Global High Purity Alumina Market Size, Share, and COVID-19 Impact Analysis, By Purity Grade (4N (99.99% Al2O3), 5N (99.999% Al2O3), and 6N (99.9999% Al2O3)), By Physical Form (Powder, Spherical Beads / Microspheres, and Dense Pellets / Sintered Forms), By End-Use Application ( Battery & Energy Storage, LED & Optoelectronics, Semiconductor & Advance Electronics, Optical & Precision Polishing, Advanced Ceramics & Transparent Ceramics, Phosphors, Catalysts & Specialty Coatings, Medical & Healthcare Applications, Industrial & High-Temperature Coatings, Optical, Display & Photonics Applications), By Sales Channel ( Direct (Industrial / OEM Contracts) and Distributors / Specialty Chemicals Traders), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal High Purity Alumina Market Insights Forecasts to 2035

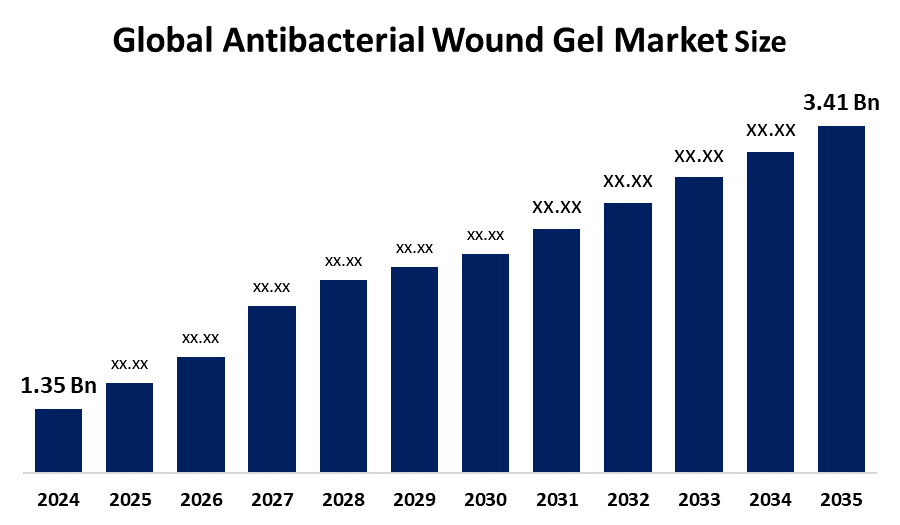

- The Global High Purity Alumina Market Size Was Estimated at USD 4.72 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.61% from 2025 to 2035

- The Worldwide High Purity Alumina Market Size is Expected to Reach USD 48.6 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global High Purity Alumina market size was worth around USD 4.72 Billion in 2024 and is predicted to grow to around USD 48.6 Billion by 2035 with a compound annual growth rate (CAGR) of 23.61% from 2025 to 2035. During the projected period, market growth is expected to be driven by the growing usage of high-purity alumina (HPA) in electric vehicle (EV) batteries and components in electronics production.

Market Overview

The global high purity alumina market refers to the industry focused on producing aluminum oxide with a higher purity level, widely used in LEDs, lithium-ion batteries, semiconductors, and advanced optical and electronic applications. The market for high purity alumina (HPA) is expanding rapidly because of the growing need for improved electronic components, LED lighting, and batteries for electric vehicles. By increasing discharge resistance and separator stability, HPA, a refined version of aluminium oxide with 99.9% or higher purity (4N–6N), improves the longevity and performance of lithium-ion batteries. It is crucial for the production of LEDs, semiconductors, and synthetic sapphire substrates used in microelectronics because of its exceptional qualities, which include thermal stability, brightness, and hardness. The U.S. Department of Energy predicts that by 2035, LED lighting will be widely adopted, which is expected to accelerate industry growth. Technological developments, such as solvent-extraction techniques and hydrochloric acid leaching, are lowering production costs and emissions, promoting sustainable growth.

The market potential is further strengthened by the increasing usage of ultra-high purity grades in patterned sapphire substrates, vertical GaN devices, and EV batteries. Further investment and innovation in the HPA sector. In 2019, Altech Chemicals produced HPA from its kaolin clay deposit using a particular method. Additionally, Altech is investigating the use of HPA in the production of epoxy moulding compounds, which are utilized in the semiconductor sector to enhance heat dissipation.

Report Coverage

This research report categorizes the high purity alumina market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the high purity alumina market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the high-purity alumina market.

Global High Purity Alumina Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.72 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 23.61% |

| 2035 Value Projection: | USD 48.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Physical Form ,By End Users |

| Companies covered:: | Sumitomo Chemical Altech Chemicals Ltd. Alpha HPA Ltd. FYI Resources Ltd. CoorsTek Inc. Baikowski SAS Sasol Limited Orbite Technologies Inc. Almatis, Inc. Alcoa Corporation Zibo Honghe Chemical Co., Ltd. Xuancheng Jingrui New Material Co., Ltd. Hebei Pengda Advanced Materials Technology Co., Ltd. Polar Sapphire Ltd. Rio Tinto and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing use of high pure alumina in LEDs, lithium-ion batteries, semiconductors, and electric vehicle power electronics is driving the market's rapid global expansion. Sapphire substrates increase LED efficiency and brightness, and HPA-coated battery separators increase longevity, safety, and charge rates. Advanced packaging and GaN device manufacture in semiconductors are supported by 6N HPA. Furthermore, EV modules' dependability is increased with HPA-based thermal interface materials that improve heat dissipation. HPA's demand is being further driven by ongoing advances in the lighting, energy storage, and high-performance electronics industries, such as AI-driven material design and energy-efficient production methods.

Restraining Factors

High production costs from energy-intensive calcination and recrystallisation procedures, especially for 5N and 6N grades, provide difficulties for the high purity alumina (HPA) industry. Large-scale use of novel solvent-extraction methods is still restricted, despite the fact that they lower emissions and energy consumption. Low-cost substitutes, including sodium-ion batteries, ceramic composites, and glass substrates, also pose a challenge to demand in cost-sensitive applications, limiting the possibility for market expansion.

Market Segmentation

The High Purity Alumina market share is classified into purity grade, physical form, end-use application, and sales channel.

- The 4N (99.99% Al2O3) segment dominated the market in 2024, approximately 41.2% and is projected to grow at a substantial CAGR during the forecast period.

Based on the purity grade, the high purity alumina market is divided into 4N (99.99% Al2O3), 5N (99.999% Al2O3), and 6N (99.9999% Al2O3). Among these, the 4N (99.99% Al2O3) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The product's use in LEDs is responsible for this rise. Additionally, it serves as a battery separator for lithium-ion batteries. The market is expected to be driven throughout the forecast period by growth in the lighting and EV industries. Additionally, it offers enough purity to enhance LED lifetime and brightness, and it is used in large-scale industrial applications where cost and performance must be balanced. Its market share is greatly influenced by the expanding EV and lighting sectors.

Get more details on this report -

- The powder segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the physical form, the high purity alumina market is divided into powder, spherical beads/microspheres, and dense pellets/sintered forms. Among these, the powder segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Because of its high purity, exceptional thermal stability, and outstanding chemical resistance, it is widely used in the production of LEDs, lithium-ion batteries, and semiconductors.

- The led & optoelectronics segment accounted for the highest share in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use application, the high purity alumina market is divided into battery & energy storage, led & optoelectronics, semiconductor & advance electronics, optical & precision polishing, advanced ceramics & transparent ceramics, phosphors, catalysts & speciality coatings, medical & healthcare applications, industrial & high-temperature coatings, optical, display & photonics applications. Among these, the led & optoelectronics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing need for energy-efficient LED lighting and display technologies is driving its expansion. The use of HPA on sapphire substrates improves LED heat conductivity, durability, and optical clarity.

- The direct (industrial/OEM contracts) segment accounted for the highest revenue market share in 2024, approximately 64% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the high purity alumina market is divided into direct (industrial/OEM contracts) and distributors/specialty chemicals traders. Among these, the direct (industrial/OEM contracts) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Strong, long-term supply agreements with significant end-use industries, including LED, semiconductor, and battery makers, are credited with this supremacy. Throughout the forecast period, these contracts will generate significant revenue growth by guaranteeing continuous quality, customized HPA grades, and cost stability.

Regional Segment Analysis of the High Purity Alumina Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share with approximately 73.9% of the High Purity Alumina market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the high purity alumina market over the predicted timeframe. The strong manufacturing capacities of nations like China, Japan, South Korea, and India are responsible for this expansion. Furthermore, this region leads the world market for LEDs and is seeing a rise in the manufacture of electric cars, especially in China. Additionally, the region's market position is further strengthened by the existence of significant battery production facilities. Additionally, due to government initiatives and rising domestic demand, China has become a global leader in lighting products. China's crucial position in the worldwide market is further reinforced by the growing electric car industry, which increases demand for high-purity alumina in battery applications.

Get more details on this report -

North America is expected to grow the fastest market share with approximately 42% at a rapid CAGR in the high purity alumina market during the forecast period. The market for high purity alumina in North America has significant growth potential because of the region's strong R&D efforts and sophisticated technology adoption. With notable advancements in semiconductor manufacturing, LED lighting applications, and electric vehicle production, the U.S., Canada, and Mexico dominate the region's market. In order to strengthen domestic mineral supply chains and lessen reliance on imports, additional investments are being made in high-purity alumina production capabilities, which will further boost market expansion. World-class electronics industry and substantial capacity to produce semiconductors. Additionally, market expansion is fuelled by growing consumer demand, especially in the semiconductor sector.

Europe is expected to grow at a rapid CAGR in the high purity alumina market during the forecast period. The use of LEDs and electric cars is encouraged by the area's emphasis on sustainability and cutting carbon emissions. Strong regulatory regimes also promote investment in high-purity alumina-based new technologies. Furthermore, it is anticipated that the need for high purity alumina would increase dramatically as Europe moves towards greener technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the high purity alumina market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sumitomo Chemical

- Altech Chemicals Ltd.

- Alpha HPA Ltd.

- FYI Resources Ltd.

- CoorsTek Inc.

- Baikowski SAS

- Sasol Limited

- Orbite Technologies Inc.

- Almatis, Inc.

- Alcoa Corporation

- Zibo Honghe Chemical Co., Ltd.

- Xuancheng Jingrui New Material Co., Ltd.

- Hebei Pengda Advanced Materials Technology Co., Ltd.

- Polar Sapphire Ltd.

- Rio Tinto

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Alpha HPA said that it had made the final investment decision to start producing High Purity Alumina (HPA) on a large scale in Gladstone, Queensland. The goal of this project was to build the biggest single-site HPA refinery in the world. It was anticipated that work on the 10-hectare complex would start in the middle of 2024, generating 120 local jobs in addition to 300 jobs during construction. Significant money from investors and governmental organizations supports the initiative.

- In August 2023, in September, Sumitomo Chemical expects to start producing its novel ultra-fine α-alumina products (NXA series) in large quantities at its Ehime Works. These new grades, which had uniform ultra-fine particles of 150 nm or less, were aimed at developing markets in the fields of life science, energy conservation, and ICT. Sumitomo, a major participant in the High Purity Alumina market, has a goal to boost sales income in its ultrahigh-purity alumina division by 30% by FY2025.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the high purity alumina market based on the below-mentioned segments:

Global High Purity Alumina Market, By Purity Grade

- 4N (99.99% Al2O3)

- 5N (99.999% Al2O3)

- 6N (99.9999% Al2O3)

Global High Purity Alumina Market, By Physical Form

- Powder

- Spherical Beads / Microspheres

- Dense Pellets / Sintered Forms

Global High Purity Alumina Market, By End-Use Application

- Battery & Energy Storage

- LED & Optoelectronics, Semiconductor & Advance Electronics

- Optical & Precision Polishing

- Advanced Ceramics & Transparent Ceramics

- Phosphors

- Catalysts & Specialty Coatings

- Medical & Healthcare Applications

- Industrial & High-Temperature Coatings

- Optical, Display & Photonics Applications

Global High Purity Alumina Market, By Sales Channel

- Direct (Industrial/OEM Contracts)

- Distributors/Specialty Chemicals Traders

Global High Purity Alumina Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?