Disinfection System

- RO Systems

- Distillation Systems

- Others

India Water Treatment Systems Market, By Installation

- POU

- POE

India Water Treatment Systems Market, By Application

- Residential

- Commercial

- Industrial

- Others

Need help to buy this report?