India Electric Bus Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (BEV, FCEV, HEV, PHEV), By Battery Type (NMC batteries, LFP batteries, NCA batteries, Others), By Application (Intercity and Intracity), and India Electric Bus Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationIndia Electric Bus Market Insights Forecasts to 2035

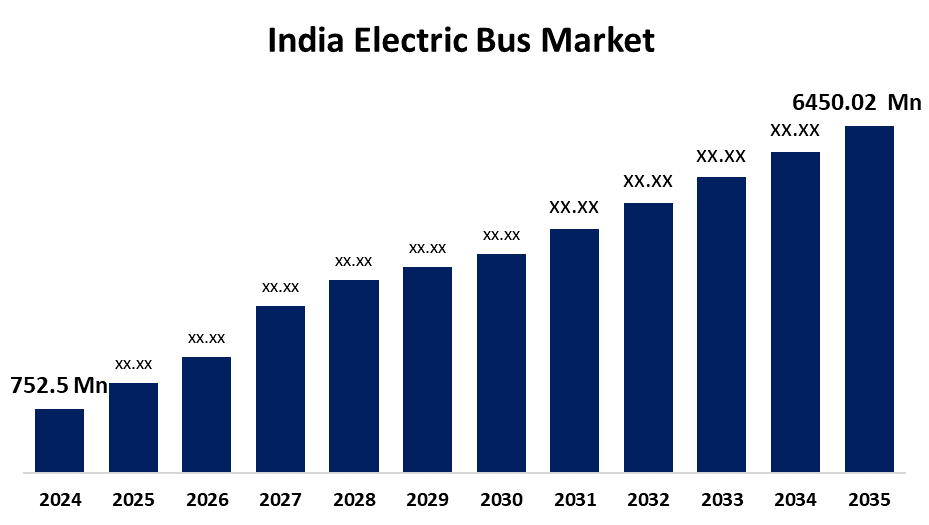

- The India Electric Bus Market Size was estimated at USD 752.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.57% from 2025 to 2035

- The India Electric Bus Market Size is Expected to Reach USD 6450.02 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India electric bus market is anticipated to reach USD 6450.02 million by 2035, growing at a CAGR of 21.57% from 2025 to 2035. The India electric bus market is driven by government incentives, environmental concerns, and falling battery costs make electric buses more affordable. Rising fuel prices and increasing urbanization further boost demand, while electric buses offer sustainable, cost-effective solutions for India's growing need for cleaner public transport.

Market Overview

The India electric bus market refers to the sector focused on the manufacturing, deployment, and operation of electric buses for public transportation within India. It includes fully electrically driven battery electric buses, which provide a sustainable substitute for conventional diesel or CNG buses and help to cut emissions, operating expenses, and comply with India's sustainability and environmental objectives. By offering sustainable, economical, and ecologically friendly substitutes for conventional diesel and CNG buses, the Indian electric bus market seeks to transform urban public transportation. Electric buses are a crucial component of India's future mobility since the country's growing urbanization has increased the need for hygienic, dependable, and effective public transportation systems. Moreover, the usage of electric buses has been accelerated by developments in charging infrastructure, as well as the increased focus on sustainability and lowering urban air pollution. With the focus on lowering dependency on fossil fuels and improving urban air quality, the electric bus market is likely to play a crucial part in India’s sustainable transportation future.

Report Coverage

This research report categorizes the market for the India electric bus market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India electric bus market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India electric bus market.

India Electric Bus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 752.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.57% |

| 2035 Value Projection: | USD 6450.02 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Fuel Type, By Battery Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | BYD Auto, YUTONG, AB VOLVO, Tata Motors, JBM Auto Limited (JBM Group), Skoda Transportation, Otokar Otomotive Savunma Sanayia, Temsa, Xiamen King Long International Trading Co., Ltd, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

India has severe environmental degradation and air pollution, especially in metropolitan areas. With their zero tailpipe emissions, electric buses complement India's environmental pledge. The need for electric buses to address climate change and minimize pollution is increasing due to the increased focus on greener, cleaner options for urban transportation. Additionally, the Indian government encourages the usage of electric buses by providing significant incentives through programs like FAME II and state-level subsidies. The shift to electric buses is fueled by policies that support low-emission public transportation since it improves air quality, increases sustainable mobility, and lessens reliance on fossil fuels.

Restraining Factors

Electric buses are substantially more expensive up front than diesel or CNG buses due to their sophisticated technologies and costly batteries. Despite the long-term gains from lower operating costs, this price differential deters adoption by private operators and cash-strapped state transport undertakings (STUs). Furthermore, India currently has a lackluster EV charging infrastructure, particularly for buses and other large vehicles. Route flexibility is restricted, and large-scale deployment is delayed due to the absence of fast-charging stations and depot-based charging facilities, particularly in tier-2 and tier-3 cities.

Market Segmentation

The India electric bus market share is classified into fuel type, battery type, and application.

- The BEV segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India electric bus market is segmented by fuel type into BEV, FCEV, HEV, and PHEV. Among these, the BEV segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is driven by BEVs offer substantially cheaper operating and maintenance expenses compared to conventional diesel or CNG buses. Because electric motors have fewer moving parts and electricity is less expensive than fossil fuels, they are more efficient throughout a vehicle's lifecycle and require less maintenance.

- The LFP segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India electric bus market is segmented by battery type into NMC batteries, LFP batteries, NCA batteries, and others. Among these, the LFP segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to LFP batteries are less expensive to create than other lithium-ion chemistries like NMC or NCA. They are reasonably priced because they rely on more plentiful resources, which is essential in India's price-sensitive public transportation market. Because of this cost advantage, manufacturers of electric buses can maintain competitive vehicle pricing while maintaining dependable electric performance.

- The intracity segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India electric bus market is segmented by application into intercity and intracity. Among these, the intracity segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to intracity buses usually traveling shorter, defined routes inside city limits, which fits well with the existing constraints on electric bus battery ranges. When compared to lengthy intercity travel, intracity applications for electric vehicles are more viable due to the reduced danger of range anxiety, predictable energy consumption, and effective route planning.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India electric bus market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BYD Auto

- YUTONG

- AB VOLVO

- Tata Motors

- JBM Auto Limited (JBM Group)

- Škoda Transportation

- Otokar Otomotive Savunma Sanayia

- Temsa

- Xiamen King Long International Trading Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Olectra Greentech placed an order with BYD for 2,325 electric bus chassis that use the Blade battery, which is renowned for its exceptional performance and safety. These buses have a 500 km range and are ideal for long-distance travel.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India electric bus Market based on the below-mentioned segments:

India Electric Bus Market, By Fuel Type

- BEV

- FCEV

- HEV

- PHEV

India Electric Bus Market, By Battery Type

- NMC batteries

- LFP batteries

- NCA batteries

- Others

India Electric Bus Market, By Application

- Intercity

- Intracity

Need help to buy this report?