Global Ship & Boat Building Market Size, Share, and COVID-19 Impact Analysis, Russia-Ukraine War Impact, Tariff Analysis, By Type (Vessel, Container, Passenger, and Other Types), By End User (Transport Companies, Military, and Other End Users), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseShip & Boat Building Market Summary, Size & Emerging Trends

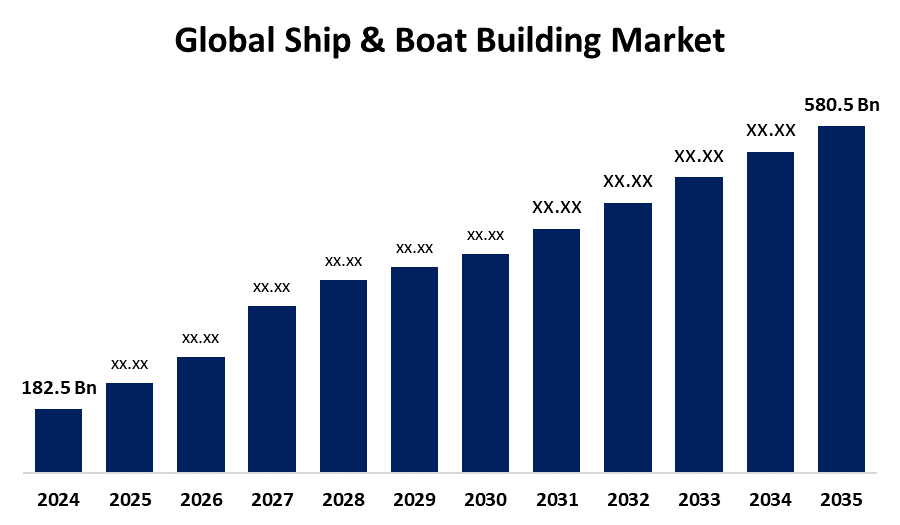

- According to Spherical Insights, The Global Ship & Boat Building Market Size is expected to Grow from USD 182.5 Billion in 2024 to USD 580.5 Billion by 2035, at a CAGR of 11.09% during the forecast period 2025-2035.

- The increasing global trade with surging emphasis on sustainable & energy-efficient solutions by the marine customers is a key growth driver for the global ship & boat building market.

Get more details on this report -

Key Market Insights

- North America is expected to account for the largest share in the ship & boat building market during the forecast period.

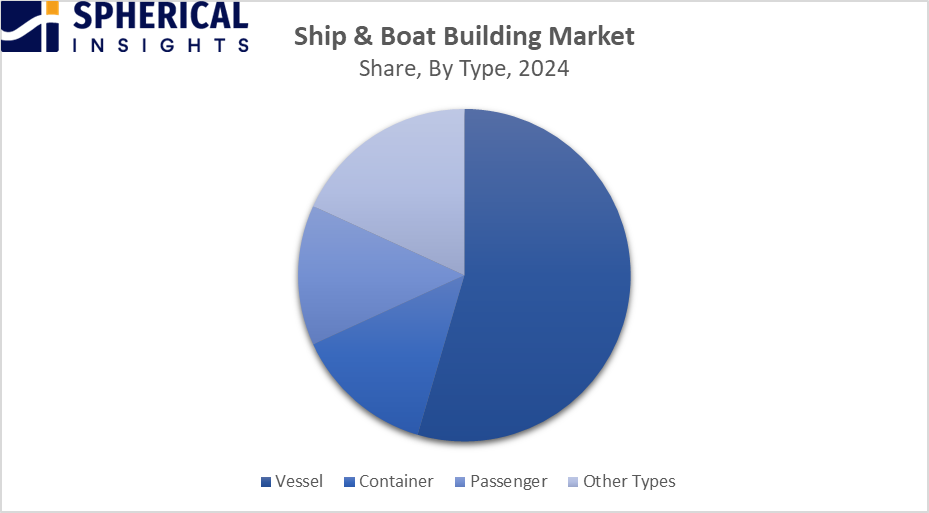

- In terms of type, the vessel segment is projected to lead the ship & boat building market in terms of type throughout the forecast period

- In terms of end user, the transport companies segment captured the largest portion of the market

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 182.5 Billion

- 2035 Projected Market Size: USD 580.5 Billion

- CAGR (2025-2035): 11.09%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Ship & Boat Building Market

The ship & boat building market is the global economic sector that emphasizes the designing, engineering, construction, repair, and conversion of watercraft. The market includes large vessels such as tankers and container ships, as well as smaller boats and marine structures. Ship & boat building refers to the building of large ocean-going vessels, usually steel, and the construction of smaller vessels from materials like wood, steel, aluminium, glass fiber, or new composite. The high international seaborne trade, advancements in fuel efficiency, and 3D printing technology adoption are responsible for driving the growth of ship & boat building. Further, increasing maritime security needs further propel its demand.

Ship & Boat Building Market Trends

- Incorporation of AI and IoT for intelligent navigation systems

- Trend toward sustainability, with an increasing popularity of hybrid and completely electric boats

- Advanced materials in the marine industry include composites such as carbon fiber and aluminium that reduce ship weight and fuel usage

- Alternative fuel and green shipbuilding, as well as autonomous vessels & smart navigation

- AR/VR digital shipyard and 3D printing integration

Ship & Boat Building Market Dynamics

Global Ship & Boat Building Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 182.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.09% |

| 2035 Value Projection: | USD 580.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Mitsubishi Heavy Industries Ltd, Hyundai Heavy Industries Co. Ltd., China State Shipbuilding Corporation, Daewoo Shipbuilding & Marine Engineering Co. Ltd., Samsung Heavy Industries, Sumitomo Heavy Industries, Hanjin Heavy Industries and Construction Co., Yangzijiang Shipbuilding Ltd, United Shipbuilding Corporation, STX Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

Increasing global trade with surging emphasis on sustainable & energy-efficient solutions by the marine customers is driving growth in the ship & boat building market

The growth of the ship & boat building market is driven by the rising global trade activities. It was estimated that over 90% of international trade by volume is carried via sea routes, and the capacity, efficiency, and innovation in shipbuilding, affected by the evolution of the global shipping and trade ecosystem. There is a surging inclination towards sustainable marine fuels (SMF). With an increasing environmental awareness, green technologies are being adopted for reducing carbon footprint and operating more sustainability, thereby protecting marine ecosystems and making shipping more eco-friendly.

Restrain Factors: The Ship & Boat Building market faces challenges due to the regular maintenance, increased production costs, and environmental regulations

The harsh marine environment, shortage of skilled labor & time, and budget constraints make it difficult in regular maintain ships and boats regularly, thereby challenging the market. Further, increased production costs and environmental regulations associated with the maritime industry are negatively affecting the market growth.

Opportunity: The development of eco-friendly vessels and the adoption of smart technologies are creating new opportunities in the ship & boat building market

Implementation of Internet of Things (IoT) technologies in vessel monitoring and maintenance systems enables real-time data analysis and predictive maintenance that effectively reduces overall operational costs and enhances vessel performance. With increasing environmental concerns, emphasis on sustainable practices, especially in the materials that are used for boat construction, promotes a healthier marine ecosystem.

Challenges: In the ship & boat building market, inappropriate resource management, increased operational costs, and a lack of skilled workforce are challenging the market

Several challenges faced by the ship & boat building market include inappropriate resource management, high operational costs, and a lack of skilled workforce. Inappropriate resource management and a skilled workforce due to inadequate training, poor communication, and over-reliance on specific individuals or systems may lead to accidents created by human and organizational errors. Further, increased operational costs are due to volatility in raw material prices, environmental regulations, and the adoption of advanced technologies.

Global Ship & Boat Building Market Ecosystem Analysis

The Global Ship & Boat Building Market ecosystem includes shipyards, component suppliers, navigation systems, regulatory bodies setting standards, and end users. Key technologies involve the integration of the Internet of Things (IoT) and AI, and sustainability in shipbuilding design. Market growth is driven by increasing global trade with surging emphasis on sustainable & energy-efficient solutions by the marine customers, while environmental regulations and inappropriate resource management & skilled workforce remain challenges. Opportunities lie in the development of eco-friendly vessels and the adoption of smart technologies.

Global Ship & Boat Building Market, By Type

The vessel segment led the ship & boat building market, generating the largest revenue share. This dominance can be attributed to the growing need for military vessels such as destroyers and frigates owing to strategic maritime defense needs. The vessels are designed for transporting unpackaged bulk cargo, like grains, coal, and minerals. Cargo ships are the most common maritime vessels used in commerce.

Get more details on this report -

The container segment in the ship & boat building market is expected to grow at a significant CAGR over the forecast period, driven by the need for investment in port facilities. A container ship is the most common mode of sea freight transport, designed to carry standard 20’, 40’, and 45’ containers, accommodating most dry-load transport.

Global Ship & Boat Building Market, By End User

The transport companies segment held the largest market share in the ship & boat building market, due to its increased load-carrying capacity, affordability, and fuel efficiency. Ships and boats are used for the transportation of petroleum-based products, crude oils, mineral ores, steel vehicles, and other similar manufactured goods.

The military segment in the ship & boat building market is projected to register the fastest CAGR, driven by increasing investments in naval capabilities and the development of advanced military vessels. The segment includes designing, constructing, modernization, and maintaining military vessels for naval forces.

North America is expected to account for the largest share of the Ship & Boat Building market during the forecast period,

Get more details on this report -

driven by the region’s robust infrastructure in countries like the US, Canada. Further, the strong demand for naval & commercial vessels, government defense budgets, and shipbuilding technological advancements are propelling the market demand.

The United States is experiencing steady growth in the ship & boat building market,

fueled by the country’s extensive network of shipyards and advanced manufacturing capabilities. Launch of long-term naval shipbuilding plan for modernizing its fleet and enhancing maritime security is expected to propel the market.

Asia Pacific is expected to grow at the fastest CAGR in the ship & boat building market during the forecast period.

This rapid growth is driven by the region's extensive shipbuilding infrastructure and government support. Further, the presence of primary manufacturing powerhouses in countries like China, Japan, and South Korea, responsible for the ship & boat building market.

China is rapidly expanding in the ship & boat building market,

due to an increased emphasis on high-value vessel segments. Further strategic partnerships in the shipbuilding sector are supporting the country’s market growth for ship & boat building.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ship & boat building market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

WORLDWIDE TOP KEY PLAYERS IN THE SHIP & BOAT BUILDING MARKET INCLUDE

- Mitsubishi Heavy Industries Ltd

- Hyundai Heavy Industries Co. Ltd.

- China State Shipbuilding Corporation

- Daewoo Shipbuilding & Marine Engineering Co. Ltd.

- Samsung Heavy Industries

- Sumitomo Heavy Industries

- Hanjin Heavy Industries and Construction Co.

- Yangzijiang Shipbuilding Ltd

- United Shipbuilding Corporation

- STX Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Product Launches in Ship & Boat Building

- In March 2025, the Canadian government announced the contract award to local shipbuilder Irving Shipbuilding Inc. for the construction of the River-class destroyers (previously known as Canadian Surface Combatants or CSC) for the Royal Canadian Navy.

- In December 2024, Lawmakers unveiled bipartisan legislation to reform the commercial maritime and shipbuilding sectors.

- In September 2024, Damen Shipyards Group signed a contract with WUZ Port and Maritime for an ASD Tug 2111. The ASD Tug 2111 would be one of the most compact vessels in the WUZ fleet. Its 21 metre length makes the tug the perfect solution to operate in the confined spaces of the Port of Gdansk’s Inner Harbour.

- In May 2024, leading Japanese companies, NYK Line (NYK), NYK Bulk & Projects Carriers (NBP), TSUNEISHI SHIPBUILDING Co., Ltd., and British renewable energy business, Drax Group (Drax), have signed a new memorandum of understanding (MoU) to develop both the world’s first biomass-fuelled ship (bioship) and the technology that could power it.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ship & boat building market based on the below-mentioned segments:

Global Ship & Boat Building Market, By Type

- Vessel

- Container

- Passenger

- Other Types

Global Ship & Boat Building Market, By End User

- Transport Companies

- Military

- Other End Users

Global Ship & Boat Building Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?