Global HPV Testing and Pap Test Market Size, Share, and COVID-19 Impact Analysis, By Test Type (HPV Testing and Pap Test), By Application (Cervical Cancer Screening and Vaginal Cancer Screening), By Product (Instruments, Consumables, and Services), By Technology (PCR, Immunodiagnostics, and Others), By End-Use (Hospitals & Clinics, Laboratories, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: HealthcareGlobal HPV Testing and Pap Test Market Insights Forecasts to 2032

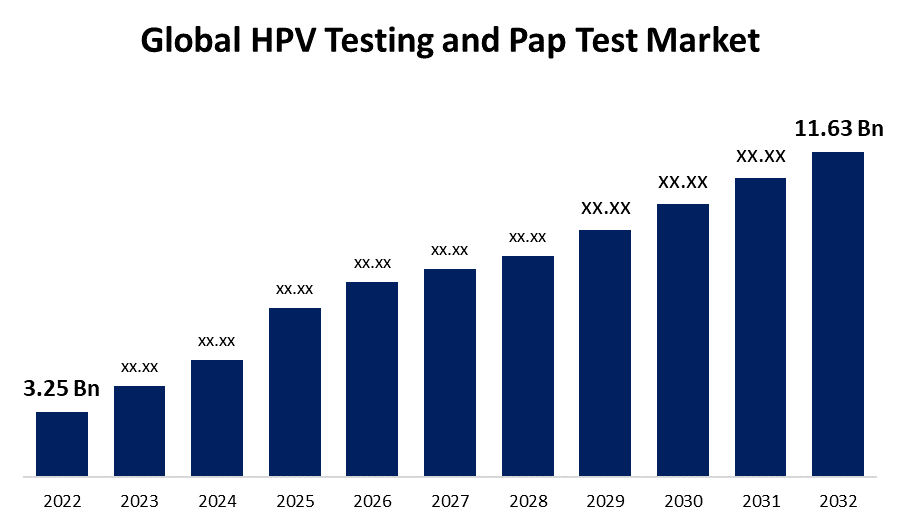

- The Global HPV Testing and Pap Test Market Size was valued at USD 3.25 Billion in 2022.

- The Market is growing at a CAGR of 13.6% from 2022 to 2032

- The Worldwide HPV Testing and Pap Test Market Size is expected to reach USD 11.63 Billion by 2032

- Asia-Pacific is expected to grow higher during the forecast period

Get more details on this report -

The Global HPV Testing and Pap Test Market Size is expected to reach USD 11.63 Billion by 2032, at a CAGR of 13.6% during the forecast period 2022 to 2032.

Market Overview

HPV testing and Pap test are crucial screening methods used to detect cervical cancer and human papillomavirus (HPV) infections in women. The Pap Test, also known as Pap smear, involves collecting cells from the cervix to examine for any abnormalities or pre-cancerous changes. This test helps identify early signs of cervical cancer, enabling timely intervention and treatment. On the other hand, HPV testing involves analyzing cervical samples to detect the presence of high-risk HPV strains, which are responsible for most cases of cervical cancer. This test is often performed in conjunction with the Pap Test or as a follow-up if the Pap Test results are inconclusive. Regular screenings are essential as they significantly reduce the risk of developing advanced cervical cancer and play a pivotal role in women's reproductive health.

Report Coverage

This research report categorizes the market for HPV testing and Pap test market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the HPV testing and Pap test market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the HPV testing and Pap test market.

Global HPV Testing and Pap Test Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.25 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 13.6% |

| 022 – 2032 Value Projection: | USD 11.63 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Test Type, By Application, By Product, By Technology, By End-Use, By Region. |

| Companies covered:: | Abbott Laboratories, Qiagen N.V., Becton, Dickinson & Company, Quest Diagnostics, Inc., Hologic, Inc., F. Hoffmann-La Roche, Femasys, Inc., Arbor Vita Corporation, NURX, Inc., Seegene, Inc., Thermo Fisher Scientific, Inc., BioMerieux SA, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The HPV testing and Pap test market is influenced by various drivers, due to the growing awareness about cervical cancer and HPV infections as significant health concerns has led to increased demand for early detection and prevention measures. The healthcare initiatives and government programs advocating regular screenings have boosted market growth. Additionally, advancements in technology and test accuracy have increased the adoption of these tests. Moreover, the rising incidence of cervical cancer globally and the need to reduce mortality rates further fuel the market expansion. Furthermore, the shift towards personalized medicine and targeted therapies has emphasized the importance of accurate diagnostics, driving the market's growth. Lastly, collaborations between diagnostic companies and healthcare providers, along with favorable reimbursement policies, have played a pivotal role in expanding the HPV testing and Pap test market reach.

Restraining Factors

The HPV testing and Pap test market faces several restraints, because the social stigma associated with discussing and undergoing tests for sexually transmitted infections, including HPV, hinders widespread acceptance and utilization of these tests. The limited accessibility to healthcare facilities, particularly in rural and underprivileged areas, restricts the availability of screening services, leading to lower test rates. The high cost of HPV testing and Pap test market procedures can act as a deterrent, especially in regions with limited healthcare resources or inadequate insurance coverage. Additionally, the emergence of alternative screening methods and diagnostic technologies may divert attention and resources from traditional tests.

Market Segmentation

- In 2022, the Pap testing segment accounted for around 54.7% market share

On the basis of the test type, the global HPV testing and Pap test market is segmented into HPV testing and Pap test. The Pap test segment has emerged as the dominant force in the HPV Testing and Pap Test market for several compelling reasons. The Pap test has a long-standing history and is a well-established screening method for cervical cancer, making it widely recognized and trusted among healthcare providers and patients alike. Its proven track record in detecting pre-cancerous changes and early-stage cervical cancer has solidified its position as a preferred screening option. The Pap test is relatively cost-effective and easily accessible, particularly in comparison to some advanced HPV testing methods. This affordability and ease of implementation have made it the go-to choice, especially in regions with limited healthcare resources or lower-income populations. The Pap test is a crucial component of many national and regional cervical cancer screening programs, supported by governments and healthcare authorities. These programs often promote the widespread adoption of Pap tests, contributing to its dominance in the market. Moreover, despite advancements in HPV testing technologies, the Pap test continues to play a pivotal role as a primary screening tool, especially in regions where HPV testing infrastructure is still developing or not universally available. Furthermore, the well-established guidelines and protocols for Pap testing have facilitated standardized practices and reporting, ensuring consistent and reliable results across different healthcare settings. Overall, the Pap test's non-invasive nature and simplicity in sample collection make it more acceptable to patients, encouraging higher compliance rates for regular screenings.

- In 2022, the cervical cancer screening segment dominated with more than 73.5% market share

Based on the type of application, the global HPV testing and Pap test market is segmented into cervical cancer screening and vaginal cancer screening. The cervical cancer screening segment has emerged as the dominant force in the HPV testing and Pap test market for several significant reasons. The cervical cancer screening, which includes both HPV testing and Pap smears, is a crucial aspect of women's healthcare and preventive medicine. Cervical cancer is a major global health concern, and screening plays a pivotal role in its early detection and management, driving higher demand for these tests. The healthcare organizations and governments worldwide have intensified their efforts to raise awareness about cervical cancer and the importance of regular screenings. National and regional screening programs often focus on cervical cancer, promoting higher adoption rates for these tests. The advancements in technology have led to the development of more accurate and sensitive screening methods, improving the overall efficacy of cervical cancer detection. HPV testing, in particular, has shown promising results in identifying high-risk HPV strains, further bolstering its importance in the screening process. Moreover, the growing focus on women's health and the shift towards preventive healthcare have elevated the significance of cervical cancer screening in routine medical check-ups. Furthermore, the cervical cancer screening segment's dominance is also attributed to the broader target audience it addresses. HPV testing and Pap smears are not limited to a specific age group, as is the case with some other cancer screenings, making them applicable to a wider population of women. Overall, partnerships and collaborations between healthcare organizations and diagnostic companies have played a crucial role in expanding the availability and accessibility of cervical cancer screening services, further contributing to the segment's dominance in the HPV testing and Pap test market.

Regional Segment Analysis of the HPV Testing and Pap Test Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 41.3% revenue share in 2022.

Get more details on this report -

North America dominates the HPV testing and Pap test market share due to several key factors because the region benefits from a well-established healthcare infrastructure and advanced medical facilities, ensuring widespread access to screening services. There is a high level of awareness among the population about the importance of regular cervical cancer screenings, leading to increased demand for HPV testing and Pap smears. The proactive government initiatives and public health programs promote early detection and preventive healthcare measures, further driving the market's growth. Additionally, North America is home to several leading diagnostic companies and research institutions, fostering innovation and advancements in testing technologies. Moreover, favorable reimbursement policies and strong healthcare spending contribute to the region's dominance in the HPV testing and Pap test market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global HPV testing and Pap test market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Abbott Laboratories

- Qiagen N.V.

- Becton, Dickinson & Company

- Quest Diagnostics, Inc.

- Hologic, Inc.

- F. Hoffmann-La Roche

- Femasys, Inc.

- Arbor Vita Corporation

- NURX, Inc.

- Seegene, Inc.

- Thermo Fisher Scientific, Inc.

- BioMerieux SA

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Roche has announced the availability of a self-sampling method for human papillomavirus (HPV) in countries that recognize the CE certification. This novel approach allows a patient to take a sample for HPV screening in solitude. The clinically verified vaginal sample is tested on a Roche molecular equipment using the Roche Cobas HPV test.

- In May 2021, Becton, Dickinson, and Company announced the CE marking of the industry's first self-collection claim for HPV screening in accordance with IVD Directive 98/79/EC. The new claim allows laboratories and facilities to use the BD Onclarity HPV Assay on either the BD Viper LT or the BD COR System to process self-collected samples using a BD diluent tube.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global HPV testing and Pap test market based on the below-mentioned segments:

HPV Testing and Pap Test Market, By Test Type

- HPV Testing

- Pap Test

HPV Testing and Pap Test Market, By Application

- Cervical Cancer Screening

- Vaginal Cancer Screening

HPV Testing and Pap Test Market, By Product

- Instruments

- Consumables

- Services

HPV Testing and Pap Test Market, By Technology

- PCR

- Immunodiagnostics

- Others

HPV Testing and Pap Test Market, By End-Use

- Hospitals & Clinics

- Laboratories

- Others

HPV Testing and Pap Test Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?