India Nitrile Butadiene Rubber Market Size, Share, By Product Type (Hoses, Belts, Cables, Molded Seals, O-Rings, And Gloves), By Application (Automotive, Oil & Gas, Mining, Construction, Medical, And Others), And India Nitrile Butadiene Rubber Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Nitrile Butadiene Rubber Market Insights Forecasts to 2035

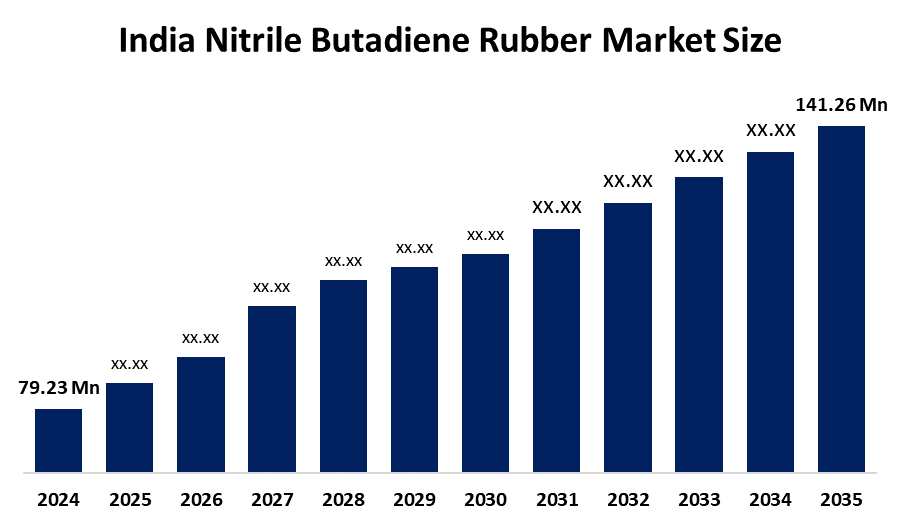

- India Nitrile Butadiene Rubber Market 2024: USD 79.23 Mn

- India Nitrile Butadiene Rubber Market Size 2035: USD 141.26 Mn

- India Nitrile Butadiene Rubber Market CAGR 2024: 5.4%

- India Nitrile Butadiene Rubber Market Segments: Product Type and Application

Get more details on this report -

The India nitrile butadiene rubber (NBR) market encompasses production, distribution and consumption of NBR. It is a synthetic elastomer known for its superior oil, fuel, chemical and abrasion resistance and is widely used in many industrial applications. NBR is used extensively for automotive parts such as fuel hoses, gaskets and seals because of the material's durability and resistance to oil but also in industrial equipment, in construction applications, and in numerous healthcare products.

The nitrile butadiene rubber in India are backed by government support, including the Make in India and the Production Linked Incentive (PLI) scheme for specialty chemicals have become significant catalysts for the NBR market by encouraging domestic chemical and material manufacturing, reducing import dependence, and attracting investment into downstream sectors like automotive and medical device production. India’s automotive sector growth with passenger vehicle sales reached over 4.2 million units in 2023–24, up around 8% year-on-year which directly underpins robust demand for NBR in automotive sealing and hose components.

As technology advances, Indian nitrile butadiene rubber providers are now using modern manufacturing methods like advanced emulsion polymerisation and state-of-the-art digital control of manufacturing processes to create more uniform products, reduce environmental impact and increase safety during production. Additionally, the development of novel specialised grades of NBR has been achieved through the application of innovative R&D techniques. Automation and sophisticated quality assurance systems are being integrated with existing manufacturing processes to ensure NBR products meet exact tolerances required for use in automotive and medical applications.

India Nitrile Butadiene Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 79.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.4% |

| 2035 Value Projection: | USD 141.26 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Apcotex Industries Limited, Reliance Industries Limited, Lanxess AG, Zeon Corporation, Kumho Petrochemical Co., Ltd., LG Chem, Versalis S.p.A., SIBUR Holding, TSRC Corporation, Nantex Industry Co., Ltd., Synthomer plc, Dynasol Group, Rishiroop Limited, Globus Rubchem Pvt Ltd., Polyerubb Industries and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Nitrile Butadiene Rubber Market:

The India nitrile butadiene rubber market is driven by the rapid expansion of the automotive industry, demand from healthcare for disposable medical gloves and medical-grade components, adoption of NBR over natural rubber due to superior chemical resistance, industrial and infrastructure development high demand for NBR products that offer durability and resistance in harsh environments, development of advanced and customized NBR grades, and strong support by favorable manufacturing policies with increased industrial output further propel the market growth.

The India nitrile butadiene rubber market is restrained by the raw material price volatility, margin pressure for manufacturers, increased pricing uncertainty, heavy dependence on imported raw materials, global supply disruptions and foreign exchange fluctuations challenges.

The future of India nitrile butadiene rubber market is bright and promising, with versatile opportunities emerging from the increasing domestic NBR manufacturing capabilities and decreasing dependence on overseas sources. The ability for large-scale export capability to medical glove manufacturers is a great opportunity for growth since India is now viewed as a low-cost alternative to be a world leader in the production of protective equipment. Advanced and customized grades of NBR for new uses in the renewable energy sector, heavy machinery, and high-performance automotive components will also create new markets opportunities and Indian manufacturers will be positioned to capture market share in both the domestic and global markets.

Market Segmentation

The India nitrile butadiene rubber market share is classified into product type and application.

By Product Type:

The India nitrile butadiene rubber market is divided by product type into hoses, belts, cables, molded seats, o-rings, and gloves. Among these, the gloves segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High demand in medical, healthcare, and industrial safety applications, increasing hygiene awareness among consumers, strict occupational safety regulations, and superior chemical resistance all contribute to the gloves segment's largest share and higher spending on nitrile butadiene rubber when compared to other product type.

By Application:

The India nitrile butadiene rubber market is divided by application into automotive, oil & gas, mining, construction, medical, and others. Among these, the automotive segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The automotive segment dominates because of essential component manufacturing, booming vehicle production, strong shift towards stricter BS-VI emission standards, and emerging electric vehicle market creates demand for NBR in specialized applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India nitrile butadiene rubber market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Nitrile Butadiene Rubber Market:

- Apcotex Industries Limited

- Reliance Industries Limited

- Lanxess AG

- Zeon Corporation

- Kumho Petrochemical Co., Ltd.

- LG Chem

- Versalis S.p.A.

- SIBUR Holding

- TSRC Corporation

- Nantex Industry Co., Ltd.

- Synthomer plc

- Dynasol Group

- Rishiroop Limited

- Globus Rubchem Pvt Ltd.

- Polyerubb Industries

- Others

Recent Developments in India Nitrile Butadiene Rubber Market:

In August 2025, ARLANXEO launched its ISCC PLUS-certified Keltan Eco rubber grades in India, derived from bio-based feedstocks, targeting automotive and industrial applications, matching conventional rubber performance, to provide specialized NBR compounds for Indian OEMs.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India nitrile butadiene rubber market based on the below-mentioned segments:

India Nitrile Butadiene Rubber Market, By Product Type

- Hoses

- Belts

- Cables

- Molded Seats

- O-Rings

- Gloves

India Nitrile Butadiene Rubber Market, By Application

- Automotive

- Oil & Gas

- Mining

- Construction

- Medical

- Others

Need help to buy this report?