Global Gluten Free Product Market By Type (Baby Food, Pastas & Pizzas, Snacks & RTE Products, Bakery Products, Condiments & Dressings), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Drugstores & Pharmacies, Online); By Region (U.S., Canada, Mexico, Rest Of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest Of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest Of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest Of Middle East & Africa, Brazil, Argentina, Rest Of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends And Forecast, 2021-2030

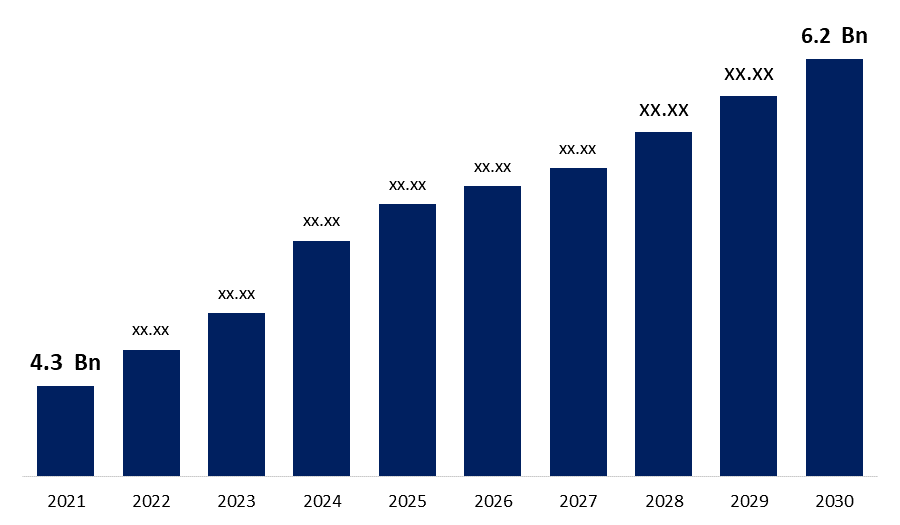

Industry: Food & BeveragesThe Global Gluten Free Product Market size was USD 4.3 Billion in 2021 and is projected to reach USD 6.2 Billion by 2030, exhibiting a CAGR of 7.7% during the forecast period. Gluten-free product is primarily developed for persons with celiac disease and gluten allergy, as gluten can cause a variety of problems, including gut swelling. However, due to the health benefits of a gluten-free diet, it is gaining in popularity even among those who do not have gluten sensitivity. It's typically used in baked goods because it gives them texture and shape, but the protein has no nutritional value. As a result, customers are aiming to eliminate gluten from their diets because it aids in weight loss, digestion, and vitality. Furthermore, increased consumer demand for functional foods and product innovation in "free-from" food sectors are expected to propel the gluten-free food market forward in the coming years.

Get more details on this report -

There has been a significant surge in demand all around the world. Clean-label and "free-from" products have gone from niche to mainstream in recent years as consumers' awareness of healthy eating has grown. Consumers seek out foods that aid in the management and maintenance of their overall health. They are looking for alternate food and beverage formulations that will help them avoid food sensitivities while also adhering to their diets. Manufacturers are responding to changing consumer preferences by producing new items to meet demand.

COVID-19 Analysis

The COVID-19 pandemic has had a significant impact on the worldwide economy and businesses. Consumers' food consumption patterns changed as a result of the pandemic's socioeconomic position. People were obliged to stay at home due to restrictions on public transportation and government lockdown. As a result of this aspect, consumers' snacking habits have changed. Their growing health consciousness, on the other hand, increased demand for guilt-free food. As people replaced meals with snacking options, sales of food products with "free-from" claims surged. According to a poll conducted by Mondelez International in 2020, approximately 64 percent of consumers in the United States favour snacking as a source of nutrition, with 56 percent seeking healthy snacking options. Furthermore, the snacking trend has become increasingly widespread, particularly among the youth.

Global Gluten Free Product Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 4.3 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 7.7%. |

| 2030 Value Projection: | USD 6.2 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Distribution Channel, By Region |

| Companies covered:: | The Kraft Heinz Company, Alara Wholefoods Ltd, Amy’s Foods, Barilla G.E.R Fratelli S.P.A, Big OZ, Bob’s Red Mill, ConAgra Brands Inc, Dr Schär AG/SPA, Enjoy Life Foods, Farmo S.P.A, Freedom Foods Group Limited, General Mills, Golden West Specialty Foods, Hero AG, Kelkin Ltd, Kellogg’s Company, Koninklijke Wessanen N.V, Norside Foods Ltd, Prima Foods, Quinoa Corporation, Raisio PLC, Seitz Glutenfrei GMBH, Silly Yaks, The Hain Celestial Group Inc, Warburtons. |

| Growth Drivers: | 1) The bakery products segment is expected to dominate the market share 2) The convenience stores segment is expected to dominate the market share |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Type Outlook

The bakery products segment is expected to dominate the market share in 2020 of global gluten free product market owing to increasing understanding of these items is at an all-time high, as is public awareness of celiac disease and other digestive health issues. As a result, the community is shifting and embracing gluten-free dietary choices on a huge scale, owing to the additional health benefits they provide beyond celiac disease prevention and treatment. Bakery is one of the food products segments where wheat flour is consumed in big quantities as a raw material ingredient for binding or manufacture of a variety of products. As a result, having a variety of gluten-free bread products is becoming increasingly important.

Distribution Channel Outlook

The convenience stores segment is expected to dominate the market share in 2020 of global gluten free product market owing to availability of numerous product categories, and frequent shopping destinations are all factors to consider. As a result, the sector has the largest market share by distribution channel in the world and is expected to develop at the fastest rate in the future years. Consumers can choose from a variety of brands and price ranges through the retail sales channel. Furthermore, convenience stores stock the majority of important household and grocery items, making it convenient for customers to shop. Furthermore, the segment's performance is projected to be boosted by greater accessibility and the availability of several convenience stores.

The supermarkets/hypermarkets segment is anticipated to emerge as the fastest-growing region of global gluten free product market over the forecast period owing to increasing mass merchandisers use numerous enticing schemes to attract customers' attention, such as product price discounts, bulk purchase schemes, and so on. Market growth is fueled by mass merchandisers stocking their shelves with free-from goods and specialised product lanes.

Get more details on this report -

Regional Outlook

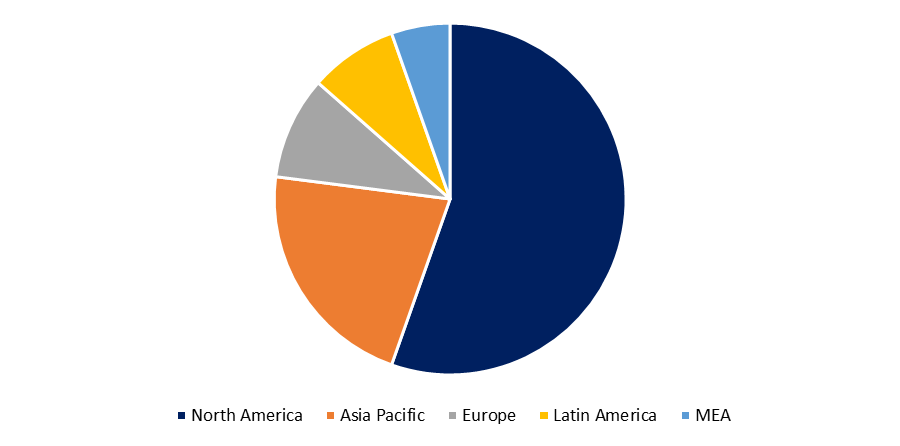

North America is expected to dominate the market share in 2020 of global gluten free product market. The regional market has benefited from a considerably higher awareness of celiac disease among consumers in the region, as well as their increased desire to eat a healthy diet. According to a report published by Beyond Celiac, a research-driven celiac disease group, around 1% of the US population will be identified with celiac disease by 2020. This aspect has pushed consumers to avoid gluten-related health concerns by switching to gluten-free alternatives. Because bread is one of the most popular goods in the region, people are opting to bake it with gluten-free flours including amaranth, tapioca, sorghum, and others. Furthermore, the transition of the gluten-free baking category into a mainstream segment, as well as changing consumer attitudes toward the free-from category, are expected to support regional market growth. General Mills, The Kraft Heinz Company, and Kellogg's Company are some of the leading participants in the gluten-free food sector in the region, driving growth by offering a diverse range of gluten-free products and developing innovative product innovations to meet changing consumer expectations.

The Europe segment is anticipated to emerge as the fastest-growing region of global gluten free product market over the forecast period owing to increase in millennial demand and a boom in marketing activity. The expansion of the gluten-free food business in Europe is partly fueled by improvements in distribution networks. This is due to an increase in investments by a number of small and midsized food production firms in emerging countries. Furthermore, factors such as rising consumer desire for convenience, rising disposable income, and changes in consumer behaviour in the region are projected to have a significant impact on the market.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. For instance, in January 2021, Partake Foods launched a multipurpose baking mix that is free of dairy, gluten, and eight main allergens. In July 2021, Kellogg’s launched a new Coco Pop gluten-free cereal to address the increasing demand for gluten-free cereal among consumers in Australia.

Market Segmentation of Global Gluten Free Product Market

By Type

- Baby Food

- Pastas & Pizzas

- Snacks & RTE Products

- Bakery Products

- Condiments & Dressings

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Drugstores & Pharmacies

- Online

Key Players

- The Kraft Heinz Company

- Alara Wholefoods Ltd

- Amy’s Foods

- Barilla G.E.R Fratelli S.P.A

- Big OZ

- Bob’s Red Mill

- ConAgra Brands Inc

- Dr Schär AG/SPA

- Enjoy Life Foods

- Farmo S.P.A.

- Freedom Foods Group Limited

- General Mills

- Golden West Specialty Foods

- Hero AG

- Kelkin Ltd

- Kellogg’s Company

- Koninklijke Wessanen N.V

- Norside Foods Ltd

- Prima Foods

- Quinoa Corporation

- Raisio PLC

- Seitz Glutenfrei GMBH

- Silly Yaks

- The Hain Celestial Group Inc

- Warburtons

Need help to buy this report?