India Digitally Delivered Services Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Solutions, and Services), By Organization Size (SMEs, Large Enterprises, and Others), By Verticals (Telecommunication and IT, Manufacturing, Healthcare and Life Science, BFSI, Government and Defense, Retail and E-commerce, and Others), and India Digitally Delivered Services Market Insights Forecasts 2023 – 2033

Industry: Electronics, ICT & MediaIndia Digitally Delivered Services Market Insights Forecasts to 2033

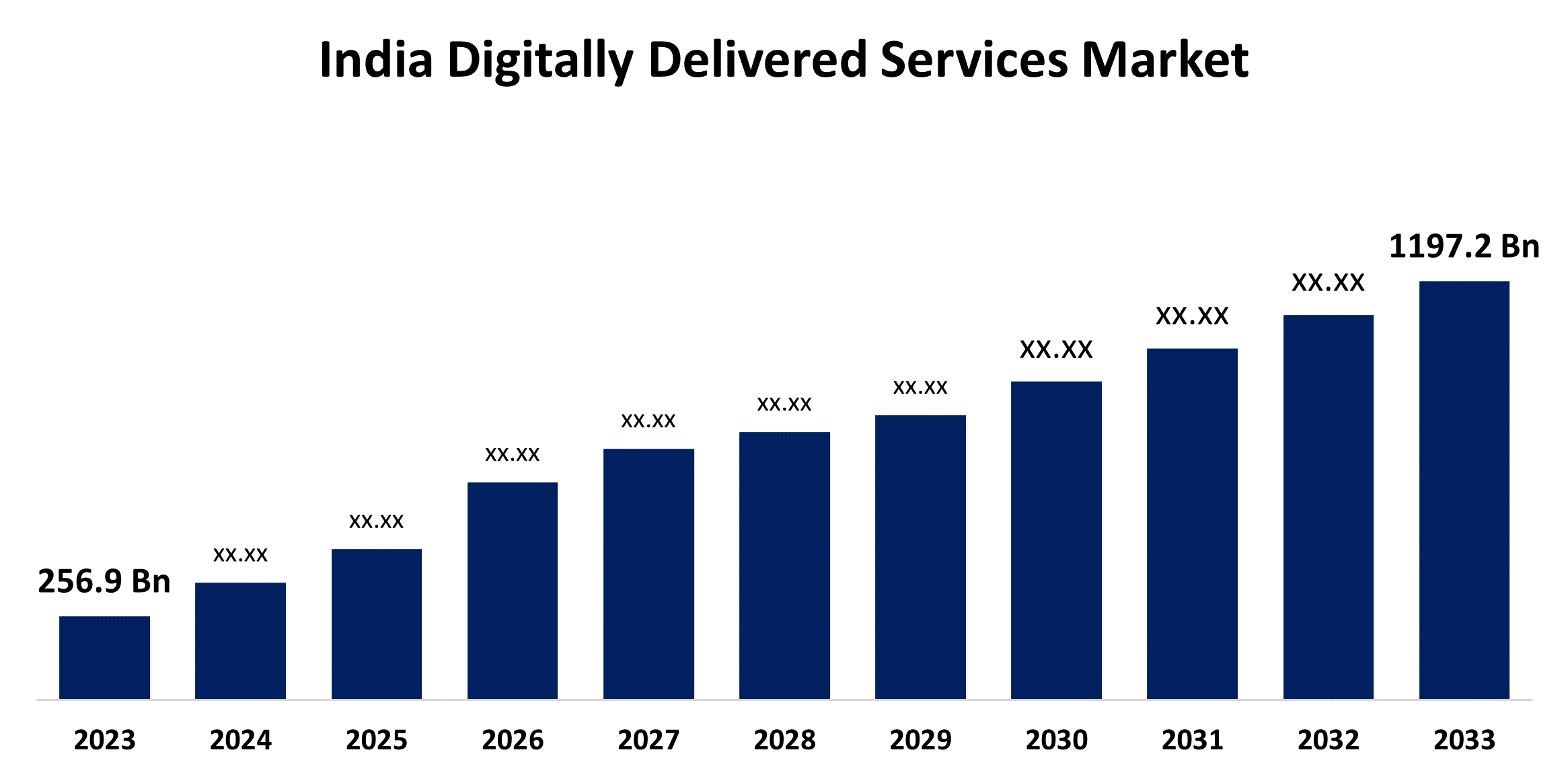

- The India Digitally Delivered Services Market Size was valued at USD 256.9 Billion in 2023

- The Market Size is Growing at a CAGR of 16.64% from 2023 to 2033.

- The India Digitally Delivered Services Market Size is Expected to Reach USD 1197.2 Billion by 2033.

Get more details on this report -

The India Digitally Delivered Services Market size is expected to reach USD 1197.2 Billion by 2033, at a CAGR of 16.64% during the forecast period 2023 to 2033.

Market Overview

Digitally deliverable services are those that can be provided remotely across computer networks. The term "digitally delivered services" refers to the electronic distribution of information, which encompasses the delivery of data and content via a variety of platforms and devices, including the web and mobile. These services assist in providing consumers with information in a timely and effective manner, hence improving customer response. In recent years, India has cemented its place as a key player in the global market, with more than a fifth of the world's services currently sold from its borders. This remarkable performance has earned India the distinction of being the world's fourth-largest exporter of digitally provided services, demonstrating its digital competence and skill. India continues to be recognized as a prominent contributor to international service trade, making important contributions to influencing the global economy by leveraging superior technology and a trained workforce. Furthermore, the use of artificial intelligence (AI), which includes models capable of creating content such as text, images, music, and even videos, increased dramatically in 2023. These technologies are set to revolutionize various aspects of the economy, resulting in increased efficiency, innovation, cost savings, personalization opportunities, job creation, and economic growth, further boosting trade in digitally delivered services.

Report Coverage

This research report categorizes the market for the India digitally delivered services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India digitally delivered services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India digitally delivered services market.

India Digitally Delivered Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 256.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.64% |

| 2033 Value Projection: | USD 1197.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component Type, By Organization Size, By Verticals |

| Companies covered:: | Mahindra ComViva, Infosys, Analysys Mason, Spice Digital Ltd, 6d technologies, Tech Mahindra, Happiest Minds, IMImobile, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The widespread use of smartphones and reasonably priced data plans has led to a sharp rise in internet penetration in India. The market for digitally delivered services has the potential to grow as more consumers have access to the Internet. In addition, the Indian government has started several programs, like Digital India, to enhance the nation's online infrastructure and encourage digital literacy. The expansion of digitally delivered services is made possible by these initiatives. Furthermore, the emergence of e-commerce giants such as Flipkart, Amazon, and Snapdeal has accustomed Indian customers to making purchases online. This has resulted in increased acceptance and trust in digital services across a variety of industries, including retail, entertainment, and finance. India has a thriving startup ecosystem centered on digital technology. These startups are constantly innovating and introducing new digitally delivered services across a variety of industries, attracting both customers and investors.

Restraining Factors

The lack of skilled workers in India is likely to pose a major barrier to the growth of the market for digitally delivered services, which could limit the sector's potential for innovation and expansion in the nation's changing digital landscape.

Market Segment

- In 2023, the services segment accounted for the largest revenue share over the forecast period.

Based on component type, the India digitally delivered services market is segmented into solutions, and services. Among these, the services segment has the largest revenue share over the forecast period. Government efforts such as Digital India and Make in India have created a favorable climate for the expansion of digital services in the country. These efforts encourage digital literacy, infrastructure development, and entrepreneurship, hence boosting innovation and investment in the services segment.

- In 2023, the large enterprises segment is witnessing significant growth over the forecast period.

Based on organization size, the India digitally delivered services market is segmented into SMEs, large enterprises, and others. Among these, the large enterprises segment is witnessing significant growth over the forecast period. This is due to their size and scope, large enterprises frequently need sophisticated digital solutions to handle a variety of company functions, such as supply chain management, financial operations, human resources, and customer relationship management. To efficiently scale operations, increase efficiency, and optimize processes, digitally delivered services must be adopted.

- In 2023, the telecommunication and IT segment is witnessing significant growth over the forecast period.

Based on verticals, the India digitally delivered services market is segmented into telecommunication and IT, manufacturing, healthcare and life science, BFSI, government and defense, retail and e-commerce, and others. Among these, the telecommunication and IT segment is witnessing significant growth over the forecast period. Technological developments like the deployment of 5G, cloud computing, AI, and IoT are driving up demand for IT services. These technologies open up new avenues for creativity and help firms run more effectively. In addition, the Indian government has started several programs, like Made in India and Digital India, to encourage digitization. The telecommunication and IT industries are expected to grow as a result of these activities, which seek to enhance digital infrastructure, expand internet access, and accelerate the uptake of digitally delivered services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India digitally delivered services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mahindra ComViva

- Infosys

- Analysys Mason

- Spice Digital Ltd

- 6d technologies

- Tech Mahindra

- Happiest Minds

- IMImobile

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the India Digitally Delivered Services Market based on the below-mentioned segments:

India Digitally Delivered Services Market, By Component Type

- Solutions

- Services

India Digitally Delivered Services Market, By Organization Size

- SMEs

- Large Enterprises

- Others

India Digitally Delivered Services Market, By Verticals

- Telecommunication and IT

- Manufacturing

- Healthcare and Life Science

- BFSI

- Government and Defense

- Retail and E-commerce

- Others

Need help to buy this report?