India Nitric Acid Market Size, Share, By Type (Concentrated Nitric Acid, Dilute Nitric Acid, And Fuming Nitric Acid), By Application (Ammonium Nitrate, Adipic Acid, Nitrobenzene, Toluene Di-Isocyanate, Nitrochlorobenzene, And Others), And India Nitric Acid Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Nitric Acid Market Insights Forecasts to 2035

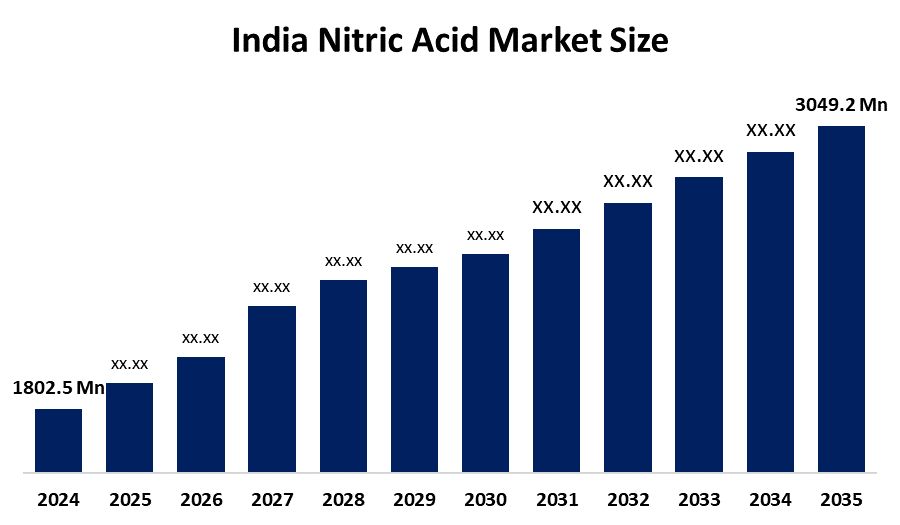

- India Nitric Acid Market 2024: 1802.5 Thousand Tonnes

- India Nitric Acid Market Size 2035: 3049.2 Thousand Tonnes

- India Nitric Acid Market CAGR 2024: 4.9%

- India Nitric Acid Market Segments: Type and Application

Get more details on this report -

The India nitric acid market refers to a sector of entire process of producing, supplying, consuming, and trading nitric acid in India. Nitric acid is one of the key building blocks for producing nitrogen-based fertilizers, therefore, it has important commercial implications for numerous downstream chemical intermediates. The use of nitric acid in the manufacture of ammonium nitrate, which is critical to meeting India's overall food security goals, will make India one of the world's largest users of nitrogen-based fertilizers. This is due to the use of ammonium nitrate as an ingredient to enhance crop yields and soil fertility.

The nitric acid in India are backed by government support, including the Production-Linked Incentive (PLI) scheme for chemicals, aims to enhance domestic chemical manufacturing, with allocations in the Department of Fertilizers budget reaching approximately Rs1,91,836 crores for FY 2024–25 indirectly bolsters nitric acid demand by strengthening fertilizer production capacity and ensuring stable supply for nitrogenous products on which India’s agriculture largely depends.

As technology advances, India’s nitric acid providers are now focused on sustainably-produced chemicals reduce energy use, decrease pollution and increase water recycling throughout the plant by implementing efficient production practices. Major chemical producers are utilizing new methods of catalysis and advanced processing systems to boost energy efficiency as well as water recycling without major treatment thus providing an environmentally friendly product to the marketplace at lower operating costs. These innovations help chemical manufacturing companies to comply with stricter regulations in relation to protecting the environment and provide a competitive advantage over others.

India Nitric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1802.5 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.9% |

| 2035 Value Projection: | 3049.2 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Deepak Fertilisers & Petrochemicals Corporation Ltd., Rashtriya Chemicals and Fertilizers Ltd., Gujarat Narmada Valley Fertilizers & Chemicals Ltd., National Fertilizers Limited, Gujarat State Fertilizers & Chemicals Ltd., BASF SE,and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Nitric Acid Market:

The India nitric acid market is driven by the widespread agricultural demand for nitrogenous fertilizers, supporting diverse cropping patterns, expanding industrial base that consumes nitric acid derivatives government policies promoting balanced fertilization, rise in sustainable farming practices, continued growth in infrastructure, mining, and automotive sectors, and increasing adoption of nitroaromatic intermediates in pharmaceuticals and fine chemicals.

The India nitric acid market is restrained by the environmental and safety concerns, require significant investment in emission control systems, safety infrastructure to comply with evolving regulations challenges, raw material price volatility, increase production costs, and stringent regulatory frameworks.

The future of India nitric acid market is bright and promising, with versatile opportunities emerging from the new higher-purity and specialty nitric acid products development for advanced industrial applications, along with environmentally friendly and sustainable production methods that fulfill the goals of India in relation to the environment. Additionally, since there has been growth in downstream industries such as polyurethane and polymer production, increase in the use of nitroaromatic intermediates in pharmaceuticals and fine chemicals, and the major companies expanding their capacity to fill the gap between demand and supply, there is opportunity for investing and developing new technology through innovation in India.

Market Segmentation

The India nitric acid market share is classified into type and application.

By Type:

The India nitric acid market is divided by type into concentrated nitric acid, dilute nitric acid and fuming nitric acid. Among these, the concentrated nitric acid segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High agricultural demand, massive consumption, critical in manufacturing specialty chemicals, rapid urbanization, and well-established infrastructure development in India all contribute to the concentrated nitric acid segment’s largest share and higher spending on nitric acid segment when compared to other type.

By Application:

The India nitric acid market is divided by application into ammonium nitrate, adipic acid, nitrobenzene, toluene di-isocyanate, nitrochlorobenzene, and others. Among these, the ammonium nitrate segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The ammonium nitrate segment dominates because of high nitrogen role in fertilizer production to support a massive agriculture sector, widespread use as an industrial explosive in mining, rapid urbanization, and well established infrastructure for nitric acid in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India nitric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Nitric Acid Market:

- Deepak Fertilisers & Petrochemicals Corporation Ltd.

- Rashtriya Chemicals and Fertilizers Ltd.

- Gujarat Narmada Valley Fertilizers & Chemicals Ltd.

- National Fertilizers Limited

- Gujarat State Fertilizers & Chemicals Ltd.

- BASF SE

- Others

Recent Developments in India Nitric Acid Market:

In December 2025, Deepak Chem Tech commenced operations at a new, 515-crore nitric acid plant in Nandesari, Vadodara district, Gujarat. This plant is aimed at strengthening the company’s vertical integration from ammonia to amines.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India nitric acid market based on the below-mentioned segments:

India Nitric Acid Market, By Type

- Concentrated Nitric Acid

- Dilute Nitric Acid

- Fuming Nitric Acid

India Nitric Acid Market, By Application

- Ammonium Nitrate

- Adipic Acid

- Nitrobenzene

- Toluene Di-Isocyanate

- Nitrochlorobenzene

- Others

Need help to buy this report?