Global Glycobiology Market Size, Share, and COVID-19 Impact Analysis, By Type (Reagents, Instruments, Kits, and Enzymes), By Applications (Drug Discovery and Development, Immunology, Diagnostics, Oncology, and Others), By End-User (Academic & Research Institutes, Pharmaceutical & Biotechnology, and CROs), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030.

Industry: HealthcareGlobal Glycobiology Market Insights Forecasts to 2030

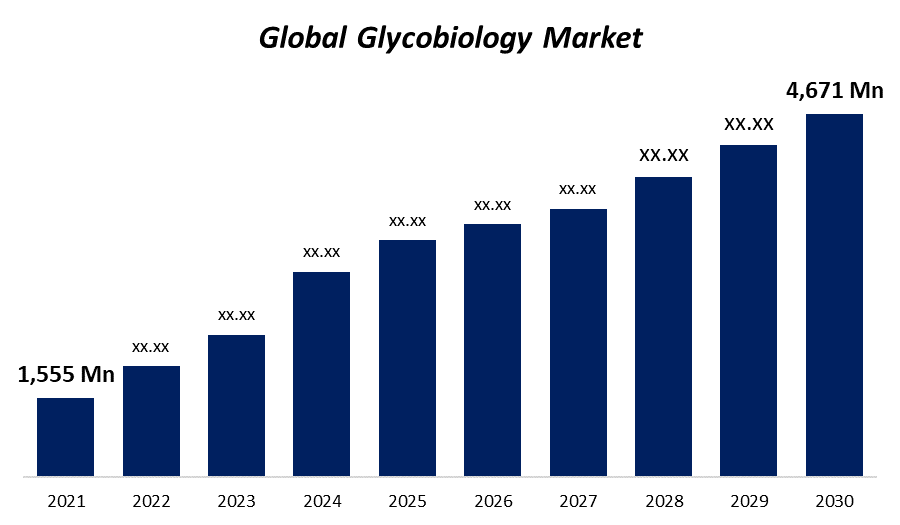

- The global glycobiology market was valued at USD 1,555 Million in 2021.

- The market is growing at a CAGR of 13% from 2021 to 2030

- The global glycobiology market is expected to reach USD 4,671 Million by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global glycobiology market is expected to reach USD 4,671 Million by 2030, at a CAGR of 13% during the forecast period 2021 to 2030. The glycobiology market has grown due to the increasing demand for government funding for glycobiology research and growing R&D expenditure by pharmaceutical and biotechnology companies.

Market Overview

Glycobiology, which is also called glycans, is the study of how carbohydrates work and affect living things. Glycans can be found in all living things. Furthermore, glycobiology is a branch of biology that is proliferating and can be used in basic research, health care, and biotechnology. The rise in technology is increasing the demand for glycobiology. In the fields of chemical and biochemical research, older methods like protein characterization are being replaced by newer technologies like High-Performance Liquid Chromatography (HPLC), Mass Spectrometry (MS), and Capillary Electrophoresis (CE). These cutting-edge methods find answers quickly and with a lot of accuracies. In 2017, for instance, Thermo Fisher Scientific spent more than $888 million on research and development. Agilent Technologies put $339 million into research and development in 2017. Smaller pharmaceutical companies are also putting more money into research and development. This part is expected to speed up the industry's growth in the coming years. The biggest pharmaceutical and biotech companies are putting a lot of money and time into researching and making better physical goods. Also, there is a growing need for treatments that can cure many life-threatening diseases, like cancer. In addition, big pharmaceutical and biotech companies are starting to think that investing in glycobiology could be an excellent way to make money. Glycomic biomarkers are also crucial in the research and development of new drugs and in diagnosing a wide range of diseases.

Report Coverage

This research report categorizes the market for global glycobiology based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global glycobiology market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global glycobiology market sub-segments.

Global Glycobiology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1,555 million |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 13% |

| 2030 Value Projection: | USD 4,671 million |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 137 |

| Segments covered: | By Type, By End-User, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Agilent Technologies, Bruker Corp, Waters Corp, Thermo Fisher Scientific, Takara Bio, Merck, Shimadzu Corp, Prozyme, New England Biolabs, and Danaher Corp. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the instruments segment dominated the market with the largest market share of 39% and market revenue of 606 million.

Based on the type, the global glycobiology market is categorized into Reagents, Instruments, Kits, and Enzymes. In 2021, the instruments segment dominated the market with the largest market share of 39% and market revenue of 606 million. Instruments took up the biggest share of the market because they were used so often in drug development and diagnostic testing.

- In 2021, the pharmaceutical and biotechnology segment accounted for the largest share of the market, with 40% and a market revenue of 622 million.

Based on end-user, the glycobiology market is categorized into Academic & Research Institutes, Pharmaceutical & Biotechnology, and CROs. In 2021, the pharmaceutical and biotechnology segment accounted for the largest share of the market, with 40% and a market revenue of 622 million. The growth of the market sector is also helped by the partnerships between big companies and research centers. As investments in research and development (R&D) for drug discovery and development and other glycobiology-based studies go up, it is expected that the pharmaceutical and biotechnology firms sector will have the highest CAGR during the forecast period.

- In 2021, the drug discovery and development segment accounted for the largest share of the market, with 35% and a market revenue of 544 million.

Based on dosage form, the glycobiology market is categorized into Drug Discovery and Development, Immunology, Diagnostics, Oncology, and Others. In 2021, the drug discovery and development segment accounted for the largest share of the market, with 35% and market revenue of 544 million. This is mostly because of the rise in research and development. Because big companies are spending more money on research and development (R&D) and clinical trials. For instance, in 2017, Merck spent USD 2.4 billion on research and development.

Regional Segment Analysis of the Glycobiology Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, the U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

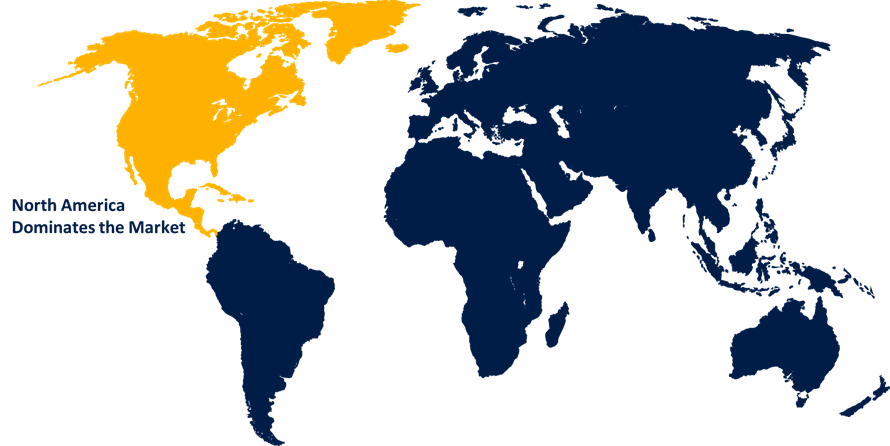

North America emerged as the largest market for the global glycobiology market, with a market share of around 39.0% and 1,555 million of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global glycobiology market, with a market share of around 39.0% and 1,555 million of the market revenue. North America is expected to be the largest market. The main things that have kept the market growth are good healthcare infrastructure and easy access to cutting-edge goods. Another important factor driving the growth of the glycobiology market in this region is the government's support for research and development.

- The Asia-Pacific market is expected to grow at the fastest CAGR between 2021 and 2030. Because the pharmaceutical and biopharmaceutical industries are growing, the region has seen a huge growth in glycobiology. In addition, the growth of the Asia-Pacific glycobiology market is also expected to be helped by investments in research organizations.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global glycobiology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Agilent Technologies

- Bruker Corp

- Waters Corp

- Thermo Fisher Scientific

- Takara Bio

- Merck

- Shimadzu Corp

- Prozyme

- New England Biolabs

- Danaher Corp

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In 2018, Shimadzu Corp. worked with PREMIER Biosoft, a global company that makes solutions for bioinformatics, to introduce its LCMS-9030 Quadrupole Time of Flight (Q-TOF) mass spectrometry system for advanced glycomics and lipidomics data research analysis.

- In 2016, ProZyme, Inc. put out the Gly-Q Glycan Analysis System on the market. This system is an integrated platform that makes psychoanalysis easy to use and quick.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global glycobiology market based on the below-mentioned segments:

Global Glycobiology Market, By Type

- Reagents

- Instruments

- Kits

- Enzymes

Global Glycobiology market, By Application

- Drug Discovery and Development

- Immunology

- Diagnostics

- Oncology

- Others

Global Glycobiology Market, By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology

- CROs

Global Glycobiology market, Regional Analysis

- North America

- THE US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?