India Soap Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bath Soap, Kitchen Soap, Medicated Soap, Laundry Soap, and Others), By Type (Organic and Conventional), and By Distribution Channel (Convenience Stores, Supermarkets and Hypermarkets, Independent Retailers, Artisanal Bakeries, Online, and Others.), and India Soap Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsIndia Soap Market Insights Forecasts to 2035

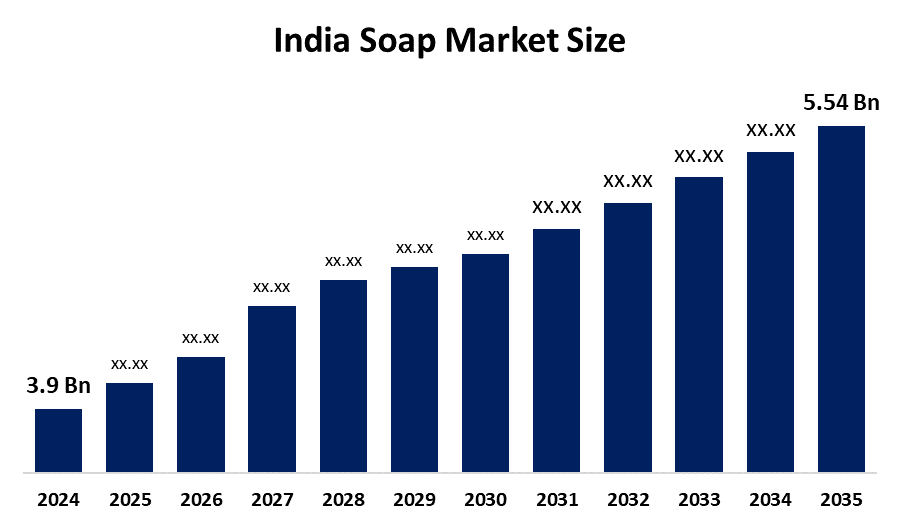

- The India Soap Market Size Was Estimated at USD 3.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.37% from 2025 to 2035

- The India Soap Market Size is Expected to Reach USD 5.54 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India soap market size is anticipated to reach USD 5.54 billion by 2035, growing at a CAGR of 34.07% from 2025 to 2035. The Indian Soap market is growing with the rising hygiene awareness, increasing urbanization, higher disposable incomes, expanding rural penetration, and strong demand for herbal, organic, and premium personal care products supported by aggressive marketing and distribution expansion.

Market Overview

The Indian soap industry is a segment of the fast-moving consumer goods (FMCG) industry that primarily focuses on the manufacturing and distribution of soaps across the country’s population base, i.e., both the rural and urban populations of India. The product of the Indian soap industry is a basic commodity that characterizes a volume-driven market with high competition levels. The manufacturing of soaps involves a wide range of products, such as beauty soaps, antibacterial soaps, herbal soaps, ayurvedic soaps, medicated soaps, moisturizing soaps, premium skincare soaps, etc.

The manufacturing of soaps primarily involves the use of vegetable oils, animal fats, caustic soda, fragrances, essential oils, colorants, moisturizers, etc. In addition, the increasing awareness of skin care and the use of herbal products are giving rise to the use of herbal, organic, chemical, and eco-friendly soaps. The primary use of the product of the Indian soap industry is for bathing purposes, handwashing, personal hygiene, etc. The factors that are responsible for the growth of the Indian soap industry are the rapid growth of the population of the country, the expansion of the rural market base of the industry, the growth of the population of the country, the expansion of the discretionary spending of the population of the country, etc. The Swachh Bharat Abhiyan initiative of the government has significantly increased the level of awareness of the population of the country regarding the maintenance of personal hygiene, thereby positively affecting the growth of the Indian soap industry. The expansion of the online retail market has also positively affected the growth of the Indian soap industry in the recent past, indicating a positive trend for the growth of the Indian soap industry.

Report Coverage

This research report categorizes the market for the India Soap market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India Soap market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India Soap market.

India Soap Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.37% |

| 2035 Value Projection: | USD 5.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type,By Type,By Distribution Channel |

| Companies covered:: | Hindustan Unilever Limited, Godrej Consumer Products Limited, ITC Limited, Wipro Consumer Care & Lighting, Reckitt Benckiser, Procter & Gamble Hygiene and Health Care, Dabur India Limited, Patanjali Ayurved Limited, Emami Limited, Mysore Sandal Soap,and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India soap market is driven by rising hygiene awareness, increasing urbanization, and growing disposable incomes. Government initiatives promoting cleanliness, such as public sanitation campaigns, have strengthened daily soap usage across rural and urban areas. A large population base and expanding rural penetration support volume growth. Additionally, rising demand for herbal, ayurvedic, antibacterial, and premium skincare soaps, along with strong advertising and wider retail distribution networks, continues to accelerate market expansion.

Restraining Factors

The India Soap market in India mostly constrained by the high price sensitivity among consumers, particularly in rural and semi-urban regions. Where there is a desire for low-cost products. Fluctuating prices of raw materials, including palm oil and vegetable oils, increase production costs, thus limiting profit margins. Competition is high in the Indian soap industry, with local and unorganized players in the market offering low-cost products, thus making it difficult for organized players to compete. In addition, increased costs of inputs, regulatory compliance, and sustainable packaging pose new challenges to the industry players.

Market Segmentation

The India soap market share is classified into product type, type, and distribution channel.

- The bath soap segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India soap market is segmented by product type into bath soap, kitchen soap, medicated soap, laundry soap, and others. Among these, the bath soap segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The bath soap segment claims a dominant position due to high frequency of use, increasing hygiene awareness, a rise in population in urban areas, growth in disposable incomes, a wider presence in rural areas, and strong demand for herbal, moisturizing, and antibacterial properties among all age groups.

- The conventional segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The India soap market is segmented by type into organic and conventional. Among these, the conventional segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Owing to its affordability, strong brand presence, widespread distribution in rural and urban markets, high daily consumption, and consumer trust in traditional soap formulations for regular hygiene needs.

- The convenience stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The India soap market is segmented by distribution channel into convenience stores, supermarkets and hypermarkets, independent retailers, artisanal bakeries, online, and others. Among these, the convenience stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. These segment is growing due to easy accessibility, frequent consumer visits, widespread presence in urban and semi-urban areas, and availability of affordable, everyday soap products, making them the preferred choice for quick purchases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Soap market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hindustan Unilever Limited

- Godrej Consumer Products Limited

- ITC Limited

- Wipro Consumer Care & Lighting

- Reckitt Benckiser

- Procter & Gamble Hygiene and Health Care

- Dabur India Limited

- Patanjali Ayurved Limited

- Emami Limited

- Mysore Sandal Soap

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India soap market based on the below-mentioned segments:

India Soap Market, By Product Type

- Bath Soap

- Kitchen Soap

- Medicated Soap

- Laundry Soap

- Others

India Soap Market, By Type

- Organic

- Conventional

India Soap Market, By Distribution channel

- Convenience Stores

- Supermarkets and Hypermarkets

- Independent Retailers

- Artisanal Bakeries

- Online

- Others

Need help to buy this report?