India Furniture Market Size, Share, By Application (Home Furniture, Office Furniture, Hospitality Furniture, Educational Furniture, and Others), By Material (Wood, Metal, Plastic, Glass, and Others), By Price Range (Economy, Mid-Range, Premium), By Distribution Channel (B2C/Retail and B2B/Project), By Geography (North India, West India, South India, and East India), India Furniture Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsIndia Furniture Market Insights Forecasts to 2035

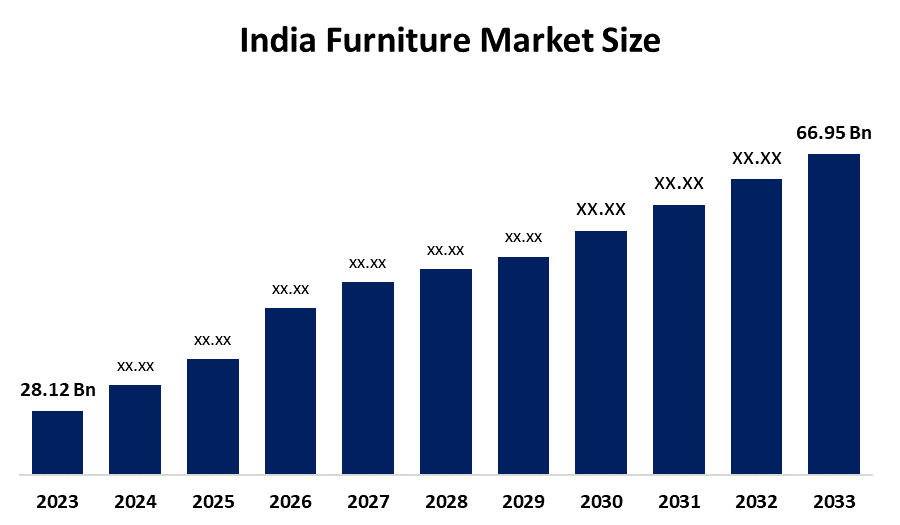

- India Furniture Market Size 2024: USD 28.12 Bn

- India Furniture Market Size 2035: USD 66.95 Bn

- India Furniture Market CAGR 2024: 8.21%

- India Furniture Market Segments: Application, Material, Price Range, Distribution Channel, and Geography

Get more details on this report -

The India Furniture Market Size includes the products which are specifically designed for the residential, commercial, hospitality, and institutional environment. These products essentially provide the function of seating, storage, work, dining, and lifestyle. Such products have become the basic necessities of comfort, functionality, and interior aesthetics in the homes, offices, hotels, educational institutions, healthcare facilities, and retail spaces. The pace of market growth is very much influenced by the factors like the rapid urbanization, an increasing number of households, rising disposable income, and changing consumer preferences for the furniture of modern, modular, and ergonomic kind. The real estate projects expansion, organized retail growth, e, commerce platforms penetration, and furniture rental models are some of the significant factors influencing the demand for furniture which, in turn, is creating a great scope of accessibility and affordability in the urban as well as the semi, urban region.

On the technological front, the furniture industry is witnessing innovations like engineered wood products, lightweight metal furniture, space, saving modular designs, and eco, friendly materials. Policies such as Pradhan Mantri Awas Yojana, Smart Cities Mission, and Make in India program are not only boosting the domestic manufacturing sector but also promoting the trend of affordable housing which is, in turn, helping the furniture industry grow indirectly. India's furniture imports and exports are considered as a mirror of its increasing worldwide involvement in the segments of design, led and commercial furniture, as per the official trade data. The Key capital moves by the top manufacturers are primarily centered on increasing their production capacity, launching new premium and modular products, as well as, getting supply chains ready to deal with the increasing demand of the urban and semi, urban consumers.

Market Dynamics of the Japan Clinical Trials Support Services Market:

The Indian furniture market is mainly influenced by the growth of the residential, commercial, hospitality, and institutional sectors, the rising disposable income, and changing consumer lifestyle trends which are largely oriented towards modern, ergonomic, and modular furniture. Besides these factors, the market is getting a boost from the expanding organized retail, penetration of e- commerce platforms, and growing interior design awareness.

Among the constraints are high raw material costs, supply chain challenges, skilled labor shortages, and competition from unorganized local manufacturers that may slow down the pace of market expansion and increase the prices of products.

There are numerous possibilities that include the adoption of sustainable and eco, friendly furniture solutions, the growth of furniture rental and subscription models, the increase in demand for premium and modular furniture, and the use of digital tools for customization and direct, to, consumer marketing.

Market Segmentation

The India Furniture Market share is classified into application, material, price range, distribution channel.

By Application:

The India furniture market is divided by application into home furniture, office furniture, hospitality furniture, educational furniture, and others. Among these, the home furniture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Growth is led by the increasing number of urban households, rising disposable income, modernization of residential interiors, and the adoption of modular and ergonomic furniture solutions.

By Material:

The India furniture market is divided by material into wood, metal, plastic, glass, and others. Among these, wood dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The wood segment has the largest share mainly because of its long life, visually attractive, widely available, the increasing use of engineered and sustainable wood products, and the preference for premium furniture designs.

By Price Range:

The India furniture market is divided by price range into economy, mid-range, and premium. Among these, the mid-range segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This segment is supported by the growing middle, class population, affordability, and the demand for high, quality, stylish, and modern furniture in both urban and semi, urban households.

By Distribution Channel:

The India furniture market is divided by distribution channel into B2C/retail and B2B/project. Among these, the B2C/retail segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Development is fueled by the higher penetration of organized retail, the adoption of e, commerce, and the rising consumer preference for the convenient online furniture shopping option.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India furniture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Clinical Trials Support Services Market:

- Godrej Interio (Godrej & Boyce Manufacturing Company Limited)

- Durian Industries Limited

- Nilkamal Limited

- Featherlite Office Systems Private Limited

- Zuari Furniture

- Wipro Furniture Private Limited

- Damro Furniture Private Limited

- Spacewood Furnishers Private Limited

- Evok (Hindware Home Retail Private Limited)

- Cello World Private Limited

- Stanley Lifestyles Limited

- Magari Designs Private Limited

- Bharat Furniture Manufacturing Company

- Furniturewalla (FW Designs Private Limited)

- IKEA

- Steelcase Inc.

- HNI Corporation

- BoConcept A/S

- MillerKnoll, Inc.

Recent Developments in Japan Clinical Trials Support Services Market:

In July 2024, the Government of India decided to help the furniture manufacturing sector by giving them Production-Linked Incentive scheme. This will help the Production-Linked Incentive scheme for furniture manufacturing sector to make things in India. The Government of India wants to increase the Production-Linked Incentive scheme for furniture manufacturing sector to export furniture from India and make the Production-Linked Incentive scheme for furniture manufacturing sector supply chain in India stronger. The Production-Linked Incentive scheme is very important, for the furniture manufacturing sector.

In June 2025, the Bureau of Indian Standards (BIS) declared that BIS certification would be compulsory for furniture products, thereby extending the scope of quality control orders to cover furniture categories. The main purpose of this move is to guarantee product quality, safety, and conformity to national standards, which in turn challenges manufacturers to harmonize their operations with quality standards and raises the trust of consumers in locally made furniture.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India furniture market based on the below-mentioned segments:

India Furniture Market, By Application

- Home Furniture

- Office Furniture

- Hospitality Furniture

- Educational Furniture

- Others

India Furniture Market, By Material

- Wood

- Metal

- Plastic

- Glass

- Others

India Furniture Market, By Price Range

- Economy

- Mid-Range

- Premium

India Furniture Market, By Distribution Channel

- B2C/Retail

- B2B/Project

India Furniture Market, By Geography

- North India

- West India

- South India

- East India

Need help to buy this report?