India Edtech Market Size, Share, and COVID-19 Impact Analysis, By Product Type (K-12 Education, Higher Education, Vocational Training, Corporate Learning, and Test Preparation), By Deployment Mode (Cloud-Based and On-Premises), By Learning Mode (Synchronous Learning, Asynchronous Learning, and Blended Learning), By End User (Students, Corporates, and Educational Institutions), and India Edtech Market, Insight, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyIndia Edtech Market Insights Forecasts to 2035

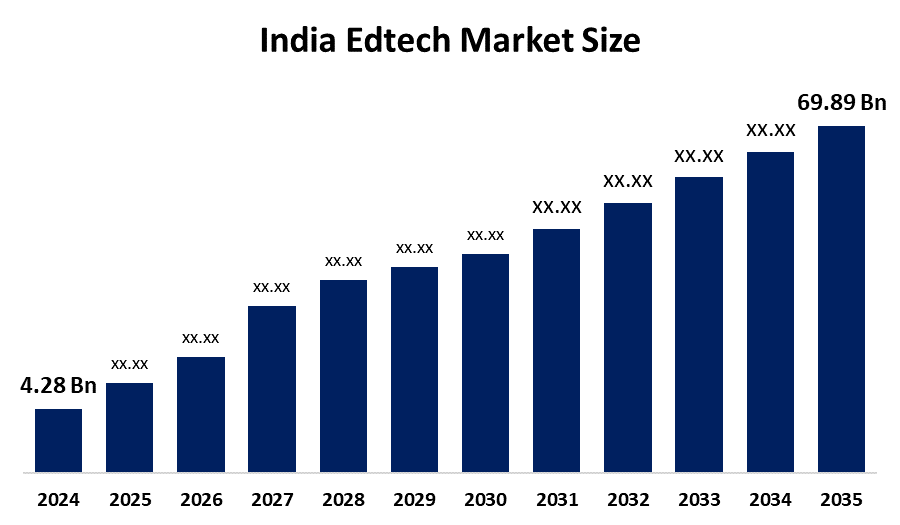

- India Edtech Market Size 2024: USD 4.28 Billion

- India Edtech Market Size 2035: USD 69.89 Billion

- India Edtech Market CAGR: 28.91%

- India Edtech Market Segments: Product Type, Deployment Mode, Learning Mode, and End User

Get more details on this report -

EdTech refers to digital technologies, software, hardware, and platforms that support teaching and learning processes, as well as management within education. EdTech consists of technologies, for example, online courses, virtual classrooms, LMS (Learning Management System), educational applications, intelligent tutoring, augmented reality (AR), virtual reality (VR), and online assessments. Schools, colleges, vocational training centers, as well as corporate and skills development institutes utilize EdTech to deliver remote learning, personal tutoring, interactive study material, student progress tracking, online examination preparation, professional certifications, etc. EdTech offers a way to promote learning as well as make educational facilities accessible and convenient.

PM e-Vidya was launched as part of the Atmanirbhar Bharat Abhiyaan by the Ministry of Education. The initiative provides multi-mode access to education through digital, online, and on-air platforms to minimise learning losses, especially in the wake of the pandemic. It supports the vision of the National Education Policy (NEP) 2020, ensuring equitable and quality education across the country. India EdTech market, SWAYAM Plus supports workforce readiness, digital skill enhancement, and public-private partnerships, which are major growth drivers in the sector. Its collaboration with major industry players like L&T, Microsoft, and Cisco reflects a strong EdTech trend bridging academia and industry using digital platforms to provide skill-based, certification-oriented programs.

Ex-Google GM Launched AI-Led Edtech Startup Fermi that aims to disrupt the edtech segment in India and the US by prioritising AI-first learning for school students in science, technology, engineering, and mathematics courses. Union Minister chaired a roundtable with founders of leading Indian EdTech startups to discuss deploying AI solutions for personalised learning, inclusion, and scalable impact. This comes ahead of a major AI summit where India tech leaders will converge on education technology topics.

Market Dynamics of the India Edtech Market:

The Indian edtech industry is majorly influenced by factors such as the increase in internet penetration and the cheap availability of smartphones, resulting in a rise in demand for remote and hybrid learning models. Also, the government's strong initiatives like Digital India and SWAYAM have also contributed significantly to the growth. The sector has been witnessing a rapid pace of adoption attributable to the increasing emphasis on skill development, employability, and industry, aligned certification programs. Moreover, the use of AI, adaptive learning, and data analytics is intensifying the personalization of education experiences. Besides that, a growing number of corporate upskilling programs, venture capital funding, and the rising popularity of online degrees and competitive exam preparation platforms have largely contributed to the overall growth of the EdTech market in India.

The edtech sector is restrained by restrictions like a lack of digital infrastructure in rural areas, high costs of acquiring customers, low rates of course completions, uncertain regulations, issues over data privacy, and tough competition, all of which affect profit, scale, and the ability to keep long-term users across different platforms.

The edtech market simplifies a model of lifelong learning where individuals can keep reskilling and upskilling throughout their careers via subscription-based and on-demand platforms. It is also empowering competency-based education, based education whereby progress is gauged by the skills learned rather than hours spent. Blockchain, backed digital certificates fortify the genuineness of the credential and its recognition worldwide. Additionally, EdTech promotes inclusive education through multi-language content, the use of assistive technologies for differently-abled learners, and AI-based doubt-solving systems that are ready anytime, thus providing continuous and fair learning experiences.

India Edtech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.28 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 28.91% |

| 2035 Value Projection: | USD 69.89 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product Type,By Deployment Mode,By End User |

| Companies covered:: | Byju’s, Doubtnut, Interval Learning, LEAD School, Scaler, Simplilearn, Toppr, Unacademy, UpGrad, Vedantu,and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India edtech market share is classified into product type, deployment mode, learning mode, and end user

By Product Type:

The India edtech market is divided by product type into K-12 education, higher education, vocational training, corporate learning, and test preparation. Among these, the K-12 education segment controlled the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The K-12 education segment controlled the market due to the country’s large school-age population, strong parental focus on academic performance, and rising demand for digital curriculum support and competitive exam preparation. Government digital initiatives and affordable internet access further boosted adoption.

By Deployment Mode:

The India edtech market is divided by deployment mode into cloud-based and on-premises. Among these, the cloud-based segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This segment dominance is driven by their scalability, flexibility, real-time updates, lower infrastructure costs, and ability to deliver content across devices without a heavy on-premises setup.

By Learning Mode:

The India edtech market is divided by learning mode into synchronous learning, asynchronous learning, and blended learning. Among these, the asynchronous learning segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Asynchronous learning is led due to its flexibility, allowing learners to access recorded lessons, digital resources, and assessments anytime, catering to diverse schedules and self-paced study preferences.

By End User:

The India edtech market is divided by end user into students, corporates, and educational institutions. Among these, the students segment accounted for the highest market share in 2024 and is anticipated to grow at a notable CAGR over the forecast period. Students segment lead because of the large base of school and college learners adopting digital platforms for curriculum support, competitive exam preparation, upskilling, and supplementary education. Increased smartphone use, affordable internet access, and demand for flexible learning solutions further fuel growth in the student segment relative to corporates and educational institutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India edtech market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Edtech Market:

- Byju’s

- Doubtnut

- Interval Learning

- LEAD School

- Scaler

- Simplilearn

- Toppr

- Unacademy

- UpGrad

- Vedantu

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India edtech market based on the below-mentioned segments:

India Edtech Market, By Product Type

- K-12 Education

- Higher Education

- Vocational Training

- Corporate Learning

- Test Preparation

India Edtech Market, By Deployment Mode

- Cloud-Based

- On-Premises

India Edtech Market, By Learning Mode

- Synchronous Learning

- Asynchronous Learning

- Blended Learning

Need help to buy this report?