Global High Integrity Pressure Protection System (HIPPS) Market Size, Share, and COVID-19 Impact Analysis, By Component (Field Initiator, Logic Solver, Valves, & Actuators), By Service (Testing, Inspection and Certification, Maintenance, Training and consultation), By End-user Industry (Oil and Gas, Chemicals, Power, Metal and Mining, Food and Beverages, Other Process Industries), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal High Integrity Pressure Protection System (HIPPS) Market Insights Forecasts to 2032

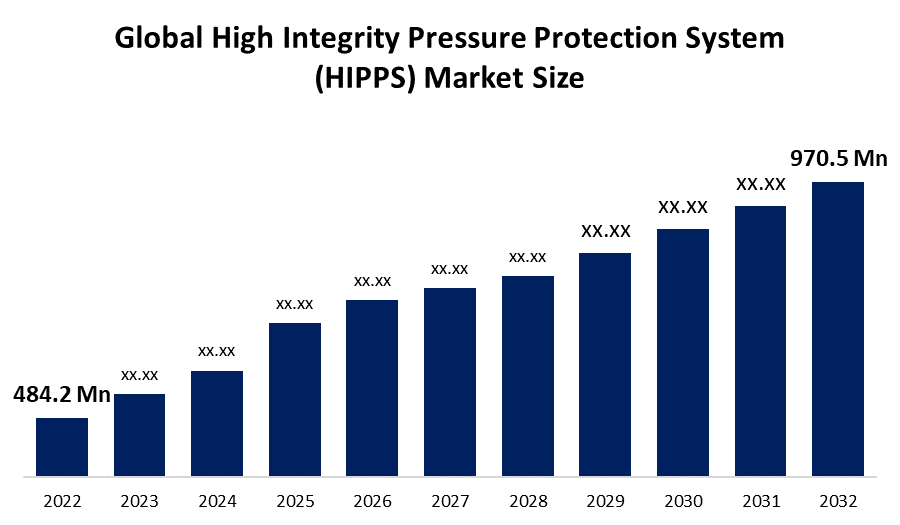

- The Global High Integrity Pressure Protection System (HIPPS) Market Size was valued at USD 484.2 million in 2022.

- The market is growing at a CAGR of 7.2% from 2022 to 2032.

- The worldwide High Integrity Pressure Protection System Market size is expected to reach USD 970.5 million by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global High Integrity Pressure Protection System (HIPPS) Market Size is expected to reach USD 970.5 million by 2032, at a CAGR of 7.2% during the forecast period 2022 to 2032.

Market Overview

High-integrity pressure protection systems (HIPPS) are safety instrumented systems (SIS) created to prevent overpressure created during risky operations, primarily in oil and gas facilities, by cutting off the source and storing the pressure in the system's upstream side. When a pipeline or vessel ruptures due to an overpressure in the process industries, a safety system is used to stop the loss of containment. Relief systems can be used to deal with overpressure; however, the environment could be negatively impacted if process fluids that are flammable, explosive, hazardous, or poisonous are released. When we need to handle high-pressure flow rates while still protecting the environment around the system, HIPPS offers a solution. Additionally, it lowers the risk profile of the facility in which it was put. Thus, it also lessens the possible economic impact caused by the absence of containment, which results in a loss of output and raises the plant's maintenance costs. Because of developing technologies like robotics, automation, and artificial intelligence, demand for these systems is always increasing. Additionally, there will probably be a surge in demand for HIPPS in the oil and gas sector due to the growth of Greenfield projects planned in nations like China and India.

Report Coverage

This research report categorizes the global high integrity pressure protection system market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global high integrity pressure protection system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global high integrity pressure protection system market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global High Integrity Pressure Protection System (HIPPS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 484.2 million |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 7.2% |

| 2032 Value Projection: | USD 970.5 million |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Component, By Service, By End-user Industry, By Region |

| Companies covered:: | ABB Ltd., Emerson Electric Company, General Electric, HIMA Paul Hildebrandt GmbH, Mogas Industries Inc, Paladin Systems Ltd, Rockwell Automation, Schlumberger Limited, Schneider Electric SE, Siemens AG, Velan ABV S.p.A., Yokogawa Electric Corporation |

Get more details on this report -

Driving Factors

The market's expansion is mainly due to the increased requirement to reduce flaring to preserve the environment and to the government's application of strict regulatory standards to maintain safety and security at manufacturing facilities. Also, increasing need to reduce gas venting and flaring to protect the environment, in that gas flaring usually takes place during events like equipment shutdowns, planned maintenance, or repairs. It allows the little disruptive gas collection and regulated pressure release from the processing systems. This is done to maintain pressure and make sure the facility is operating safely and effectively. Moreover, Increased demand for electricity and energy due to a growing global population has a direct influence on the market for high-integrity pressure protection systems. Throughout the forecast period, the market for high-integrity pressure protection systems is expected to increase due to strict government laws and regulations about industrial safety and the demand for dependable safety systems. Furthermore, it is anticipated that the market for high-integrity pressure protection systems would expand due to rising urbanization and manufacturing in emerging countries, as well as strict safety regulations.

Restraining Factors

The primary barrier to the market expansion for high integrity pressure protection systems is the high maintenance costs. Another reason that restrains the market's expansion for high-integrity pressure protection systems is the lack of awareness and complexity of standards, both of which have a direct influence on the sales of high-integrity pressure systems. Also, small and medium-sized businesses may find it challenging to control these costs, even though huge firms can. The demand for enterprises to improve their safety systems arises from the fact that HIPPSs must adhere to regulatory requirements that are continuously revised in response to new regulations and technological breakthroughs. Deploying safety systems and components will demand further expenses.

Market Segmentation

- In 2022 the valves segment is influencing the market with the largest market share over the forecast period.

Based on components, the global high integrity pressure protection system (HIPPS) market is segmented into various segments such as field initiators, logic solvers, valves, and actuators. Among these segments, the valves segment is dominating the market growth during the forecast period. Without using any energy, valves are used to control plant pressure and discharge a precise amount of steam or gas. Valves start or stop the passage of any harmful fluid or exogenous hydrocarbons (gases) when a potentially dangerous activity is detected. Also, the valve, which is used to shut off a pipeline to prevent overpressure from developing downstream of the system, is the most important part of a HIPPS system's operation. The majority of HIPPS’s assembly costs are related to valves.

- In 2022, the testing, inspection, and certification segment is dominating the largest market share during the forecast period.

Based on the services, the global high integrity pressure protection system (HIPPS) market is segmented into different categories including testing, inspection and certification, maintenance, training, and consultation. Services for testing, inspection, and certification are extremely important in the HIPPS sector. HIPPS is routinely checked for omissions, flaws, or any other errors that might lower its operational reliability and cause failure. A crucial component of HIPPS's whole life cycle is maintenance. This makes it easier to maintain the system's intended SIL rating.

- In 2022, the oil and gas segment is leading the largest market share over the forecast period.

On the basis of end-user, the global high integrity pressure protection system (HIPPS) market is classified into different segments such as oil and gas, chemicals, power, metal and mining, food and beverages, and other process industries. Among these, the oil and gas segment is dominating the market growth over the forecast period. high integrity pressure protection system makes use of an oil and gas company's system design and integration experience. To support the HIPPS market's growth over the coming years, the industry's players concentrate on creating cutting-edge goods and solutions. ATV HIPPS, a division of the ATV Group and ATV SpA, has acquired the wellhead equipment and controls business Hydro Pneumatic. The company's expanded high integrity pressure protection system technological offering may be advantageous in this case. As new projects are started and current oil extraction operations are expanded in numerous nations, the demand for HIPPS is projected to rise dramatically within the forecasted timeframe.

Regional Segment Analysis of the global high integrity pressure protection system market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is dominating the market with the largest market growth during the forecast period

Get more details on this report -

The Asia-Pacific market is likely to expand the fastest market during the forecast period, owing to China, Japan, and India being some of the major nations in this area due to its emphasis on expanding its oil and gas refining capacity and the noticeable rise of its chemicals sector. For instance, the IEA forecasts that Asia will continue to be the primary market for LNG, receiving 70% of all LNG imports by 2020.

North America has a significant global market share during the forecast period, due to high-integrity pressure protection systems being widely used in the oil and gas industry, notably in North America, which is projected to be a major driver of market expansion. Shale gas growth in Mexico is also probably going to be a major driver for the high-integrity pressure protection system market because of its large application in the oil and gas industry.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global high integrity pressure protection system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- Emerson Electric Company

- General Electric

- HIMA Paul Hildebrandt GmbH

- Mogas Industries Inc

- Paladin Systems Ltd

- Rockwell Automation

- Schlumberger Limited

- Schneider Electric SE

- Siemens AG

- Velan ABV S.p.A.

- Yokogawa Electric Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2021, according to the IEC 61508 standard of the International Electrotechnical Commission, Emerson introduced the first complete valve assemblies that satisfy safety integrity level (SIL) 3.

- In September 2021, the new Electric Exaquantum Safety Function Monitoring (SFM) software from Yokogawa was made available as a way to determine whether actual operational performance is in line with safety design objectives. The updated software complies with the International Electrotechnical Commission (IEC) 61511 standard and offers several additional capabilities to assist SFM users in identifying possible safety concerns, streamlining maintenance tasks, and enhancing the design of safety solutions as a whole.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global High Integrity Pressure Protection System (HIPPS) Market based on the below-mentioned segments:

Global High Integrity Pressure Protection System Market, By Component

- Field Initiator

- Logic Solver

- Valves

- Actuators

Global High Integrity Pressure Protection System Market, By Service

- Testing

- Inspection and certification

- Maintenance

- Training

- Consultation

Global High Integrity Pressure Protection System Market, By End User Industry

- Oil and Gas

- Chemicals

- Power

- Metal and Mining

- Food and Beverages

- Other Process Industries

High Integrity Pressure Protection System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?