Global High Voltage Switchgear Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (Gas Insulated, Oil Insulated, Air Insulated), By Application (Power Generation, Industrial, Oil and Gas, Others); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of the Middle East & Africa, Brazil, Argentina, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

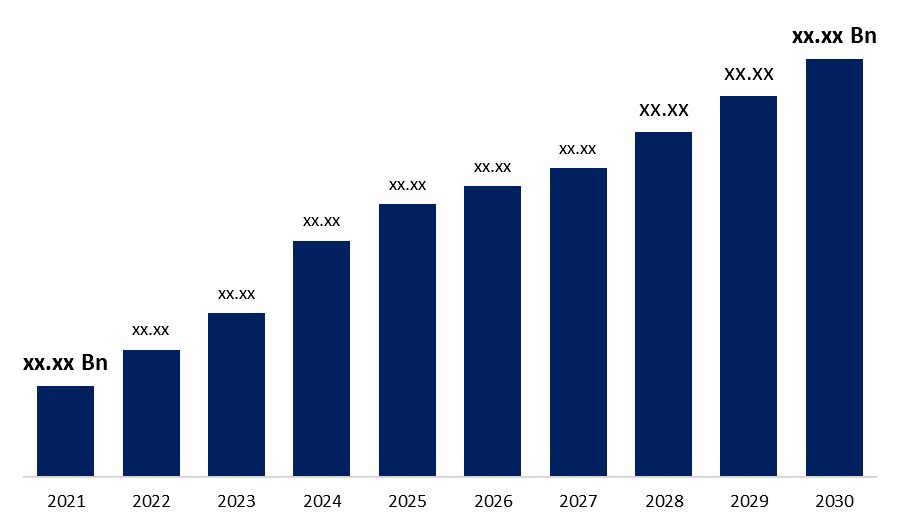

Industry: Energy & PowerThe Global High Voltage Switchgear Market is expanding at a CAGR of around 6.5% during the forecast period, from 2021 to 2030. High voltage switchgear is a device that controls the flow of huge amounts of electric power and is an essential component of electric substations. To meet market demands, electricity suppliers around the world are growing more reliant on remote energy sources as supplements, allowing the sector to bridge the gap between supply and demand. As a result, there is a greater emphasis on adopting high voltage current transfers.

Get more details on this report -

Rising trends toward sustainable power reconciliations across transmission and distribution networks, as well as the replacement of obsolete electrical components, are credited to the industry's growth. Tax breaks and subsidies to integrate productive electricity networks, as well as financial incentives, will improve the business environment. New regulations aimed at reducing/limiting power outages and improving power distribution networks are causing a surge in demand for power sector equipment. The equipment to make wiser decisions by supplying real-time data to show faults and improvement chances is a major force driving the Switchgears market.

Continuous government support in over 130 countries, strong net-zero objectives declared by countries accounting for about 90% of global GDP, and rising wind and solar PV competitiveness are all driving this expansion. Around 290 gigawatts (GW) of additional renewable energy capacity will be added in 2021, representing a 3% increase over the already strong growth experienced in 2020. In 2021, solar PV accounted for more than half of global renewable energy expansion, followed by wind and hydropower. Renewable power growth in the European Union is likely to outperform what the existing National Energy and Climate Plans (NECPs) forecast for 2030, according to the trajectory of renewable capacity increase from 2021 to 2026.

The pandemic was a significant disruptor, creating both challenges and opportunities for the sector. COVID-19's influence has also emphasized the need for better risk management, increased preparedness, and resilience. Many supply chain restrictions continued to plague switchgear makers, particularly in base metals (copper, aluminum, steel), plastics, electronics, and transportation services. The COVID-19 pandemic's consequences, including steps taken by businesses and governments to contain the virus, led to a considerable drop in manufacturing and industrial activity, immediately harming the switchgear market, as it is predominantly used in such industries and business units.

Global High Voltage Switchgear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 120 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6.5% |

| 2030 Value Projection: | USD 140 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Mitsubishi Electric Corporation, Powell Industries, Hyosung Heavy Industries, Schneider Electric, General Electric, Ormazabal, Siemens, Bharat Heavy Electricals Limited, Toshiba Corporation, CG Power and Industrial Solutions Limited, ABB, Chint Group, Eaton, Lucy Group Ltd, Hitachi Ltd, E + I Engineering, Skema S.p.A, Regal Rexnord Corporation, Fuji Electric Co., Ltd, Hyundai Electric & Energy Systems Co., Ltd, Flowserve Corporation. |

| Growth Drivers: | 1)The gas-insulated segment is expected to dominate the 2)The power generation segment is expected to dominate the market |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Type Outlook

The gas-insulated segment is expected to dominate the market share in 2020 in the global High voltage switchgearing systems market owing to the most used in a variety of industries to meet a variety of purposes at variable voltage levels. Sulfur hexafluoride (SF6) or a mixture of SF6 and other insulating gases is used in enclosed enclosures in GIS. GIS normally has continuous current and interrupting ratings of 3,000 A and 40 kA. Gas-insulated high-voltage switchgear (GIS) is lightweight material switchgear that contains high-voltage devices including circuit breakers and disconnectors and may be operated safely in limited places. Circuit breakers, relays, and other components are among those used. High voltage switchgear adheres to IEC and ANSI standards and is utilized in transmission and distribution networks, manufacturing and processing, infrastructure, and transportation applications.

Application Outlook

The power generation segment is expected to dominate the market share in 2020 of the global high voltage switchgearing systems market owing to meet power demand, transmission and distribution utilities use both nonrenewable and renewable energy sources. The increasing usage of renewable energy sources for power generation needs an updating of existing infrastructure to allow for the seamless integration of renewable-generated electricity. Developing countries, particularly in Asia Pacific and South America, are aiming for 100% electrification and, as a result, are heavily spending in expanding existing infrastructure. These factors are expected to stimulate the growth of transmission and distribution utilities.

Regional Outlook

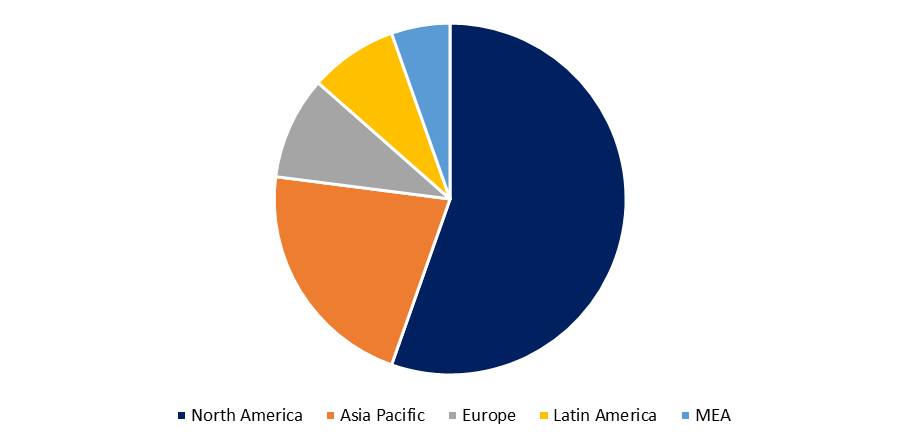

North America is estimated to be the largest market among the regions for the market studied in 2019. Canada has emphasized investments in electric grid infrastructure as well as the construction of new T&D networks, which will improve switchgear market profitability. However, market growth will be driven by the upgrading and rebuilding of existing transmission grid networks, as well as growing investments in solar and wind farms to fulfil rising sustainable energy demand. Furthermore, expanding cross-border energy trade agreements, in tandem with government measures to offer viable power transmission, will lead to customers purchasing updated electrical components.

Get more details on this report -

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. For instance, in January 2022, ABB collaborated with Samsung Electronics to develop solutions for energy savings, energy management, and smart Internet of Things (IoT) connectivity for residential and commercial buildings. In April 2021, GE and Hitachi-ABB Power Grids agreed to a non-exclusive cross-licensing deal that will allow them to grow their high-voltage equipment line by using a game-changing gas alternative to sulphur hexafluoride (SF6).

The European Commission's Life Climate Action Programme awarded GE Renewable Energy's Grid Solutions business USD 2.6 million in July 2021 to help fund the development of a 245-kilovolt (kV) g3 live tank circuit breaker free of sulphur hexafluoride (SF6). The new circuit breaker will use GE's g3 gas technology to provide the same high performance and small-dimensional footprint as a traditional SF6 circuit breaker.

Major companies in the global High Voltage Switchgear (ESP) market include Mitsubishi Electric Corporation, Powell Industries, Hyosung Heavy Industries, Schneider Electric, Ormazabal, Hitachi Ltd., E + I Engineering, Siemens, General Electric, Bharat Heavy Electricals Limited, Toshiba Corporation, CG Power and Industrial Solutions Limited, ABB, Chint Group, Eaton, Lucy Group Ltd., Skema S.p.A., Fuji Electric Co., Ltd., Regal Rexnord Corporation, and Hyundai Electric & Energy Systems Co., Ltd.

Market Segmentation of Global High Voltage Switch Gearing Systems Market

By Type

- Gas Insulated

- Oil Insulated

- Air Insulated

By Application

- Power Generation

- Industrial

- Oil and Gas

- Others

Key Players

- Mitsubishi Electric Corporation

- Powell Industries

- Hyosung Heavy Industries

- Schneider Electric

- General Electric

- Ormazabal

- Siemens

- Bharat Heavy Electricals Limited

- Toshiba Corporation

- CG Power and Industrial Solutions Limited

- ABB

- Chint Group

- Eaton

- Lucy Group Ltd.

- Hitachi Ltd.

- E + I Engineering

- Skema S.p.A.

- Regal Rexnord Corporation

- Fuji Electric Co., Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

Need help to buy this report?