India Autonomous Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Level of Automation (Level 1, Level 2, Level 3, Level 4, and Level 5), By Application (Civil, Defense, Transportation & Logistics, and Construction), By Drive Type (Semi-autonomous and Fully Autonomous), By Vehicle Type (Passenger Car and Commercial Vehicle), By Component (Hardware, Software, and Services), and India Autonomous Vehicle Market Insights, Industry Trend, Forecasts to 2032.

Industry: Automotive & TransportationIndia Autonomous Vehicle Market Insights Forecasts to 2032

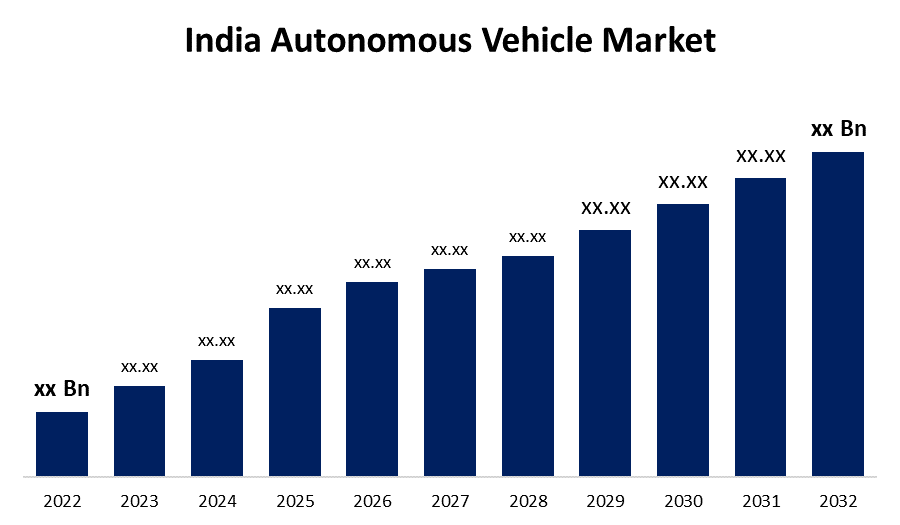

- The India Autonomous Vehicle Market Size was valued at USD XX Billion in 2022.

- The Market is growing at a CAGR of 20.8% from 2022 to 2032.

- The India Autonomous Vehicle Market Size is expected to reach USD XX Billion by 2032.

Get more details on this report -

The India Autonomous Vehicle Market is anticipated to exceed USD XX Billion by 2032, growing at a CAGR of 20.8% from 2022 to 2032.

Market Overview

Autonomous vehicles, also known as self-driving cars, are gaining popularity in the country, owing to advances in artificial intelligence, sensor technologies, and a growing demand for safer and more efficient transportation solutions. Several factors were influencing the development of self-driving cars in India. The growing urbanization and traffic congestion in major cities such as Delhi, Mumbai, and Bangalore have increased the demand for intelligent mobility solutions that can alleviate congestion while also improving transportation efficiency. Furthermore, the Indian government's emphasis on promoting electric and sustainable transportation has aided in the adoption of autonomous electric vehicles (EVs). Domestic and international automakers, technology companies, and startups that were actively investing in R&D were key players in the India autonomous vehicle market. Collaborations between industry stakeholders, academia, and the government were common to foster the growth of autonomous vehicles in the country.

Report Coverage

This research report categorizes the market for the India Autonomous Vehicle market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Autonomous Vehicle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Autonomous Vehicle market.

India Autonomous Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD XX Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 20.8% |

| 022 – 2032 Value Projection: | USD XX Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Level of Automation, By Application, By Drive Type, By Vehicle Type, By Component. |

| Companies covered:: | Tata Motors, Ashok Leyland, Maruti Suzuki India Limited, Hella India Automotive Pvt. Ltd., Mahindra & Mahindra and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

To combat air pollution and reduce reliance on fossil fuels, the Indian government has actively promoted electric vehicles (EVs). The incorporation of autonomous technology into electric vehicles is consistent with the country's goals for sustainable mobility and encourages investment in autonomous EV research and development. The increasing demand for connected services and infotainment systems in vehicles has opened opportunities for autonomous vehicles. Consumers are looking for integrated systems that enhance their driving experience, and autonomous vehicles can provide seamless connectivity options. The Indian government has shown interest in fostering a favorable environment for autonomous vehicles. Policies, regulations, and pilot projects for testing and deploying autonomous vehicles are being developed to pave the way for their safe and legal operation on Indian roads.

Restraining Factors

Autonomous vehicle technology can be costly, making the initial cost of autonomous vehicles prohibitive for many Indian consumers. Furthermore, building the necessary infrastructure to support autonomous vehicles, such as charging stations for electric autonomous vehicles, may necessitate significant investment.

Market Segmentation

The India Autonomous Vehicle Market share is classified into drive type, and vehicle type.

- The semi-autonomous segment accounted for the largest share of the India autonomous vehicle market in 2022.

The India autonomous vehicle market is segmented by drive type into semi-autonomous and fully autonomous. Among these, the semi-autonomous segment accounted for the largest share of the India autonomous vehicle market in 2022. Due to the potential benefits, the use of semi-autonomous vehicles has been continuously increasing. These include increased safety, reduced driver fatigue, and increased fuel efficiency. Furthermore, the Indian government's emphasis on promoting electric and connected mobility has fueled interest in semi-autonomous vehicles, which align with the country's sustainable transportation goals.

- The passenger car segment dominated the largest share of the India autonomous vehicle market in 2022.

Based on the vehicle type, the India autonomous vehicle market is divided into passenger car and commercial vehicle. Among these, the passenger car segment dominated the largest share of the India autonomous vehicle market in 2022. Initially, automotive companies and startups focused on developing autonomous technology for passenger cars, leading to more advancements in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India autonomous vehicle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tata Motors

- Ashok Leyland

- Maruti Suzuki India Limited

- Hella India Automotive Pvt. Ltd.

- Mahindra & Mahindra

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the India Autonomous Vehicle Market based on the below-mentioned segments:

India Autonomous Vehicle Market, By Level of Automation

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

India Autonomous Vehicle Market, By Application

- Civil

- Defense

- Transportation & Logistics

- Construction

India Autonomous Vehicle Market, By Drive Type

- Semi-autonomous

- Fully Autonomous

India Autonomous Vehicle Market, By Vehicle Type

- Passenger Car

- Commercial Vehicle

India Autonomous Vehicle Market, By Component

- Hardware,

- Software and Services

Need help to buy this report?