India Specialty & Fine Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Products (Construction Chemicals, Food & Feed Additives, Specialty Polymers, Specialty & Pulp Chemicals, Specialty Textile Chemicals, Pharmaceutical & Nutraceutical Additives, Other Products), and India Specialty & Fine Chemicals Market Insights, Industry Trend, Forecasts to 2032

Industry: Specialty & Fine ChemicalsIndia Specialty & Fine Chemicals Market Insights Forecasts to 2032

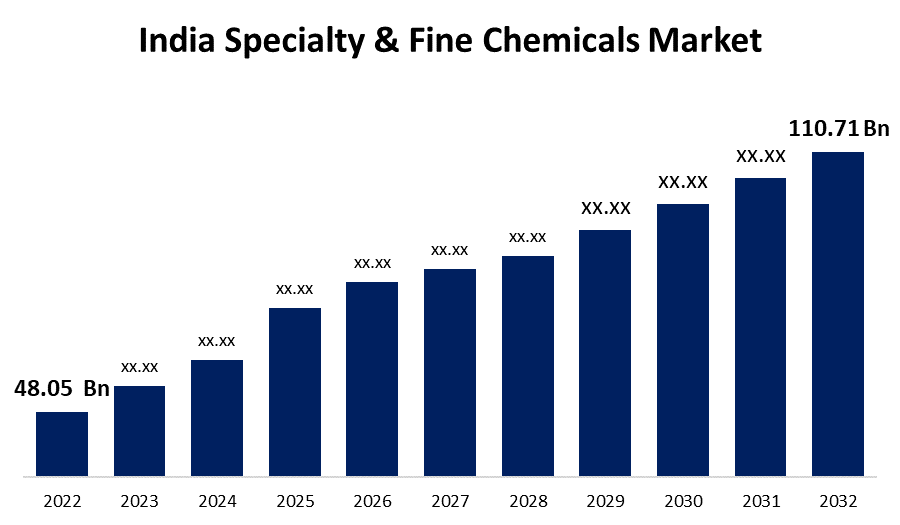

- The India Specialty & Fine Chemicals Market Size was valued at USD 48.05 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.7% from 2022 to 2032

- The India Specialty & Fine Chemicals Market Size is expected to reach USD 110.71 Billion By 2032.

Get more details on this report -

The India Specialty & Fine Chemicals Market Size is expected to reach USD 110.71 Billion By 2032, at a CAGR of 8.7% during the forecast period 2022 to 2032.

Market Overview

India's specialty and fine chemicals sector is essential to the nation's economic growth. These chemicals are high-value-added compounds utilized as intermediates in a wide range of end-use industries, including pharmaceuticals, agrochemicals, textiles, food processing, paints & coatings, cosmetics, and several more. The pharmaceutical and agrochemical industries account for a sizable amount of demand. India is the third-largest producer worldwide of pharmaceuticals by volume, and many of these businesses depend upon specialty chemicals to make a variety of medications. The agricultural business, which manufactures everything from fertilizers to insecticides, likewise significantly relies on specialty chemicals. The country exports a considerable amount of its specialty and fine chemical output to foreign countries, positioning it as a global market leader. The 'Make in India' movement has also increased manufacturing capability. The Indian government, with its "Make in India" campaign, was supporting local chemical manufacturing, which could have a favorable impact on this industry.

Report Coverage

This research report categorizes the market of India Specialty & Fine Chemicals Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India Specialty & Fine Chemicals Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the India Specialty & Fine Chemicals Market.

India Specialty & Fine Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 48.05 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.7% |

| 2032 Value Projection: | USD 110.71 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Products, and COVID-19 Impact Analysis |

| Companies covered:: | Infinity Speciality Chemicals, AJ Chemicals, Finornic Chemicals, Atul Ltd, Para Fine Chem Industries, Jeevan Chemicals, Pon Pure Chemicals Group, Karnataka Aromas, Sami-Sabinsa Group Limited, Spanlab, Jindal Speciality Chemicals, Deccan Fine Chemicals, Fine Chemicals Inc., Aarti Industries, Chemplast Sanmar, Gujrat Heavy Chemicals. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Indian specialty and fine chemicals market has grown rapidly in the last decade, owing to growing demand from both domestic and foreign markets. The specialty and fine chemicals sector is a significant segment of the Indian chemical industry, supplying pharmaceuticals, agrochemicals, dyes and pigments, flavors and perfumes, and other industries. In India, the pharmaceutical industry is the largest user of specialty and fine chemicals. As the nation remained a major center for generic medicine production, there was an increase in market demand for high-quality active pharmaceutical ingredients (APIs) and derivatives. Along with circumstances such as expanding end-user demand, increasing financial resources, and an expanding middle-class population, India's specialty and fine chemicals market is experiencing major growth. In order to comply with global ecological norms and standards, the chemicals industry has been shifting toward sustainable operations and investing in green chemical research and development. Furthermore, expenditures in technological advancement and research are propelling the market's expansion. Companies are progressively spending on research and development to create new goods, improve old formulations, and meet quality requirements around the world.

Market Segment

- In 2022, the construction chemicals segment dominated with more than 37.2% market share over the forecast period.

Based on the products, the India Specialty & Fine Chemicals is segmented into construction chemicals, food & feed additives, specialty polymers, specialty & pulp chemicals, specialty textile chemicals, pharmaceutical & nutraceutical additives, and other products. The construction chemicals segment has captured the highest market share in the India Specialty & Fine Chemicals. The residential and commercial building sector in India is quickly expanding, which has increased the demand for construction chemicals. These compounds are utilized to improve the quality, resilience, and versatility of building materials like concrete, mortar, and grout. As modernization and infrastructure development remain top priorities, the demand for construction chemicals has skyrocketed.

- In 2022, the water treatment chemicals segment is influencing the largest CAGR over the forecast period.

On the basis of products, the India Specialty & Fine Chemicals is segmented into institutional & industrial cleaners, electronic chemicals, rubber processing chemicals, flavors & fragrances, cosmetic chemicals, oilfield chemicals, mining chemicals, plastic additives, catalysts, water treatment chemicals, and other products. Among these segments, the water treatment chemicals segment dominates the largest market share over the forecast period. The need for water treatment chemicals has been gradually expanding partly because of growing fears regarding water pollution and the necessity for clean water in various industrial operations and communities. Furthermore, India has long operated with a substantial oil and gas industry, and the market for oilfield chemicals used in drilling, production, and refining activities has remained robust.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Specialty & Fine Chemicals Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Also, due to their capacity to deliver a one-stop purchasing experience, consumers favor store-based channels.

List of Key Companies

- Infinity Speciality Chemicals

- AJ Chemicals

- Finornic Chemicals

- Atul Ltd

- Para Fine Chem Industries

- Jeevan Chemicals

- Pon Pure Chemicals Group

- Karnataka Aromas

- Sami-Sabinsa Group Limited

- Spanlab

- Jindal Speciality Chemicals

- Deccan Fine Chemicals

- Fine Chemicals Inc.

- Aarti Industries

- Chemplast Sanmar

- Gujrat Heavy Chemicals

Key Target Audience

- Specialty & Fine Chemicals Market Players

- Specialty & Fine Chemicals Investors

- Specialty & Fine Chemicals End-users

- Specialty & Fine Chemicals Government Authorities

- Specialty & Fine Chemicals Consulting and Research Firm

- Specialty & Fine Chemicals Venture capitalists

- Specialty & Fine Chemicals Value-Added Resellers (VARs)

Recent Development

- On April 2023, Ami Organics has announced their entry into the semiconductor industry. Baba Fine Chemicals (BFC), a manufacturer of specialty chemicals, has been bought by the company for a majority interest. BFC is in the business of producing specialized chemicals for the semiconductor and electronics industries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the India Specialty & Fine Chemicals Market based on the below-mentioned segments:

India Specialty & Fine Chemicals Market, By Product

- Construction Chemicals

- Food & Feed Additives

- Specialty Polymers

- Specialty & Pulp Chemicals

- Specialty Textile Chemicals

- Pharmaceutical & Nutraceutical Additives

- Institutional & Industrial Cleaners

- Electronic Chemicals

- Rubber Processing Chemicals

- Flavors & Fragrances

- Cosmetic Chemicals

- Oilfield Chemicals

- Mining Chemicals

- Plastic Additives

- Catalysts

- Water Treatment Chemicals

- Other Products

Need help to buy this report?