India Dairy Market Size, Share, and COVID-19 Impact Analysis, By Category (Butter, Cheese, Cream, Dairy Desserts, Milk, Sour Milk Drinks, and Yogurt), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Retailers, Online Retail Stores, and Others), and India Dairy Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesIndia Dairy Market Insights Forecasts to 2035

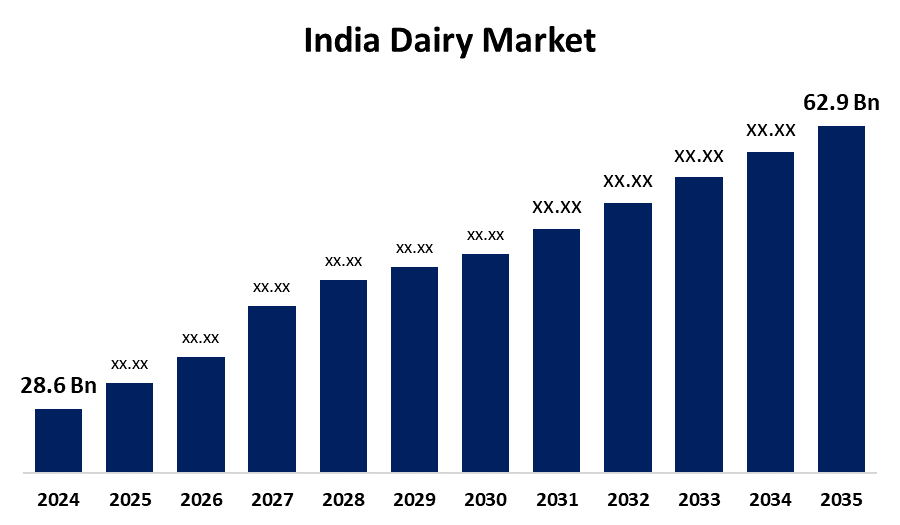

- The India Dairy Market Size was estimated at USD 28.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.43% from 2025 to 2035

- The India Dairy Market Size is Expected to Reach USD 62.9 Billion by 2035

Get more details on this report -

The India Dairy Market Size is Anticipated to reach USD 62.9 Billion By 2035, Growing at a CAGR of 7.43% from 2025 to 2035. Consumers are becoming increasingly health-conscious, which has resulted in a demand for dairy products that have some nutritional value. Such a trend encompasses an increasing demand for low-fat, sugar-free, and organic dairy products, and also probiotic products such as yogurt and kefir.

Market Overview

The India dairy market refers to the production, processing, distribution, and consumption of dairy products within the country. India, being the largest milk-producing country in the world, has a central position in the global milk and dairy market. The market consists of a large variety of products including milk, yogurt, paneer, butter, cheese, and milk-based drinks, satisfying various consumer tastes. The increasing trend of consumption of functional dairy products like vitamins & minerals-fortified milk among health-conscious people is driving the market growth. Accordingly, customers are suggesting their value-added product demand to drive market growth. For instance, in March 2020, Hangyo, an industry based in South Mumbai, introduced a new range of gourmet ice creams with omega-3, 6, and 9 fortifications.

Report Coverage

This research report categorizes the market for the India dairy market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India dairy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India dairy market.

India Dairy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 28.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.43% |

| 2035 Value Projection: | USD 62.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Category, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Heritage Foods Limited, Karnataka Cooperative Milk Producers Federation Limited, Kwality Milk Foods Ltd, Milk food Limited, National Dairy Development Board, Parag Milk Foods, Punjab State Cooperative Milk Producers Federation Ltd, Rajasthan Cooperative Dairy Federation Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological innovations are transforming the dairy sector, causing it to become more efficient and productive. Precision agriculture methods, enhanced animal breeding techniques, computerized milking systems, and advanced processing technologies are ensuring maximum use of resources and zero waste. In addition, cold chain technologies are being adopted to provide quality dairy products to consumers nationwide.

Restraining Factors

One of the major constraints in the Indian dairy industry is the poor cold chain infrastructure, particularly in rural India where much of the milk production comes from. Inadequate storage and transport facilities lead to post-harvest losses and reduce the quality of dairy products.

Market Segmentation

The India dairy market share is classified into category and distribution channel.

- The yogurt segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India dairy market is segmented by category into butter, cheese, cream, dairy desserts, milk, sour milk drinks, and yogurt. Among these, the yogurt segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This impressive growth path is fueled by growing health awareness among Indian consumers and the increasing demand for probiotic dairy products. The growth of the segment is also driven by product innovation, especially in flavoured and functional yogurt types, and the launch of convenient packaging formats. Large dairy firms are investing heavily in yogurt manufacturing plants and introducing new product variants to benefit from this increasing demand.

- The specialty retailers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India dairy market is segmented by distribution channel into supermarkets/hypermarkets, specialty retailers, online retail stores, and others. Among these, the specialty retailers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. specialty retailers also are expanding rapidly in developing and developed nations, including India. The benefits of product knowledge, unmatched customer experience, and a broad range of higher-quality products facilitate segmental growth. These stores were specialized in the sale of a specific product of different brands and would never sell any other product except the given range. Such factors ensure the generation of immense profit income and enhance sales of dairy and dairy-based products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India dairy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Heritage Foods Limited

- Karnataka Cooperative Milk Producers Federation Limited

- Kwality Milk Foods Ltd

- Milk food Limited

- National Dairy Development Board

- Parag Milk Foods

- Punjab State Cooperative Milk Producers Federation Ltd

- Rajasthan Cooperative Dairy Federation Ltd

- Others

Recent Developments:

- In March 2024, Nova Dairy, a pioneer in India's dairy industry, launched its new product, A2 Cow Ghee, which was made using the ancient Bilona ghee curd churning process of A2 cow milk. The product offered health and quality advantages, reinforcing the brand’s commitment to purity.

- In January 2024, Gujarat Cooperative Milk Marketing Federation (GCMMF) introduced Sagar Skimmed Milk throughout India. The launch was designed to cater to changing consumer preferences, with Sagar Skimmed Milk appealing to the economic segment and health-conscious individuals seeking fat-free milk. The increased demand for clean-labelled dairy products, integration of dairy products into Indian diets, supportive government policies, and technological innovations and advancements drove the growth of the Indian dairy market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India dairy market based on the below-mentioned segments:

India Dairy Market, By Category

- Butter

- Cheese

- Cream

- Dairy Desserts

- Milk

- Sour Milk Drinks

- Yogurt

India Dairy Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Retailers

- Online Retail Stores

- Others

Need help to buy this report?