India Automotive Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Types (Two-Wheelers, Passenger Cars, Commercial Vehicles, Three-Wheelers), By Fuel Type (Diesel, Petrol/Gasoline, Electric, CNG/LPG, Others), By End-use (Personal, Commercial), and India Automotive Market Insights Forecasts to 2032

Industry: Automotive & TransportationIndia Automotive Market Insights Forecasts to 2032

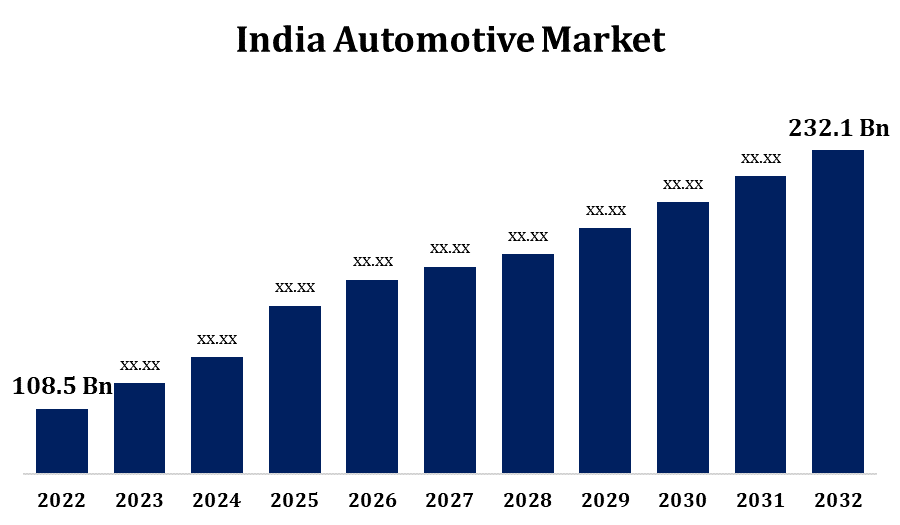

- The India Automotive Market Size was valued at USD 108.5 Billion in 2022

- The Market Size is Growing at a CAGR of 7.9% from 2022 to 2032

- The India Automotive Market Size is Expected to Reach USD 232.1 Billion by 2032

Get more details on this report -

The India Automotive Market Size is Expected to Reach USD 232.1 Billion by 2032, at a CAGR of 7.9% during the forecast period 2022 to 2032.

Market Overview

The automotive vehicle industry simply means the production, manufacturing, and sale of vehicles. These vehicles are classified by their unique design, utility, and purpose. The Indian automotive market is witnessing high demand over the forecast period owing to various factors such as modifying transportation laws, the need for an alternative source of fuels, and many others. India is the fourth largest producer of automobiles, with an annual production of more than 4 million vehicles. The innovative ideas for making more efficient and sustainable automotive products have driven the Indian automotive market during the forecast period. India is a well-recognized automobile manufacturing hub owing to its low-cost production. The cheap labor, easy availability, and low cost of raw materials are the factors that drive the manufacturing industry.

Report Coverage

This research report categorizes the market for the India automotive market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India automotive market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India automotive market.

India Automotive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 108.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.9% |

| 2032 Value Projection: | USD 232.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Types, By Fuel Type, By End-use |

| Companies covered:: | ASHOK LEYLAND, Bajaj Auto Ltd., Mercedes-Benz Group AG., EICHER MOTORS LIMITED, Honda Motor Co., Ltd., Hyundai Motor India, Mahindra & Mahindra Ltd., MARUTI SUZUKI INDIA LIMITED, Piaggio & C. SpA, Tata Motors, TOYOTA MOTOR CORPORATION., Volkswagen Group, AB Volvo, TVS Motor Company, Hero Moto Corp., Royal Enfield, MG Motor India Pvt. Ltd, Mercedes-Benz India Pvt Ltd, Atul Auto Limited and Other Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in passenger car sales is being driven by urbanization, changing lifestyles, and rising middle-class incomes. India's technological advancement has been a driving force in the growth of the India automotive market. This development has resulted in an increase in population income and the creation of more job opportunities. The increase in income is directly related to a change in lifestyle and the use of passenger cars, which drives the Indian automotive market during the forecast period. Commercial vehicle demand has increased in recent years as the economy and industrial sector have expanded, necessitating the transportation of goods over long distances. This commercial vehicle market contributes significantly to India's growing economy and drives the automobile industry.

Restraining Factors

The Indian automotive market faces several challenges. Due to an increase in road accidents, the government has raised policies for maintaining vehicle safety and quality standards. Government regulations for the automotive industry change frequently, and manufacturers may find it difficult to adapt to these policies. Fuel price increases put tremendous pressure on vehicle prices, making them more expensive and less affordable. Adapting and implementing new technologies, such as autonomous driving systems, is more expensive, raising vehicle prices. It may hamper the market growth.

Market Segment

- In 2022, the three-wheeler segment is expected to hold the largest share of the India automotive market during the forecast period.

Based on the vehicle types, the India automotive market is classified into two-wheelers, passenger cars, commercial vehicles, and three-wheelers. Among these, the three-wheeler segment is expected to hold the largest share of the India automotive market during the forecast period. Three-wheelers are frequently used for short-distance transportation. As three-wheelers provide low-cost short-distance passenger transportation, the market capitalizes on Indian consumers' high price sensitivity. As a growing population in India, which necessitates transportation, demand is expected to remain stable during the forecast period.

- In 2022, the electric segment accounted for the largest revenue share over the forecast period.

Based on the fuel type, the India automotive market is segmented into diesel, petrol/gasoline, electric, CNG/LPG, and others. Among these, the electric segment has the largest revenue share over the forecast period. Government incentives, increased environmental awareness, and technological breakthroughs are all contributing to the surge in demand for electric vehicles in the Indian automotive market during the forecast period. Government policies and incentives have played an important role in driving EV adoption in India.

- In 2022, the commercial segment accounted for significant growth over the forecast period.

Based on the end-use, the India automotive market is segmented into personal and commercial. Among these, the commercial segment has significant growth over the forecast period. Commercial vehicle demand has increased in recent years as the economy and industrial sector have expanded, necessitating the transportation of goods over long distances. This commercial vehicle market is important to India's expanding economy and drives the Indian automotive market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India automotive market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ASHOK LEYLAND

- Bajaj Auto Ltd.

- Mercedes-Benz Group AG.

- EICHER MOTORS LIMITED

- Honda Motor Co., Ltd.

- Hyundai Motor India

- Mahindra & Mahindra Ltd.

- MARUTI SUZUKI INDIA LIMITED

- Piaggio & C. SpA

- Tata Motors

- TOYOTA MOTOR CORPORATION.

- Volkswagen Group

- AB Volvo

- TVS Motor Company

- Hero Moto Corp.

- Royal Enfield

- MG Motor India Pvt. Ltd

- Mercedes-Benz India Pvt Ltd

- Atul Auto Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, Hero MotoCorp announced an INR 420 crore (USD 55.76 million) investment in Ather Energy as part of its 'Be the Future of Mobility' strategy.

- In November 2021, TVS Motor agreed to invest INR 1,200 crore (USD 159.33 million) with the Tamil Nadu government to develop new electric vehicle technologies and expand their manufacturing capacity.

- In November 2021, Automaker Volkswagen India partnered with Centre's Kendriya Police Kalyan Bhandar scheme to offer its products to personnel of central security agencies and their families.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the India automotive market based on the below-mentioned segments:

India Automotive Market, By Vehicle Type

- Two-Wheelers

- Passenger Cars

- Commercial Vehicles

- Three-Wheelers

India Automotive Market, By Fuel Type

- Diesel

- Petrol/Gasoline

- Electric

- CNG/LPG

- Others

India Automotive Market, By End-Use

- Personal

- Commercial

Need help to buy this report?