Global Hard Kombucha Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Plain and Flavored), By ABV Content (Up to 5.0% ABV, 6.0% to 10.0% ABV and Others), By Distribution Channel (On-trade and Off-trade), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Hard Kombucha Market Size Insights Forecasts to 2035

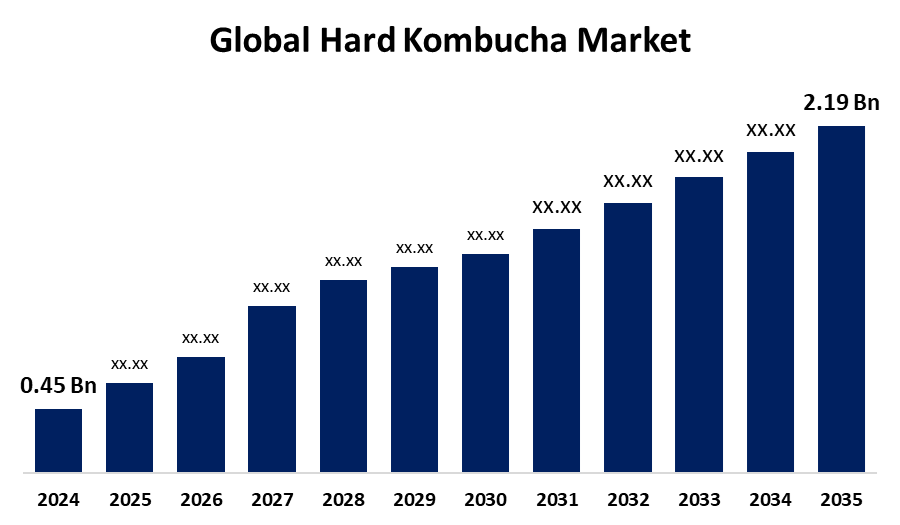

- The Global Hard Kombucha Market Size Was Estimated at USD 0.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.47% from 2025 to 2035

- The Worldwide Hard Kombucha Market Size is Expected to Reach USD 2.19 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Hard Kombucha Market Size was worth around USD 0.45 Billion in 2024 and is predicted to grow to around USD 2.19 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 15.47% from 2025 and 2035. The hard kombucha market is driven by growing health awareness, heightening interest in functional and low-ABV drinks, new flavors, and increased distribution across online and retail platforms, resonating with consumers interested in healthier, tasteful, and convenient alcoholic beverage options.

Market Overview

The Hard Kombucha Industry is the business engaged in manufacturing, distributing, and retailing alcoholic kombucha drinks. Hard kombucha is a fermented tea beverage with added alcohol, ranging from 4% to 7% alcohol by volume (ABV). The hard kombucha industry focuses on offering consumers healthier, functional alcoholic beverages that capture the probiotic and antioxidant effects of kombucha combined with palatable alcoholic content. Hard kombucha is appealing to consumers interested in health who are looking for low-sugar content, natural ingredients, and a refreshing flavor. The advantages of hard kombucha are digestive health benefits, reduced calories when compared with regular alcoholic beverages, and a distinctive taste. Its applications range from social drinking on an occasional basis, to wellness-oriented consumption, and as a substitute for beer or cider. Furthermore, packaging innovations concerning sustainability and convenience also appeal to environmentally conscious consumers. All these, coupled with increased understanding and passion among millennials and Gen Z, drive the hard kombucha industry forward as a quickly growing market in the alcoholic beverage industry with a focus on wellness and distinctive flavor experiences.

Report Coverage

This research report categorizes the hard kombucha market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hard kombucha market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hard kombucha market.

Global Hard Kombucha Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.45 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.47% |

| 2035 Value Projection: | USD 2.19 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Product Type, By ABV Content, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Remedy Drinks, Jiant, Flying Embers, JuneShine, Boochcraft, Kyla, Unity Vibration, Dr Hops, Ventura Brewing Company, Allkind, Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As consumers become increasingly health-conscious, they want alternatives to mainstream alcoholic drinks that provide functional benefits. Hard kombucha is appealing because it contains probiotics, naturally ferments, and contains fewer sugars, which support digestive health and overall well-being. This fits into the increasing trend for clean-label, natural products. Consumer perception of hard kombucha as a healthier variant pushes consumer adoption, which fuels the market, particularly among millennials and Gen Z, who emphasize health in lifestyle choices. Additionally, Constant innovation with innovative flavors, organic ingredients, and appealing packages fuels consumer demand and induces trial. Seasonal and exotic releases of flavors also make brands stand out in an increasingly competitive marketplace, which drives growth and boosts consumer interest.

Restraining Factors

Hard kombucha involves a sophisticated fermentation process involving good-quality natural materials such as tea, sugar, and live cultures. Production is more costly than in the case of traditional alcoholic drinks. The increased cost of production results in high retail prices, which make it unaffordable for price-conscious consumers and delay mass-market penetration, particularly in emerging markets. Additionally, the distinct tart, slightly acidic, and effervescent taste of hard kombucha may be difficult for new customers not accustomed to fermented drinks. That taste barrier limits its appeal mainly to niche health-oriented or bold consumers, so it is hard to gain popular success quickly.

Market Segmentation

The hard kombucha market share is classified into product type, ABV content, and distribution channel.

- The flavored segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the hard kombucha market is divided into plain and flavored. Among these, the flavored segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to flavored hard kombucha appeals to a broader consumer base by providing varied taste profiles beyond the conventional tartness. Interesting fruit, herbal, and spice additions meet different tastes, making the product more pleasant and easier to consume, particularly for first-time kombucha drinkers. The variety fuels greater trial rates and repeat purchases.

- The up to 5.0% segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the ABV content, the hard kombucha market is divided into up to 5.0% abv, 6.0% to 10.0% abv, and others. Among these, the up to 5.0% segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to lower alcohol content aligns with the style of health-oriented consumers preferring to consume alcoholic drinks without excessive alcohol consumption. Up to 5.0% ABV provides a balanced choice that slots into healthy lifestyles, appealing to consumers desiring less calorie and less alcoholic functional drinks, thereby enhancing its market share.

- The off-trade segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the distribution channel, the hard kombucha market is divided into on-trade and off-trade. Among these, the off-trade segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is driven by off-trade channels such as supermarkets, health food stores, and online sites drive the growth of hard kombucha as they make it more convenient and available to a large number of consumers. Consumers can easily buy and have it at home, facilitating frequent usage. Convenience increases sales volume and plays a major role in off-trade supremacy in the market.

Regional Segment Analysis of the Hard Kombucha Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the hard kombucha market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the hard kombucha market over the predicted timeframe. North American consumers, particularly in the United States, have increasingly adopted wellness-focused lifestyles, driving substantial demand for functional drinks. Hard kombucha, with its probiotic nature, low sugar, and natural ingredients, resonates with consumers looking for healthier versions of alcoholic beverages. The culture of "mindful drinking" is common among Millennials and Gen Z, who gravitate toward lower-alcohol, gut-friendly drinks. This confluence of health trends and positioning has driven hard kombucha to mainstream popularity throughout the region, underpinning long-term market leadership.

Asia Pacific is expected to grow at a rapid CAGR in the hard kombucha market during the forecast period. Asia-Pacific consumers are increasingly focused on health and well-being, driving demand for functional drinks such as hard kombucha. As pressure mounts around sugar consumption and digestive health, the probiotic virtues of kombucha attract health-conscious consumers. Low alcohol content and natural ingredients ease the transition according to regional tastes for lighter, healthier beverages. This move toward health-led drinking is driving the adoption of hard kombucha in emerging as well as developed markets such as China, Japan, South Korea, and Australia.

Europe is predicted to hold a significant share of the hard kombucha market throughout the estimated period. Europe boasts a well-established and deep-rooted health-aware consumer base, most notably in Germany, the UK, and the Netherlands. With high levels of awareness regarding gut health, organic products, and fermented foods, kombucha is already well-established. Hard kombucha organically slots into this trend as a "better-for-you" alcoholic drink. Low-alcohol, low-sugar, probiotic-rich-conscious consumers have embraced hard kombucha as a substitute for beer or sugary cocktails, cementing its place in Europe's dynamic alcoholic beverage market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hard kombucha market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Remedy Drinks

- Jiant

- Flying Embers

- JuneShine

- Boochcraft

- Kyla

- Unity Vibration

- Dr Hops

- Ventura Brewing Company

- Allkind

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, Bower, a new Australian hard kombucha company, released its product in Sydney, creating a new functional alcohol category. Their hard kombucha is fermented for a careful 28-day double fermentation using champagne yeast, making the resulting 4% ABV drink still contain the health benefits of regular kombucha, such as probiotics and organic acids.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hard kombucha market based on the below-mentioned segments:

Global Hard Kombucha Market, By Product Type

- Plain

- Flavored

Global Hard Kombucha Market, By ABV Content

- Up to 5.0% ABV

- 6.0% to 10.0% ABV

- Others

Global Hard Kombucha Market, By Distribution Channel

- On-trade

- Off-trade

Global Hard Kombucha Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?