Global Hybrid Train Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (Electro Diesel, Battery Operated, Hydrogen, CNG, LNG, and Solar), By Application (Passenger and Freight) By Operating Speed (>100 km/h, 100-200 km/h, <200 km/h) By Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2021 - 2030

Industry: Automotive & TransportationGlobal Hybrid Train Market Insights Forecasts to 2030

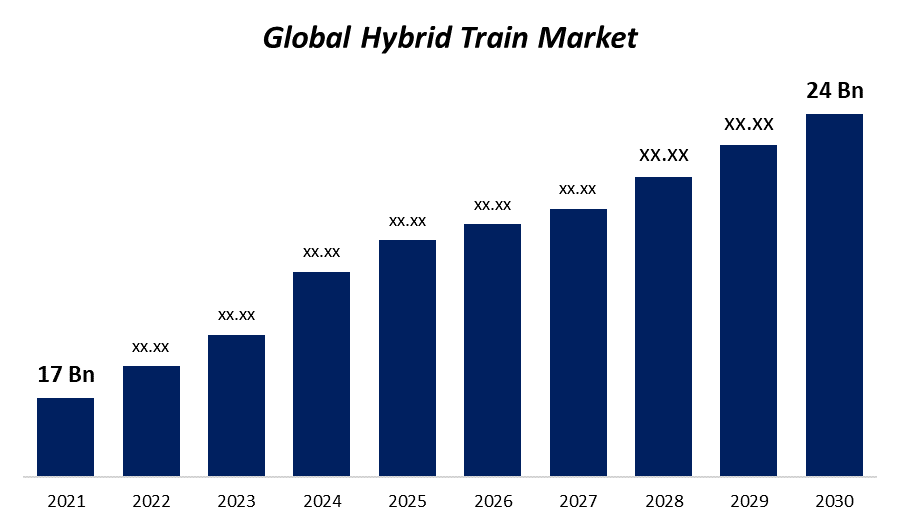

The Global Hybrid Train Market Size was valued at USD 17 Billion in 2021 and is expected to reach USD 24 Billion in 2030 at a CAGR of 6% from 2021 to 2030. A hybrid train is a locomotive transportation mode that uses diesel fuel in addition to an on-board rechargeable energy storage system (RESS). To facilitate smooth functioning, they are situated between the source of power and the traction transmission system, which is directly coupled with the wheels. Additionally, they use a variety of energy-storing components, such as supercapacitors, flywheels, and batteries, to maintain extra energy generated by regenerative braking. In comparison to conventional fuel trains, hybrid trains are more dependable, noise- and emission-free, economical, and environmentally benign. Currently, hybrid trains come with solar electricity, battery power, compressed natural gas (CNG), and electro-diesel propulsion options.

Get more details on this report -

Global demand for rail vehicles in metropolitan areas, where the current transportation infrastructure is proving insufficient, is sparked by the expanding population. The demand for new rail vehicles is anticipated to increase with the growth of infrastructural networks. Manufacturers of hybrid trains should benefit from the growing expenditures made by governments throughout the world in building rail infrastructure by expanding their geographic reach and revenue streams.

Driving Factors

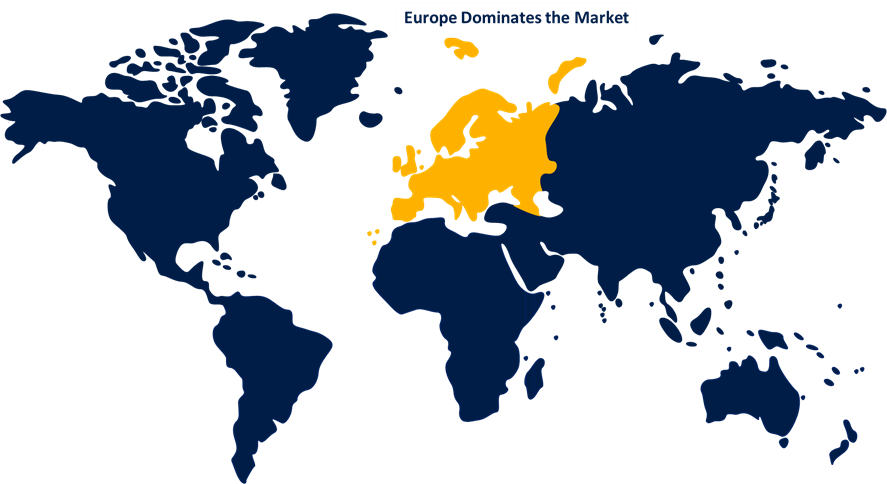

Due to rising local demand, supportive government policies, and cost advantages, production activity is expected to rise in nations like Brazil, Russia, and China. Due to the developed infrastructure for passenger transit, the hybrid train market in Europe is anticipated to increase steadily, whereas the industry in North America is driven by freight transportation.

Over the upcoming years, the demand for transportation that is dependable, sustainable, affordable, and energy-efficient is anticipated to expand. Additionally, the market is anticipated to grow in the upcoming years due to the growing requirement to regulate the environment's rising levels of pollution and noise. Additionally, it is projected that the market would be driven by the increased need for public transportation to help reduce the amount of traffic on the roads, the scarcity of natural resources, and the rising cost of fuel.

Restraining Factors

The market is expected to have opportunities due to government backing for alternative fuel-powered railroad operations. There are some limitations and difficulties that can impede market expansion. Market restrictions are likely to be caused by the high cost of maintenance and overhaul as well as the propensity for renovating and using conventional railway systems.

COVID 19 Impact

The COVID-19 pandemic has had a negative impact on the hybrid train sector, upsetting the entire ecosystem and suspending both production and sales of new rail cars globally. However, demand is anticipated to rebound. Furthermore, strict emission regulations set by numerous governments have compelled manufacturers to employ new, less polluting hybrid train technology. Additionally, ongoing research and development projects in this industry are probably going to have a significant impact on market expansion.

Global Hybrid Train Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 17 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6% |

| 2030 Value Projection: | USD 24 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Propulsion Type, By Application, By Operating Speed, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Kawasaki Heavy Industries, CRRC, Bombardier, Alstom, General Electric, Hyundai Rotem, Construcciones Y Auxiliar De Ferrocarriles (CAF), Hitachi, Siemens, Toshiba, Alstom SA, Wabtec Corporation, Stadler Rail AG, China Railway Rolling Stock and other key vendors. |

| Pitfalls & Challenges: | Due to the increasing number of COVID-19 cases |

Get more details on this report -

Segmentation

The global hybrid train market is segmented into Propulsion Type, Application, Operating Speed, and Region.

Global Hybrid Train Market, By Propulsion Type

The powertrain for the battery-powered train propulsion is made up of several motors and batteries. These batteries can be charged at charging stations or by overhead wires. Because they are less expensive to install and run than traditional diesel trains, battery-powered trains are efficient. These trains also operate quietly and have no emissions, which satisfies the need for emission-free railroad operations. These trains have a recyclability efficiency of 80–90%. Lithium-Ion batteries are typically utilised in battery-powered trains all over the world. For instance, BNSF and Wabtec Corporation will start testing battery-electric locomotives between Barstow and Stockton in California in January 2021 as part of their research into the viability of the technology.

Global Hybrid Train Market, By Application

Due to the expansion in rail-based freight transportation, particularly in Europe, the market for hybrid trains is growing at the fastest rate for freight transportation. For instance, CRRC (China) announced HXN6 hybrid locomotives in June 2022, which may lower diesel engine noise by more than 80%, exhaust emissions by 40% to 80%, and fuel consumption by 30% to 50%. Additionally, the HXN6 hybrid locomotive has excellent traction performance. A single locomotive is capable of hauling more than 10,000 tonnes of goods during shunting. Additionally, the market for cost-effective and efficient passenger transportation will account for the largest market in 2022 because of In order to relieve traffic and provide an inexpensive method of intercity and intracity travel, a number of cities are putting new rail infrastructure projects into action. The market for hybrid trains will rise in response to growing urbanisation and rising consumer demands for greater connectivity, comfort, dependability, and safety.

Global Hybrid Train Market, By Operating Speed

The main usage of electric propulsion is to reach speeds of more than 200 km/h. As a result, operating trains with a speed of more than 200 km/h are powered by dual propulsion and pushed by electricity. Currently, hybrid trains going faster than 200 km/h make up a smaller portion. In the upcoming years, hybrid trains with a top speed of more than 200 km/h are anticipated to grow as a result of the steady advancement in railway technology. The market for hybrid trains is being driven by the rapid technical advancements in the rail sector, which are prompting train makers to increase their R&D spending.

Get more details on this report -

Global Hybrid Train Market, By Region

Due to the increased adoption of hybrid trains in nations like France, Spain, Germany, and the UK, the hybrid train industry in Europe is anticipated to experience considerable growth over the forecast period. Furthermore, the demand for hybrid trains is anticipated to rise as urbanisation and rail infrastructure construction activities increase in European countries, driving the industry ahead throughout the course of the projected period. Due to a rise in government measures focused at decreasing carbon emissions, the market is anticipated to develop.

Recent Developments in Global Hybrid Train Market

- In July 2020, Hitachi Rail and Hyperdrive Innovation made public their exclusive agreement to create a battery centre in the UK's North East and to develop battery packs for zero-emission trains.

- In July 2020, Cummins Inc. announced that it would partner with NPROXX, a pioneer in hydrogen storage and transportation, to start a joint venture for hydrogen storage tanks. The joint venture's name will be NPROXX moving forward. Through the joint venture, customers will be able to buy hydrogen and compressed natural gas storage devices for both on-highway and rail applications.

List of Key Market Players

- Kawasaki Heavy Industries

- CRRC

- Bombardier

- Alstom

- General Electric

- Hyundai Rotem

- Construcciones Y Auxiliar De Ferrocarriles (CAF)

- Hitachi

- Siemens

- Toshiba

- Alstom SA

- Wabtec Corporation

- Stadler Rail AG

- China Railway Rolling Stock

Segmentation

By Propulsion Type

- Electro Diesel

- Battery Operated

- Hydrogen

- CNG

- LNG

- Solar

By Application

- Passenger

- Freight

By Operating Speed

- >100 km/h

- 100-200 km/h

- <200 km/h

By Region

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Propulsion Type

- North America, by Application

- North America, by Operating Speed

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Propulsion Type

- Europe, by Application

- Europe, by Operating Speed

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Propulsion Type

- Asia Pacific, by Application

- Asia Pacific, by Operating Speed

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Propulsion Type

- Middle East & Africa, by Application

- Middle East & Africa, by Operating Speed

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Propulsion Type

- South America, by Component

- South America, by Operating Speed

Need help to buy this report?