Global Grafted Polyolefins Market Size, Share, and COVID-19 Impact Analysis, By Type (Maleic Anhydride Grafted PE, Maleic Anhydride Grafted PP, Maleic Anhydride Grafted EVA), By Processing Technology (Extrusion, Emulsion), By End Use (Automotive, Packaging, Construction, Textiles, Adhesives & Sealants, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Grafted Polyolefins Market Size Insights Forecasts to 2033

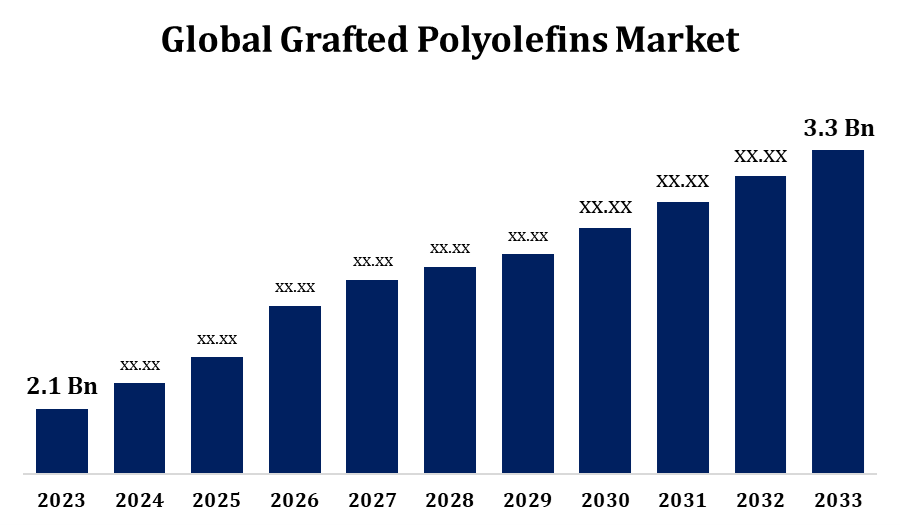

- The Global Grafted Polyolefins Market Size was valued at USD 2.1 Billion in 2023.

- The market is growing at a CAGR of 4.62% from 2023 to 2033.

- The Worldwide Grafted Polyolefins Market Size is Expected to reach USD 3.3 Billion by 2033.

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Grafted Polyolefins Market Size is experiencing steady growth driven by increasing demand across automotive, packaging, construction, and electronics industries. These materials such as maleic anhydride grafted polyethylene (PE) and polypropylene (PP) offer enhanced compatibility, adhesion, and impact resistance, making them ideal for composite materials and multilayer packaging. The automotive sector benefits from their lightweight nature and structural performance, supporting trends toward fuel efficiency and electric vehicles. In packaging, their role as tie layers and compatibilizers enhances barrier properties and recyclability. Asia-Pacific dominates the market due to rapid industrialization and expanding manufacturing activities, while North America and Europe focus on advanced applications and sustainable materials. Innovations in reactive extrusion and functionalization technologies continue to expand their usage. Environmental concerns are encouraging the development of bio-based alternatives, further shaping the market’s evolution.

Grafted Polyolefins Market Value Chain Analysis

The value chain of the grafted polyolefins market begins with raw material suppliers providing base polyolefins like polyethylene and polypropylene, along with grafting agents such as maleic anhydride. These are processed by chemical manufacturers through techniques like reactive extrusion to produce grafted polyolefins with enhanced adhesion, compatibility, and performance. The modified polymers are then supplied to compounders and masterbatch producers, who blend them with additives and fillers tailored for specific applications. These compounds are further utilized by end-use industries—such as automotive, packaging, construction, and electronics for manufacturing finished goods like bumpers, multilayer films, and pipes. Distributors and logistics partners ensure efficient supply chain operations across regions. R&D institutions and regulatory bodies influence the chain through innovation and compliance. Circular economy initiatives are increasingly impacting sourcing and product design strategies.

Grafted Polyolefins Market Opportunity Analysis

The grafted polyolefins market presents significant growth opportunities driven by rising demand for high-performance, lightweight, and recyclable materials. In the automotive sector, the shift toward electric vehicles is accelerating the use of grafted polyolefins in lightweight composites and structural parts. Packaging industries are adopting these materials as compatibilizers and tie layers to improve barrier properties and enable multilayer film recycling. Growing infrastructure and construction activities, especially in emerging economies, offer further scope for application in pipes, panels, and adhesives. Additionally, the push for sustainable solutions is fueling research into bio-based and recyclable grafted variants. Advancements in reactive extrusion and polymer grafting technologies are expanding functional possibilities across diverse sectors. Strategic partnerships and regional capacity expansions present further opportunities for market players to meet evolving end-user demands and environmental regulations.

Global Grafted Polyolefins Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.62% |

| 2033 Value Projection: | USD 3.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Processing Technology, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Arkema, Borealis AG, Clariant, COACE, Dow, Guangzhou Lushan New Materials Co., Ltd., LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation, Mitsui Chemicals Asia Pacific, Ltd., SI Group, Inc., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Grafted Polyolefins Market Dynamics

Increasing the packaging industry to drive market growth

The rapidly growing packaging industry is a key driver of grafted polyolefins market growth, as manufacturers seek materials that offer enhanced performance and sustainability. Grafted polyolefins, particularly maleic anhydride grafted polyethylene (PE) and polypropylene (PP), serve as compatibilizers and tie layers in multilayer film structures, improving adhesion between dissimilar polymers. This is essential for producing durable, flexible packaging with superior barrier properties. As demand rises for lightweight, recyclable, and functional packaging especially in food, pharmaceuticals, and e-commerce grafted polyolefins play a crucial role in meeting these requirements. Their ability to support circular packaging solutions aligns with growing environmental regulations and brand commitments to sustainability. Emerging markets with expanding consumer goods sectors further amplify demand, making the packaging industry a major growth engine for grafted polyolefin applications globally.

Restraints & Challenges

Volatility in raw material prices, especially for base polymers and grafting agents like maleic anhydride, can affect production costs and profit margins. Technical complexities in the grafting process, such as achieving uniform dispersion and consistent grafting levels, may impact product quality and performance. Environmental concerns related to fossil-based feedstocks also pressure manufacturers to develop sustainable alternatives, which can be cost-intensive and technologically demanding. Additionally, competition from other advanced polymers and compatibilizers limits market penetration in some high-performance applications. Regulatory hurdles related to food contact materials and recycling compliance pose further complications. Supply chain disruptions, particularly in regions dependent on imports, can delay production and delivery timelines. Addressing these challenges requires continuous innovation and strategic industry collaboration.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Grafted Polyolefins Market from 2023 to 2033. The automotive sector, particularly with the rise of electric vehicles, is adopting grafted polyolefins for lightweight components and improved material performance. The region’s packaging industry also contributes significantly, using these materials in multilayer films and flexible packaging to enhance adhesion and recyclability. With major players like Dow and LyondellBasell based in North America, the region benefits from strong R&D, technological advancements, and an established supply chain. Regulatory initiatives promoting sustainable materials further support market expansion. As industries shift toward circular economy goals, the demand for high-performance, eco-friendly grafted polyolefins continues to grow across applications such as consumer goods, construction, and industrial manufacturing.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region sees strong demand from key sectors such as automotive, packaging, and construction, where grafted polyolefins are used for lightweight parts, multilayer films, and durable building materials. Competitive raw material availability, favorable government policies, and well-established production infrastructure support robust market growth. China holds the largest share due to its integrated supply chain and high production capacity, while India and ASEAN nations are emerging as high-growth markets with increasing investments in infrastructure and consumer goods. Additionally, rising focus on sustainability is encouraging the adoption of bio-based variants. Overall, Asia-Pacific stands as the most dynamic and fastest-growing region in the global grafted polyolefins landscape.

Segmentation Analysis

Insights by Type

The Maleic anhydride segment accounted for the largest market share over the forecast period 2023 to 2033. MAH-grafted polypropylene and polyethylene are widely used for their excellent adhesion, impact strength, and thermal resistance, making them ideal for automotive components, packaging films, and construction materials. The segment benefits from advancements in melt grafting and reactive extrusion technologies, which ensure consistent quality and efficient production. Demand is particularly strong in Asia-Pacific, driven by rapid industrial growth, and in North America, supported by innovation and environmental regulations. The rising emphasis on recyclable and high-performance materials further boosts the adoption of MAH-grafted products. As industries prioritize lightweight, durable, and sustainable solutions, the maleic anhydride segment is expected to lead market growth in the coming years.

Insights by Processing Technology

The extrusion segment accounted for the largest market share over the forecast period 2023 to 2033. By leveraging reactive extrusion and melt-grafting techniques, manufacturers can produce high-quality grafted polyolefins continuously in forms like films, sheets, pipes, and automotive parts. This method offers precise control over temperature, pressure, and mixing ensuring uniform grafting and excellent adhesion properties. Its ability to handle large volumes cost-effectively makes it ideal for end-use industries such as packaging, automotive, and construction, which demand materials with enhanced barrier, mechanical, and compatibilization properties. As demand rises for lightweight, durable, and sustainable polymer solutions, the extrusion segment is set to drive future market growth.

Insights by End Type

The automotive segment accounted for the largest market share over the forecast period 2023 to 2033. Grafted polyolefins, especially those modified with maleic anhydride, are widely used in automotive applications such as bumpers, dashboards, fuel tanks, and under-the-hood components due to their excellent adhesion, impact resistance, and thermal stability. As the industry shifts toward electric and hybrid vehicles, the need for materials that support weight reduction and improve energy efficiency has grown. These polymers also enable better bonding between dissimilar materials, which is essential in multi-material automotive assemblies. Asia-Pacific leads in vehicle production, driving material consumption, while North America and Europe focus on sustainability and regulatory compliance. Overall, grafted polyolefins are increasingly integral to next-generation automotive design and manufacturing.

Recent Market Developments

- In November 2023, Borealis has announced its acquisition of Integra Plastics AD, a prominent Bulgarian company specializing in advanced mechanical recycling.

Competitive Landscape

Major players in the market

- Arkema

- Borealis AG

- Clariant

- COACE

- Dow

- Guangzhou Lushan New Materials Co., Ltd.

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals Asia Pacific, Ltd.

- SI Group, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Grafted Polyolefins Market, Type Analysis

- Maleic Anhydride Grafted PE

- Maleic Anhydride Grafted PP

- Maleic Anhydride Grafted EVA

Grafted Polyolefins Market, Processing Technology Analysis

- Extrusion

- Emulsion

Grafted Polyolefins Market, End Use Industry Analysis

- Automotive

- Packaging

- Construction

- Textiles

- Adhesives & Sealants

- Others

Grafted Polyolefins Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?