India Phenol Market Size, Share, By Derivative (Bisphenol A, Phenolic Resin, Caprolactum, Alkyl Phenyls, And Others), By End Use (Chemical, Construction, Automotive, Electronic Communication, Metallurgy, And Others), And India Phenol Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsIndia Phenol Market Insights Forecasts to 2035

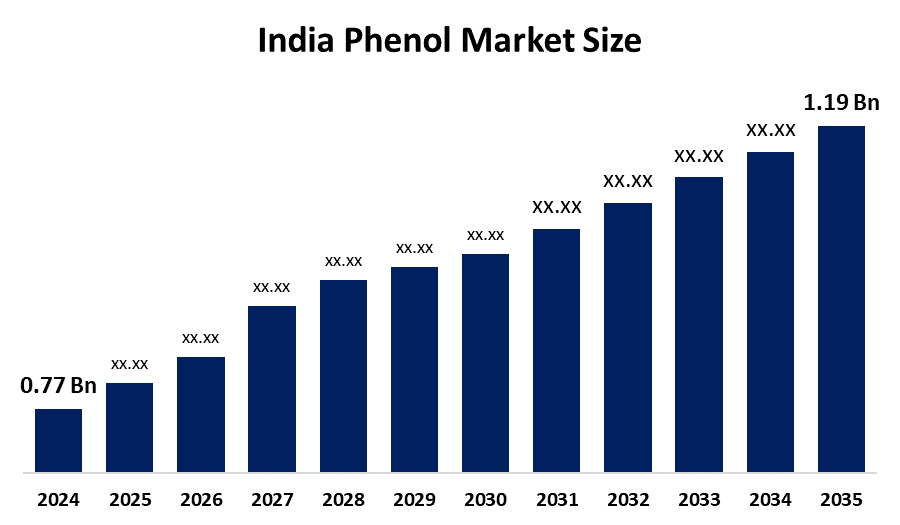

- India Phenol Market Size 2024: USD 0.77 Bn

- India Phenol Market Size 2035: USD 1.19 Bn

- India Phenol Market CAGR 2024: 4.04%

- India Phenol Market Segments: Derivative and End Use

Get more details on this report -

The India phenol market encompasses the production, importation, distribution, and consumption of phenol. Phenol is a versatile aromatic organic compound that is the major feedstock in the production of many downstream chemical products, including phenolic resins, bisphenol-A, caprolactum, and other intermediate chemicals used in producing plastics, adhesives, coatings, and pharmaceuticals. It is critical chemical component of industries such as automotive, construction, electronics, and healthcare. Its derivatives are used to manufacture high-performance and long-lasting materials.

The phenol in India is backed by government support, including the Make in India and the Production Linked Incentive (PLI) scheme, which aim to boost local production capacities and reduce import dependence for critical chemicals and intermediates has encouraged investments in sectors such as pharmaceuticals and electronics, which are major consumers of phenol and its derivatives, thus indirectly supporting phenol demand.

As technology advances, Indian phenol providers are now using more effective production techniques, combining downstream manufacturing with phenol production, and using digital process controls to improve facility functioning, reduce environmental emission, and ensure consistent quality to enhance the production of phenol. Sustainable and energy-efficient manufacturing processes as well as new catalyst systems and methods for improving the performance of chemical manufacturing processes to decrease energy consumption and increase yield are being actively studied in order to produce phenolic plastics that can be utilized in multiple ways in India.

India Phenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.77 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.04% |

| 2035 Value Projection: | USD 1.19 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Derivative,By End Use |

| Companies covered:: | Deepak Phenolics Limited, Hindustan Organic Chemicals Limited, Aarti Industries Limited, Haldia Petrochemicals Limited, SI Group, Inc., Kanoria Chemicals & Industries Limited, Aditya Birla Chemicals, Atul Limited, Shubham Chemicals and Solvents Limited, Arihant Solvents and Chemicals, Vizag Chemical International, Shiv Shakti India Private Limited, and NS Chemicals Private Limited and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Phenol Market:

The India phenol market is driven by rapid expansion of the automotive industry, strong support from government infrastructure programs, growth in pharmaceuticals and healthcare, expanding electronics sector, rising domestic production capacity reduces import reliance, growing interest in incorporating sustainable and energy-efficient manufacturing practices, and increased innovations in phenol derivative applications.

The India phenol market is restrained by the volatility in prices of key feedstocks, cost pressure that can reduce margins and affect profitability, global supply chain disruptions, currency fluctuations, complex environmental and safety regulations, increase compliance costs and operational complexity challenges.

The future of India phenol market is bright and promising, with versatile opportunities emerging from the strong downstream demand for the continued industrialization and government investment in infrastructure, automotive electrification, electronic manufacturing, and pharmaceuticals will drive the continued robust demand. As the emergence of new phenol applications increases in advanced polymers, ecologically friendly materials, and high-performance composites, the continued need for these innovative applications will provide a pathway for value-added growth. Global trend toward sustainable and eco-friendly products, and the ability to produce bio-based phenol feedstocks in India, will create new opportunities that align with India’s environmental goals while also supporting India’s goal of developing a strong and competitive chemical industry ecosystem.

Market Segmentation

The India phenol market share is classified into derivative and end use.

By Derivative:

The India phenol market is divided by derivative into bisphenol a, phenolic resin, caprolactum, alkyl phenyls, and others. Among these, the phenolic resins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rapid infrastructure development, rapid urbanization, high demand in the construction, plywood, and laminates sectors, increased domestic production capacity, and well established infrastructure all contribute to the phenolic resins segment's largest share and higher spending on phenol when compared to other derivative.

By end use:

The India phenol market is divided by end use into chemical, construction, automotive, electronic communication, metallurgy, and others. Among these, the chemical segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The chemical segment dominates because of high demand for phenolic derivatives, extensive applications in manufacturing plastics, growth in pharmaceuticals, rising urbanization, and increasing infrastructure projects in India for phenols.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India phenol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Phenol Market:

- Deepak Phenolics Limited

- Hindustan Organic Chemicals Ltd.

- Aarti Industries Ltd.

- Haldia Petrochemicals Ltd.

- SI Group, Inc.

- Kanoria Chemicals & Industries

- Aditya Birla Chemicals

- Atul Ltd.

- Shubham Chemicals and Solvents Limited

- Arihant Solvents and Chemicals

- Vizag Chemical International

- Shiv Shakti India Pvt. Ltd.

- NS Chemicals Pvt Ltd.

- Others

Recent Developments in India Phenol Market:

In April 2025, DCTL, a subsidiary of Deepak Nitrite Ltd, approved a Rs 3500 crore investment to establish a manufacturing complex for phenol and acetone. This project aimed to produce 300 KTA of phenol and 185 KTA of acetone, effectively doubling the existing capacity held by Deepak Phenolics Limited.

In November 2024, HPL signed a license amendment with Lummus Technology to expand the phenol production capacity at its upcoming plant in Haldia, West Bengal. The expansion increased the planned capacity by 15%, from 300 KTPA to 345 KTPA.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India phenol market based on the below-mentioned segments:

India Phenol Market, By Derivative

- Bisphenol A

- Phenolic Resin

- Caprolactum

- Alkyl Phenyls

- Others

India Phenol Market, By End Use

- Chemical

- Construction

- Automotive

- Electronic Communication

- Metallurgy

- Others

Need help to buy this report?