Global Heavy Mineral Sand Market Size, Share, and COVID-19 Impact Analysis, By Mineral Type (Ilmenite, Rutile, Zircon, Monazite, Garnet, and Others), By Extraction Method (Dry Mining, Dredging, and Hydraulic Mining), By Application (Construction, Paints and Coatings, Ceramics, Electronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Heavy Mineral Sand Market Insights Forecasts to 2035

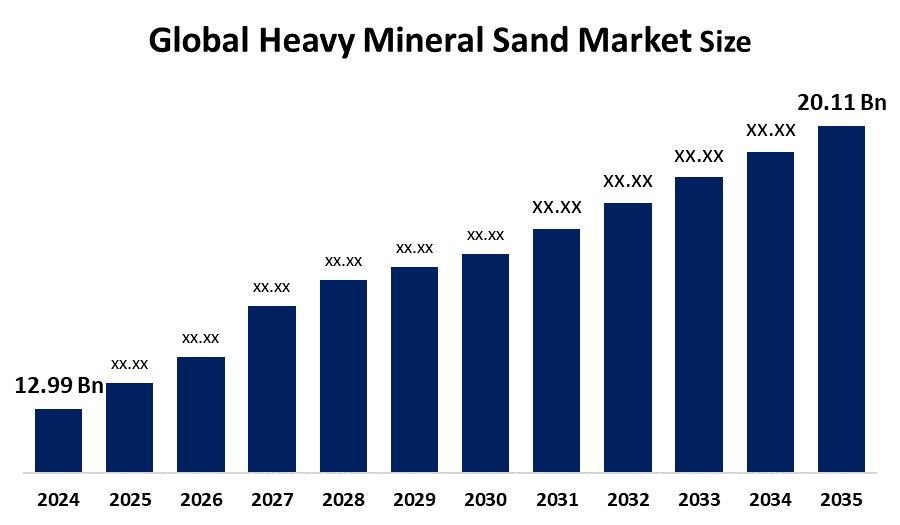

- The Global Heavy Mineral Sand Market Size Was Estimated at USD 12.99 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.05% from 2025 to 2035

- The Worldwide Heavy Mineral Sand Market Size is Expected to Reach USD 20.11 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global heavy mineral sand market size was worth around USD 12.99 billion in 2024 and is predicted to grow to around USD 20.11 billion by 2035 with a compound annual growth rate (CAGR) of 4.05% from 2025 to 2035. The heavy mineral sand market is growing mainly owing to the growth in demand for titanium and zircon minerals from growing industries such as construction, ceramics, paints and coatings, and aerospace. The demand is strong, especially in the Asia Pacific region, due to rapid industrialization and urbanization.

Market Overview

Heavy mineral sand, commonly known as beach sand, is a natural occurrence of placer deposits containing dense minerals such as ilmenite, rutile, zircon, garnet, and monazite that accumulate along coastal and inland shoreline environments. These minerals are the principal raw materials for a variety of industries. Titanium-bearing minerals such as ilmenite and rutile are processed to make titanium dioxide used in paints, plastics, and coatings, with zircon supporting ceramics, foundry moulds, refractories, and advanced applications such as zirconium chemicals. The drivers for the global heavy mineral sands market include increasing construction activity, growing demand for titanium dioxide pigments, and the need for lightweight yet high-performance materials from the growth of the aerospace, automotive, and electronic industries. Innovation within the industry is driven by developments in mining technologies, including automated dredging, improved gravity and electrostatic separation, and AI-based mineral sorting systems, which help to increase efficiency while reducing environmental impact.

It is developments pertaining to water recycling, reduced tailings generation, and environment-friendly land restoration that are fast becoming industry norms. Opportunities continue to emerge in underexplored coastal deposits, particularly in Africa and Southeast Asia, and in downstream value-added processing for titanium metal, zirconium products, and rare earth extraction from monazite. The competitive landscape is dominated by key players such as Iluka Resources, Rio Tinto, Tronox Holdings, Kenmare Resources, and TiZir, all of which are investing heavily in capacity expansion, technology upgrades, and long-term supply chain security. In 2024, the government of Sri Lanka called for tenders for various mineral sand products, including ilmenite and zircon, sourced from beach sands. This development underlines state-supported promotion and marketing of heavy mineral outputs as a means to control supplies, attract investment, and improve the country's standing in the global heavy mineral sand market.

Report Coverage

This research report categorizes the heavy mineral sand market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the heavy mineral sand market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the heavy mineral sand market.

Global Heavy Mineral Sand Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.99 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 4.05% |

| 024 – 2035 Value Projection: | USD 20.11 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Mineral Type, By Extraction Method |

| Companies covered:: | Tronox Holdings plc, mare Resources plc, The Chemours Company, Bemax Resources Limited, Mineral Commodities Ltd, Sheffield Resources Limited, KenBase Resources Limited, Astron Corporation Limited, Doral Mineral Sands Pty Ltd, Lanka Mineral Sands Limited, Zirconium Chemicals Pvt. Ltd., Trimex Sands Private Limited, Southern Ionics Minerals, LLC, Cristal Mining Australia Limited, and Others Players |

| Growth Drivers: | CAGR of 4.05% |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Global Heavy Mineral Sand Market Size is driven by increasing demand for titanium dioxide, zircon, and ilmenite in industries such as paints, coatings, ceramics, and aerospace. Rapid urbanization, industrial growth, and rising construction activities fuel the need for these minerals. Advancements in extraction and processing technologies, together with the exploration of new mineral sand deposits, increase market availability. Environmental regulations encouraging sustainable mining practices also support responsible growth. In addition, growing demand from expanding industries such as electronics and automotive that utilize high-purity minerals adds to the demand. Global infrastructure and industrialization projects in emerging economies further drive the heavy mineral sand market.

Restraining Factors

The Heavy Mineral Sand Market Size is restrained by environmental concerns and strict mining regulations that put controls on extraction activities. High operational and processing costs, coupled with resource depletion in key mining regions, challenge supply stability. Fluctuations in global mineral prices and competition from alternative raw materials also make it tough for the market to grow and earn a profit.

Market Segmentation

The heavy mineral sand market share is classified into mineral type, extraction method, and application.

- The ilmenite segment dominated the market in 2024, approximately 65% and is projected to grow at a substantial CAGR during the forecast period.

Based on the mineral type, the heavy mineral sand market is divided into ilmenite, rutile, zircon, monazite, garnet, and others. Among these, the ilmenite segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The ilmenite segment dominated the market due to its high demand for producing titanium dioxide, which is a key ingredient in paints, coatings, plastics, and paper. The rapid growth of construction and infrastructure projects globally has increased demand for products based on titanium dioxide. Besides these, abundant availability, relatively lower cost compared to rutile, and increasing use in welding electrodes and titanium metal production further solidify the leadership and growth momentum of ilmenite.

- The dry mining segment accounted for the largest share in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the extraction method, the heavy mineral sand market is divided into dry mining, dredging, and hydraulic mining. Among these, the dry mining segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth in the dry mining segment is attributed to cost-effectiveness, flexibility in operation, and suitability for shallow, onshore heavy mineral deposits. Dry mining allows easier access to inland reserves, requires less water, and enables continuous operation on varied terrains. Its lower environmental impact and reduced infrastructure needs further support for adoption. The increase in exploration activities in arid regions, as well as the improvement in technologies regarding dry separation, contributed to the segment's strong growth.

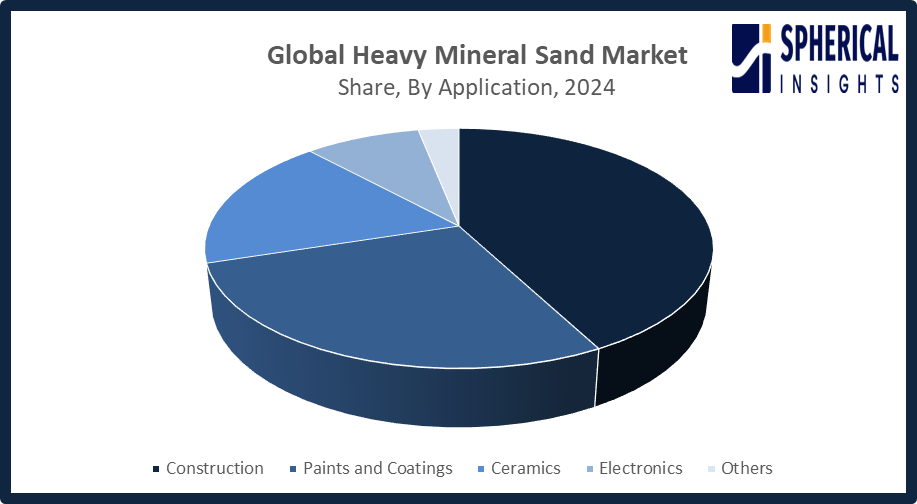

- The construction segment accounted for the highest market revenue in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the heavy mineral sand market is divided into construction, paints and coatings, ceramics, electronics, and others. Among these, the construction segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The construction segment market growth is due to strong global demand for paints, coatings, ceramics, and cement additives derived from heavy mineral sands such as ilmenite, rutile, and zircon. Rapid urbanization, infrastructure expansion, and housing development significantly boosted the need for titanium dioxide-based coatings and zircon-based ceramic materials. Additionally, construction’s reliance on durable, high-performance materials drove consistent consumption, making it the dominant application segment.

Get more details on this report -

Regional Segment Analysis of the Heavy Mineral Sand Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the heavy mineral sand market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the heavy mineral sand market over the predicted timeframe. The Asia Pacific region will have a 42% share in the heavy mineral sand (beach sand) market due to rich mineral reserves, a strong industrial base, and increased infrastructure activities. Major countries such as Australia, India, China, and Indonesia play major roles. In Australia, with its advanced mining technologies, the country maintains its position as one of the leaders in the production of ilmenite, rutile, and zircon. India has huge coastal deposits and a growing demand for titanium dioxide and ceramics. China, on the other hand, will drive the consumption of titanium dioxide and zircon-based products through its large manufacturing sector. Indonesia adds to the regional supply through growing mining operations, while the Asia Pacific's position is collectively strengthened.

In 2025, India launched the National Critical Mineral Mission (NCMM) to boost self-reliance in critical minerals. The Geological Survey of India will conduct 1,200 exploration projects. Twenty-four minerals were added to Part D of the MMDR Act, giving the Central Government exclusive auction rights, and a Centre of Excellence on Critical Minerals (CECM) is proposed.

In October 2022, the Indian government proposed revoking its 2019 ban on private beach sand mineral mining. Gautam Adani’s Adani Group registered two new companies to enter this sector, aiming to process and sell titanium dioxide, ilmenite, rutile, garnet, sillimanite, and leucoxene, marking its expansion into the beach sand mining industry.

North America is expected to grow at a rapid CAGR in the heavy mineral sand market during the forecast period. North America is rapidly growing in the beach sand market, approximate24% market share, due to increasing demand for titanium dioxide, ceramics, and aerospace-grade materials. The United States heads the contributors owing to investments in advanced manufacturing, automotive, and construction sectors that require high-quality heavy minerals. Canada is another contributor because of exploration and mining regarding zircon and garnet-rich deposits. Technological advances in extraction, increasing infrastructure development, and environmental regulations aimed at ensuring sustainability further accelerate the growth rate and attractiveness of the regional market.

Europe’s heavy mineral sand market is growing steadily, with increasing demand for titanium dioxide, ceramics, and specialty coatings for construction and automotive applications. Norway, the Netherlands, and Germany are the main contributors. Norway supplies ilmenite and rutile from a network of small coastal deposits, while Germany and the Netherlands have limited direct supply but are significant processors and end-users. Stringent environmental regulations and a move to more sustainable materials further encourage quality mineral supply, underpinning ongoing growth throughout the European market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the heavy mineral sand market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tronox Holdings plc

- mare Resources plc

- The Chemours Company

- Bemax Resources Limited

- Mineral Commodities Ltd

- Sheffield Resources Limited

- KenBase Resources Limited

- Astron Corporation Limited

- Doral Mineral Sands Pty Ltd

- Lanka Mineral Sands Limited

- Zirconium Chemicals Pvt. Ltd.

- Trimex Sands Private Limited

- Southern Ionics Minerals, LLC

- Cristal Mining Australia Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

-

August 2025: Rio Tinto placed Richards Bay Minerals (South Africa), its Quebec Iron and Titanium operations, and its U.S. borates mine under strategic review. This move indicates that complex industrial minerals must demonstrate strong capital returns relative to the company’s growth priorities, a shift that could influence zircon, titanium, and borate supply chains, project economics, and future deal activity.

-

June 2025: Energy Fuels Inc. announced that the Government of Victoria, Australia, approved the Work Plan for its Donald Rare Earth and Mineral Sands Project in the Wimmera region. The approval enables the project’s construction and positions it as a significant future producer of critical minerals and rare earth elements.

-

March 2025: The Chemours Company and Energy Fuels Inc. announced a strategic alliance to expand their collaboration, aiming to strengthen the U.S. domestic rare earth and critical minerals supply chain in response to rising demand.

-

October 2022: The Chemours Company held the ribbon-cutting ceremony for its Trail Ridge South mineral sand mine, representing a $93 million investment. The new operation—supporting Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials—is expected to generate approximately 50 local jobs across the surrounding three-county area.

-

August 2019: The Chemours Company completed the acquisition of Southern Ionics Minerals, LLC (SIM), a Florida-based mineral exploration, mining, and manufacturing firm. Formerly a subsidiary of Southern Ionics Incorporated (Mississippi), SIM expands Chemours’ capabilities across titanium technologies, fluoroproducts, and chemical solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the heavy mineral sand market based on the below-mentioned segments:

Global Heavy Mineral Sand (Beach Sand) Market, By Mineral Type

- Ilmenite

- Rutile

- Zircon

- Monazite

- Garnet

- Others

Global Heavy Mineral Sand (Beach Sand) Market, By Extraction Method

- Dry Mining

- Dredging

- Hydraulic Mining

Global Heavy Mineral Sand (Beach Sand) Market, By Application

- Construction

- Paints and Coatings

- Ceramics

- Electronics

- Others

Global Heavy Mineral Sand (Beach Sand) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?