India Luxury Housing Market Size, Share, and COVID-19 Impact Analysis, By Type (Villas, Landed Apartments, Condominiums, Houses, Others), By Cities (New Delhi, Mumbai, Bengaluru, Kolkata, Chennai, Others), and India Luxury Housing Market Insights Forecasts 2023 – 2033

Industry: Construction & ManufacturingIndia Luxury Housing Market Insights Forecasts to 2033

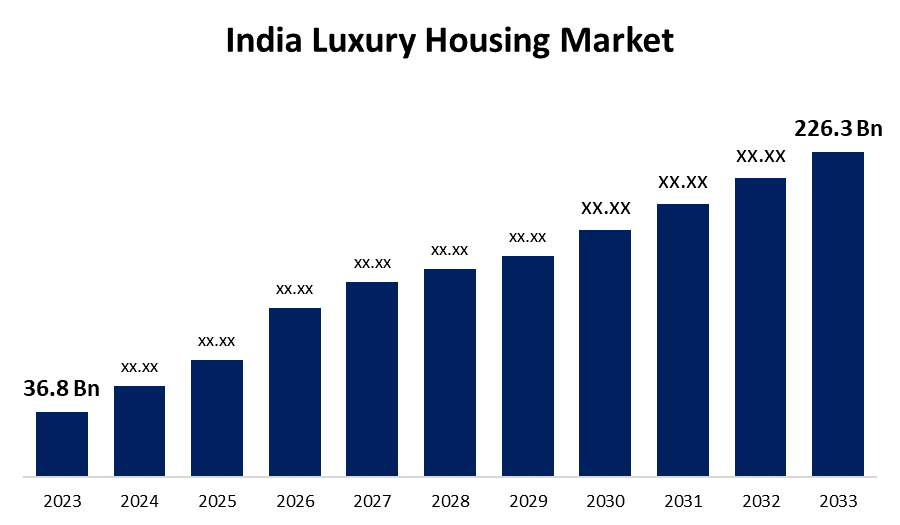

- The India Luxury Housing Market Size was valued at USD 36.8 Billion in 2023

- The Market Size is Growing at a CAGR of 19.9% from 2023 to 2033.

- The India Luxury Housing Market Size is Expected to Reach USD 226.3 Billion by 2033.

Get more details on this report -

The India Luxury Housing Market Size is expected to reach USD 226.3 Billion by 2033, at a CAGR of 19.9% during the forecast period 2023 to 2033.

Market Overview

The demand for luxury houses has significantly increased as India's economy continues to grow and people's level of wealth rises. Developers have responded to this trend by raising the bar and providing move-in-ready condominiums with outstanding architecture, satisfying the discriminating tastes of buyers looking for an incredibly opulent and contemporary living environment. The Indian luxury housing market might be boosted by these developments' abundance of amenities and facilities, which are also tailored to the preferences of the residents and offer a multitude of multipurpose rooms for different activities, top-notch security measures for peace of mind, and prime high-end locations that elevate the entire living experience. Additionally, developers in the India luxury housing market are working to match the rising demands of affluent Indian home consumers who demand nothing less than the finest in terms of housing options by offering them best-in-class services. Furthermore, developers in India's luxury housing market are becoming more and more aware of the growing desire for ostentatious homes that not only function as catch-all compounds but also showcase a discriminating taste in comfort and extravagance. To accommodate the requirements and tastes of discriminating consumers looking for the pinnacle of luxury living, developers in India's luxury housing market are increasingly drawn to creating live-work spaces that not only offer a resort-like lifestyle but also seamlessly blend work and leisure.

Report Coverage

This research report categorizes the market for the India luxury housing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India luxury housing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India luxury housing market.

India Luxury Housing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 36.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 19.9% |

| 2033 Value Projection: | USD 226.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Cities and COVID-19 Impact Analysis. |

| Companies covered:: | Oberoi Realty, Mahindra Lifespaces, Tata Housing, K Raheja Corp, Ajmera Group, Prestige Group, Panchshil Realty, Brigade Group, Omaxe, Lodha Group, Hiranandani Group, Godrej Properties and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Indian luxury housing market is seeing a notable upsurge, mostly due to a noticeable shift in customer tastes toward large, luxurious living areas. Notably, buyers' budgets have increased, with upper and upper-middle-class buyers adding more money to acquire larger and more upscale apartments, in addition to high-net-worth individuals (HNIs) and ultra-high-net-worth individuals (UHNIs) who are increasingly viewing real estate as a critical long-term hedge against inflation. The development of the Indian economy and the influx of many business models, including technology, social media, venture capital, and start-ups, have given rise to a new class of affluent people with substantial spending power. This is primarily too accountable for the rise in demand for luxury housing.

Restraining Factors

Regulatory concerns, like hold-ups regarding authorizations and permits, can pose obstacles for developers trying to get into the Indian luxury housing market. Furthermore, it might be challenging for developers to deliver luxury residences at affordable prices due to high construction expenses and land prices. Additionally, the most significant obstacles in the Indian luxury housing market are high maintenance costs and affordability for middle-class and upper-middle-class buyers of luxury houses will hamper the Indian luxury housing market.

Market Segment

- In 2023, the villas segment accounted for the largest revenue share over the forecast period.

Based on type, the India luxury housing market is segmented into villas, landed apartments condominiums, houses, and others. Among these, the villas segment has the largest revenue share over the forecast period. This is because a villa project's amenities are usually fewer in number than those in an apartment building, and customers get greater solitude access. A villa is a better investment because the consumer is the only owner of the entire piece of land it is built on. Owing to these considerations, the villa segment makes up the largest portion of the Indian luxury housing market.

- In 2023, New Delhi is witnessing significant growth over the forecast period.

Based on cities, the India luxury housing market is segmented into New Delhi, Mumbai, Bengaluru, Kolkata, Chennai, and Others. Among these, New Delhi is witnessing significant growth over the forecast period. This is due to the strong local economy, rising disposable earnings, a desire for a greater standard of living, and a shortage of luxurious residences in large cities. As a result, New Delhi is expanding at the fastest rate in the Indian luxury housing market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India luxury housing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oberoi Realty

- Mahindra Lifespaces

- Tata Housing

- K Raheja Corp

- Ajmera Group

- Prestige Group

- Panchshil Realty

- Brigade Group

- Omaxe

- Lodha Group

- Hiranandani Group

- Godrej Properties

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, A luxury residential building worth USD 1 billion was sold in just 72 hours by DLF, while Godrej Properties, its competitor, is offering USD 3 million in two off-plan purchases to clients who are invited only, suggesting that the Indian luxury housing market is rebounding.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the India Luxury Housing Market based on the below-mentioned segments:

India Luxury Housing Market, By Type

- Villas

- Landed Apartments

- Condominiums

- Houses

- Others

India Luxury Housing Market, By Cities

- New Delhi

- Mumbai

- Bengaluru

- Kolkata

- Chennai

- Others

Need help to buy this report?