India Washing Machine Market Size, Share, And COVID-19 Impact Analysis, By Type (Front Load and Top Load), By Technology (Fully Automatic and Semi-Automatic) By Distribution Channel (Retail Stores and Online), and India Washing Machine Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsIndia Washing Machine Market Insights Forecasts to 2033

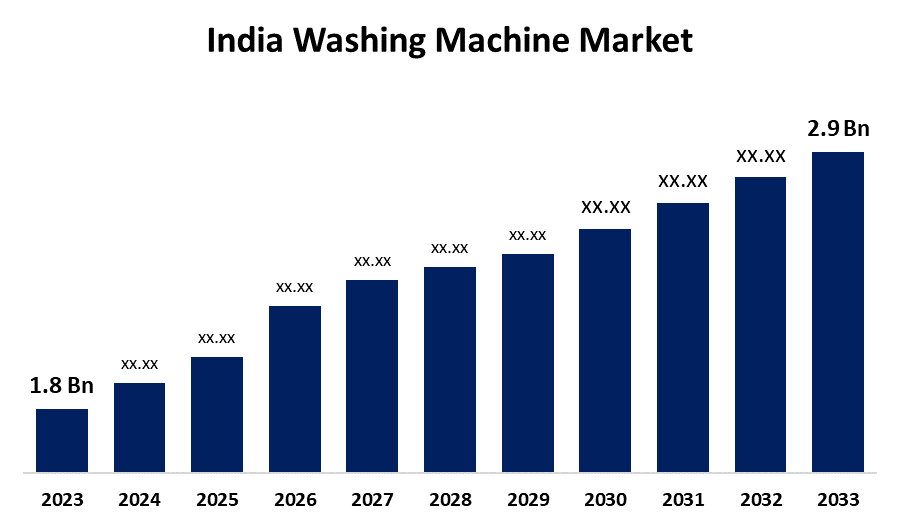

- The India Washing Machine Market Size Was Valued at around USD 1.8 Billion in 2023.

- The India Washing Machine Market Size is Expected to Grow at a CAGR of 4.88% from 2023 to 2033.

- The India Washing Machine Market Size is Expected to Reach USD 2.9 Billion by 2033.

Get more details on this report -

The India Washing Machine Market Size is predicted to Grow from 1.8 Billion in 2023 to USD 2.9 Billion by 2033 at a CAGR of 4.88% during the forecast period. The increasing demand for laundromats and dry-cleaning facilities is the key driver for the growth of the market throughout the nation.

Market Overview

The Indian washing machine industry involves the manufacturing, distribution, and sale of washing machines used for household laundry purposes. The numerous configurations that contemporary washing machines often have for spin speed, water temperature, and washing cycle allow the consumers to personalize the washing process according to the type of clothing being washed. Automatic detergent supply and Wi-Fi connection are some smart technology options presents in some higher-end versions as well. Moreover, India's washing machine industry is going through revolutionary shifts with the force of technological developments as well as changing consumer demands. The rising trend towards energy efficiency and sustainability is largely spurring the growth in the market. Furthermore, all the companies across India are launching washing machines equipped with innovative functionalities, like water-saving functionality and low power consumption, due to the increasing awareness of consumers about the environment, which is supporting the growth in the market in India.

Report Coverage

This research report categorizes the India washing machine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the India washing machine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the India washing machine market.

India Washing Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.8 |

| 2033 Value Projection: | USD 2.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Technology, By Distribution Channel And COVID-19 Impact Analysis |

| Companies covered:: | Samsung, LG, IFB Home Appliances, Bosch, Whirlpool, Panasonic, Croma, Godrej, Haier Group Corporation, Videocon, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for washing machines is influenced by a number of factors. These are the rise in the number of wireless & information technology installations, the expansion in home remodeling activities, and the speedy development of wireless & information technology. More smart home technologies are taking residence in Western nations due to the explosion in home repair activities. Furthermore, the rising volume of expenditure on house upgrades is generating greater demand for goods, particularly since mortgage and housing expenses are escalating. Further, it is expected that shifting lifestyles, growing per capita income, and a growing concern for reducing energy costs would spur demand for such products. Thus, propelling the India washing machine market

Restraints & Challenges

India washing machines market growth is badly inhibited by the excessive consumption of electricity. The consumer and government authorities are increasingly prioritizing energy efficiency with an increase in the cost of energy and a greater focus on environmental protection. Consumption of electricity within a home can significantly be escalated by washing machines, particularly those older or inefficient. Consumer reluctance to change or purchase new washing machines might result from fears regarding increased utility bills.

Market Segmentation

The India washing machines market share is classified into type, technology, and distribution channel.

- The top load segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on type, the India washing machines market is classified into front load and top load. Among these, the top load segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is because they are more convenient, user-friendly, and familiar to consumers, top load washing machines remain at the forefront of the market for washing machines. They have features such as easier maintenance, quicker wash cycles, and the ability to add laundry during cycles. The market for top load washing machines is expanding as manufacturers tend to come out with new models with the latest features in order to attract customers.

- The semi-automatic segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on technology, the India washing machines market is classified into fully automatic and semi-automatic. Among these, the semi-automatic segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The Indian market has traditionally been ruled by semi-automatic washing machines due to their affordability and suitability for regions with unpredictable energy and water supplies. The machines are cheaper than fully automatic ones; thus, price-conscious buyers prefer them despite requiring human intervention to empty and fill the water.

- The online segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on distribution channel, the India washing machines market is classified into retail stores and online. Among these, the online segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Indian sales of washing machines online have gone up tremendously due to the expansion of e-commerce websites such as Amazon, Flipkart, and others. Such shopping websites are attractive to consumers since they offer a wide range of products, low prices, easy comparisons, and multiple payment options. Moreover, more individuals are buying washing machines online due to the convenience of online shopping, which enables you to shop around various models, read other people's experiences, and compare prices without needing to step outside your home. This is especially common in locations with a high internet penetration level, like urban and semi-urban areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India washing machine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung

- LG

- IFB Home Appliances

- Bosch

- Whirlpool

- Panasonic

- Croma

- Godrej

- Haier Group Corporation

- Videocon

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In May 2025, Voltas had introduced a 7 KG washing machine that came out as a top choice among laundry machines. This model ensured effective and reliable performance.

- In doc 2023, Bosch had unveiled a washing machine with a 6.5 kg capacity, differing as a reliable option that provided the best cleaning results and a high-level laundry experience.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India washing machines market based on the below-mentioned segments.

India Washing Machine Market, By Type

- Front Load

- Top Load

India Washing Machine Market, By Technology

- Fully Automatic

- Semi-Automatic

India Washing Machine Market, By Distribution Channel

- Retail Stores

- Online

Need help to buy this report?