Global Hereditary Testing Market Size, Share, and COVID-19 Impact Analysis, By Disease Type (Hereditary Cancer Testing and Hereditary Non-cancer Testing), By Technology (Cytogenetic, Biochemical, and Molecular Testing), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: HealthcareGlobal Hereditary Testing Market Insights Forecasts to 2032

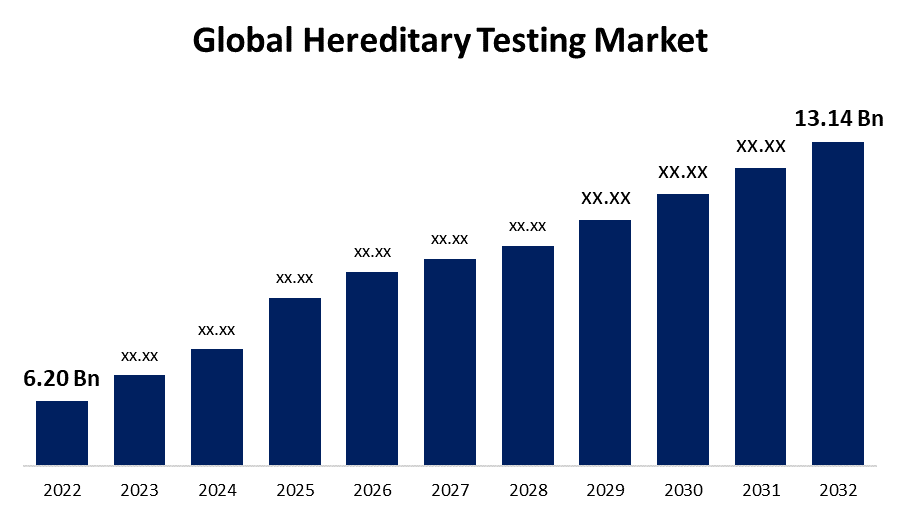

- The Global Hereditary Testing Market Size was valued at USD 6.20 Billion in 2022.

- The market is growing at a CAGR of 7.8% from 2023 to 2032

- The Worldwide Hereditary Testing Market Size is expected to reach USD 13.14 Billion by 2032

- North America is expected to grow significant during the forecast period

Get more details on this report -

The Global Hereditary Testing Market Size is expected to reach USD 13.14 billion by 2032, at a CAGR of 7.8% during the forecast period 2023 to 2032.

Market Overview

Hereditary testing, also known as genetic testing or DNA testing, is a medical procedure that analyzes an individual's DNA to identify genetic variations and mutations that may be associated with inherited disorders or diseases. This type of testing provides valuable information about a person's risk factors, enables early detection of certain conditions, and aids in making informed medical decisions. Hereditary testing can be used to assess the likelihood of developing certain cancers, cardiovascular diseases, or neurological disorders, among others. It can also provide insights into an individual's response to certain medications, helping to personalize treatment plans. The testing process involves collecting a sample, usually through a blood or saliva test, which is then analyzed in a laboratory using advanced genetic sequencing technologies. However, it is important to note that hereditary testing is a complex process that requires genetic counseling and careful interpretation of results by healthcare professionals.

Report Coverage

This research report categorizes the market for hereditary testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hereditary testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the hereditary testing market.

Global Hereditary Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 6.20 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.8% |

| 2032 Value Projection: | USD 13.14 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Disease Type, By Technology, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Myriad Genetics, Inc., Invitae Corporation, Illumina, Inc., Natera, Inc., Laboratory Corporation of America Holdings, F. Hoffmann-La Roche Ltd., Quest Diagnostics Incorporated, Coopersurgical, Inc., Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., Twist Bioscience, SOPHiA GENETICS, Fulgent Genetics, MedGenome, and CENTOGENE N.V. And Other Key Venders |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The hereditary testing market is driven by several factors because the increasing awareness and understanding of genetic diseases among the general population and healthcare professionals is a major driver. With advancements in genetic research and the availability of information, there is a growing recognition of the value of hereditary testing in diagnosing and managing inherited conditions. Additionally, the rising prevalence of genetic disorders and the need for early detection and preventive measures contribute to market growth. Furthermore, technological advancements in DNA sequencing and genetic testing methods have improved the accuracy, speed, and cost-effectiveness of hereditary testing, making it more accessible to a larger population. Moreover, the integration of hereditary testing into personalized medicine and the growing demand for tailored healthcare solutions further propel the market forward. Finally, supportive government initiatives and favorable reimbursement policies for genetic testing have a positive impact on market expansion.

Restraining Factors

The hereditary testing market also faces certain restraints that hinder its growth. One significant restraint is the high cost associated with genetic testing procedures, including sample collection, laboratory analysis, and data interpretation. The expense often limits accessibility, particularly in resource-constrained regions or for individuals without adequate insurance coverage. Additionally, the complexity of genetic test results and the potential for misinterpretation or miscommunication pose challenges. Genetic counseling and education are crucial to ensure proper understanding and informed decision-making. Moreover, concerns regarding privacy and the ethical implications of genetic testing, such as the potential misuse of genetic information, raise apprehensions among individuals, leading to hesitation in undergoing testing.

Market Segmentation

- In 2022, the hereditary non-cancer testing segment accounted for around 73.5% market share

On the basis of the disease type, the global hereditary testing market is segmented into hereditary cancer testing and hereditary non-cancer testing. The hereditary non-cancer testing segment has emerged as the dominant force in the hereditary testing market, commanding a significant revenue share. The hereditary non-cancer testing encompasses a wide range of genetic disorders and conditions beyond cancer, such as cardiovascular diseases, neurological disorders, and rare genetic disorders. This broad scope of testing appeals to a larger population, as hereditary non-cancer conditions are prevalent and impact individuals across various age groups and demographics. The advancements in genetic research and technological innovations have greatly contributed to the growth of hereditary non-cancer testing. The availability of advanced genetic sequencing technologies, such as next-generation sequencing (NGS), has revolutionized the field by enabling comprehensive analysis of the genome, thereby enhancing the accuracy and reliability of hereditary non-cancer testing. This has allowed for the identification of genetic variations and mutations associated with a wide range of non-cancer conditions, leading to improved diagnostic capabilities. Furthermore, increasing awareness and understanding of hereditary non-cancer conditions among healthcare professionals and the general population have also fueled the demand for testing. Healthcare providers recognize the importance of early detection and proactive management of hereditary non-cancer conditions to prevent or delay the onset of symptoms and improve patient outcomes. Additionally, the integration of hereditary non-cancer testing into personalized medicine and the growing emphasis on precision healthcare have further boosted the market. Tailoring treatment plans based on an individual's genetic profile and risk factors for non-cancer conditions has shown promising results in terms of optimizing therapy efficacy and minimizing adverse effects. Overall, the dominance of the hereditary non-cancer testing segment in the market can be attributed to its broad scope, technological advancements, increased awareness, and the alignment of testing with personalized medicine approaches.

- In 2022, the molecular testing segment dominated with more than 45.2% market share

Based on the technology, the global hereditary testing market is segmented into cytogenetic, biochemical, and molecular testing. The molecular testing segment has emerged as the dominant force in the hereditary testing market, commanding a significant revenue share. This can be attributed to several factors because molecular testing offers a high level of accuracy and sensitivity in detecting genetic variations and mutations. It involves analyzing the individual's DNA at a molecular level, allowing for precise identification of genetic abnormalities associated with hereditary disorders. The advancements in molecular biology techniques, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), have greatly enhanced the efficiency and throughput of molecular testing, enabling faster and more comprehensive analysis of genetic information. Moreover, molecular testing provides a wide range of applications in hereditary testing, including carrier testing, diagnostic testing, predictive testing, and pharmacogenomics. This versatility allows healthcare professionals to utilize molecular testing for various purposes, catering to the diverse needs of patients and enabling personalized treatment plans. Additionally, molecular testing has been instrumental in the development of targeted therapies and precision medicine approaches, where the identification of specific genetic markers helps guide treatment decisions and improves patient outcomes. Furthermore, the increasing prevalence of genetic disorders and the growing demand for early detection and preventive measures have propelled the adoption of molecular testing in hereditary testing. The ability to detect genetic variations even before the onset of symptoms allows for proactive management and interventions, leading to better disease management and improved patient care. Overall, the dominance of the molecular testing segment in the hereditary testing market can be attributed to its high accuracy, diverse applications, and significant contributions to precision medicine, making it a vital component in the diagnosis and management of hereditary disorders.

Regional Segment Analysis of the Hereditary Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

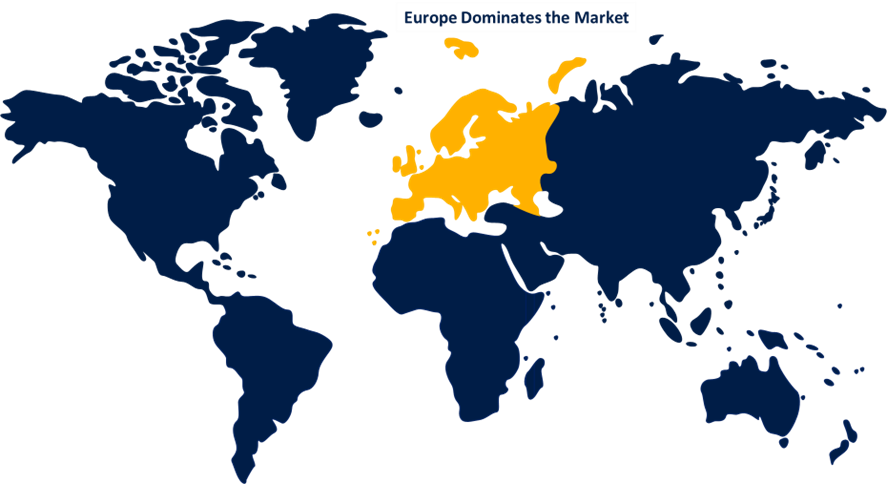

Europe dominated the market with more than 34.1% revenue share in 2022.

Get more details on this report -

Based on region, Europe has emerged as a key player in the hereditary testing market, accounting for the largest revenue share. Several factors contribute to Europe's dominant position in this field, the region has a well-established healthcare infrastructure and a strong emphasis on preventive medicine, making it receptive to the implementation of hereditary testing programs. Moreover, Europe boasts a high level of awareness and understanding of genetic diseases among healthcare professionals and the general population. This awareness, combined with robust genetic research capabilities and advancements in technology, has fostered the growth of hereditary testing in the region. Additionally, supportive government policies, favorable reimbursement schemes, and collaborations between research institutions, genetic testing laboratories, and healthcare providers have further accelerated market expansion. Europe's leadership in hereditary testing underscores its commitment to personalized medicine and its potential to drive innovation and advancements in the field.

Recent Developments

- In February 2023, MedGenome, a prominent genomics research and diagnostics business, recently launched a genetic test in India to diagnose Facioscapulohumeral Muscular Dystrophy (FSHD). This test analyses an individual's DNA and identifies the genetic variants related with FSHD using modern genetic sequencing methods. The introduction of this test addresses the need for precise and timely identification of this uncommon genetic condition, allowing patients and healthcare providers in India to make educated treatment and management decisions.

- In September 2022, Unity, a noninvasive prenatal test developed by BillionToOne, detects hemolytic illness in both the fetus and the baby. This novel test provides a less intrusive and more accurate alternative to invasive treatments such as amniocentesis. Unity can identify the risk of hemolytic illness by analyzing cell-free DNA from the mother's blood, allowing for early treatments and personalized care for afflicted pregnancies, thereby improving outcomes for both moms and kids.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global hereditary testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Myriad Genetics, Inc.

- Invitae Corporation

- Illumina, Inc.

- Natera, Inc.

- Laboratory Corporation of America Holdings

- F. Hoffmann-La Roche Ltd.

- Quest Diagnostics Incorporated

- Coopersurgical, Inc.

- Agilent Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- Twist Bioscience

- SOPHiA GENETICS

- Fulgent Genetics

- MedGenome

- CENTOGENE N.V.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global hereditary testing market based on the below-mentioned segments:

Hereditary Testing Market, By Disease Type

- Hereditary Cancer Testing

- Hereditary Non-cancer Testing

Hereditary Testing Market, By Technology

- Cytogenetic

- Biochemical

- Molecular Testing

Hereditary Testing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?