India Fleet Management Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Commercial Vehicles, Passenger Cars, Aircrafts, and Watercrafts), By Technology (GNSS, and Cellular Systems), By End User (Automotive, Energy and Utilities, Manufacturing, Retail, Transportation and Logistics, Construction, and Others), and India Fleet Management Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationIndia Fleet Management Market Insights Forecasts to 2035

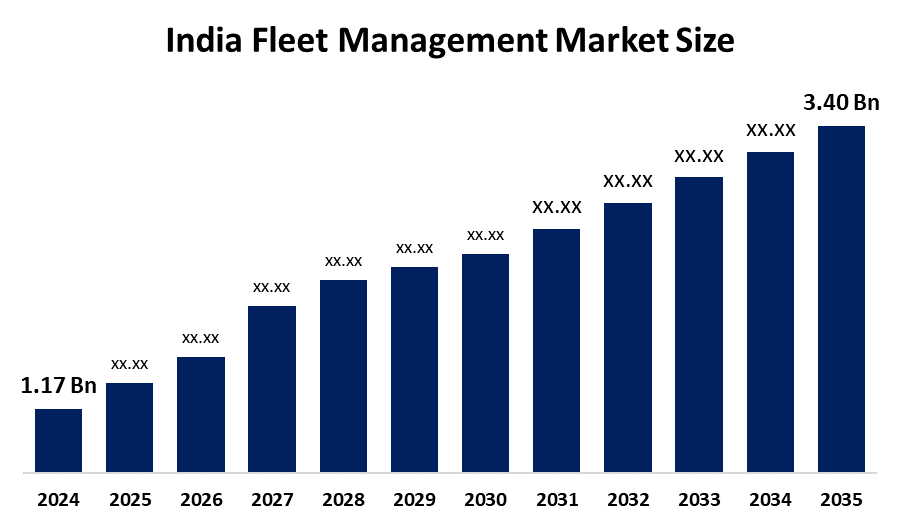

- The India Fleet Management Market Size Was Estimated at USD 1.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.18% from 2025 to 2035

- The India Fleet Management Market Size is Expected to Reach USD 3.40 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Fleet Management Market Size is anticipated to reach USD 3.40 Billion by 2035, Growing at a CAGR of 10.18% from 2025 to 2035. Opportunities in data-driven logistics, telematics integration, electric vehicle adoption, regulatory compliance solutions, AI-based route optimization, and the growing need for cost-effectiveness and real-time fleet monitoring are all offered by the India fleet management market.

Market Overview

The whole industrial segment devoted to the management, coordination, and optimization of commercial vehicle fleets operating throughout the nation is known as the India fleet management market. The ecosystem of tools, software, and services for streamlining commercial vehicle operations, such as GPS telematics, IoT-enabled tracking, route optimization, predictive maintenance, fuel monitoring, and compliance tools, is included in the India fleet management market. The integration of telematics and Internet of Things (IoT) technologies, which enable real-time vehicle tracking, driver behavior monitoring, and data collection on vehicle health, is responsible for the India fleet management market. Technology developments, environmental concerns, regulatory requirements, and an increasing demand for operational efficiency all work together to drive the fleet management market's rapid growth in India.

Report Coverage

This research report categorizes the market for India fleet management market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India fleet management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India fleet management market.

India Fleet Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.17 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.18% |

| 2035 Value Projection: | USD 3.40 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Vehicle Type, By Technology, By End User |

| Companies covered:: | TATA Consultancy Services Limited, Mahindra Group, Zoho Corporation Pvt. Ltd., Fleetx Technologies Private Limited, Trimble Mobility Solutions India, iTriangle Infotech Pvt. Ltd., BT TECHLABS PRIVATE LIMITED, Uffizio India Software Consultants Pvt. Ltd., SmartDrive Systems India Pvt. Ltd., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The growing need for effective transportation and real-time vehicle tracking systems, which boost operational effectiveness and cut expenses for companies, is propelling the India fleet management market. The growing use of cloud-based, analytical solutions for field vehicle management and fleet owners' increased emphasis on operational efficiency are the two main factors driving the India fleet management market. Numerous causes, such as regulatory compliance, technology developments, and the growing demand for electric vehicles, are driving the growth of India fleet management market. The pressing need for effective route planning, real-time fleet tracking, and cutting down on idle time in vehicles to save operating costs are the main factors fuelling the India fleet management market.

Restraining Factors

High upfront investment costs, a lack of technological know-how, infrastructural difficulties, data privacy issues, complicated regulations, and traditional fleet operators' reluctance to use cutting-edge telematics solutions are some of the factors restricting the growth of the India fleet management market.

Market Segmentation

The India fleet management market share is classified into vehicle type, technology, and end user.

- The commercial vehicles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The India fleet management market is segmented by vehicle type into commercial vehicles, passenger cars, aircrafts, and watercrafts. Among these, the commercial vehicles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The widespread use of trucks, buses, and other commercial transport vehicles in a variety of industries, including e-commerce, construction, logistics, and transportation, is responsible for the commercial vehicles segment. The growing need for cost-effective fleet management, improved safety, and efficient fleet operations in commercial transportation greatly aided in this segment expansion.

- The GNSS segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India fleet management market is segmented by technology into GNSS, and cellular systems. Among these, the GNSS segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Navigation Satellite Systems are widely used for accurate vehicle tracking, navigation, and route optimization, which is what gave rise to the GNSS segment. Superior accuracy and dependability are provided by GNSS technology, which is essential for effective fleet operations in a variety of industries.

- The transportation and logistics segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Fleet Management market is segmented by end user into automotive, energy and utilities, manufacturing, retail, transportation and logistics, construction, and others. Among these, the transportation and logistics segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The constantly growing transportation and logistics segment is responsible for the segment's growth, which is driven by the growing need for cost optimization, real-time tracking, and effective fleet management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Fleet Management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TATA Consultancy Services Limited

- Mahindra Group

- Zoho Corporation Pvt. Ltd.

- Fleetx Technologies Private Limited

- Trimble Mobility Solutions India

- iTriangle Infotech Pvt. Ltd.

- BT TECHLABS PRIVATE LIMITED

- Uffizio India Software Consultants Pvt. Ltd.

- SmartDrive Systems India Pvt. Ltd.

- Others

Recent Developments

- In January 2025, ZF launched SCALAR, its digital fleet management technology, at the Bharat Mobility Expo in India. The platform is marketed as the first all-inclusive fleet orchestration solution in the industry that is specifically designed to meet the various needs of Indian fleets, encompassing both passenger and cargo transportation. SCALAR provides cutting-edge capabilities for real-time fleet optimization, such as increased sustainability and safety, cost savings, and productivity gains.

- In December 2024, A strategic alliance between Hitachi ZeroCarbon, a top supplier of end-to-end fleet vehicle decarbonization solutions, and COBUS Industries, a world leader in airport mobility solutions, was launched. By 2025, Hitachi will have equipped 100 e.COBUS Extended Range (ER) buses with its ZeroCarbon BatteryManager system as a joint venture.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India fleet management market based on the below-mentioned segments:

India Fleet Management Market, By Vehicle Type

- Commercial Vehicles

- Passenger Cars

- Aircrafts

- Watercrafts

India Fleet Management Market, By Technology

- GNSS

- Cellular Systems

India Fleet Management Market, By End User

- Automotive

- Energy and Utilities

- Manufacturing

- Retail

- Transportation and Logistics

- Construction

- Others

Need help to buy this report?