Global Fluoropolymer Processing Aid Market Size By Polymer Type (PE, PVC, PP), By Application (Fiber, Wires & Cables, Cast Films), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), And Segment Forecasts, By Geographic Scope And Forecast to 2032

Industry: Machinery & EquipmentGlobal Fluoropolymer Processing Aid Market Size Insights Forecasts to 2032

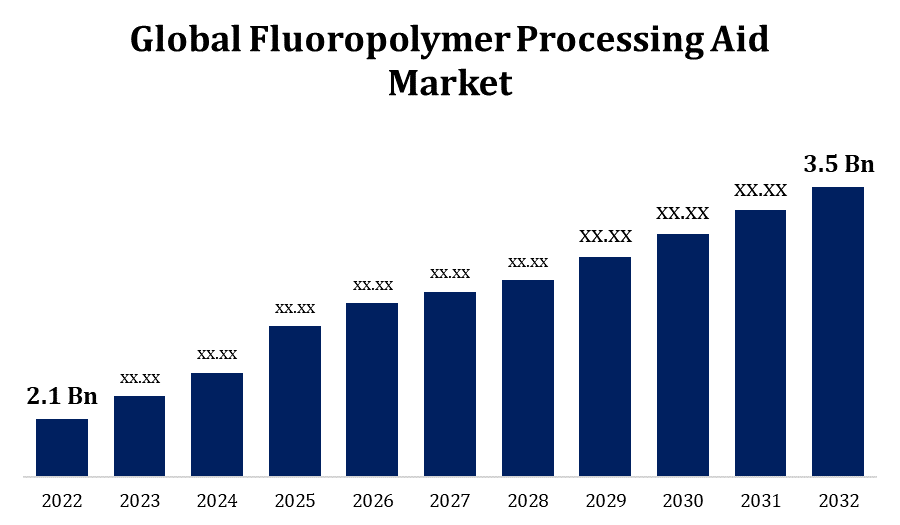

- The Global Fluoropolymer Processing Aid Market Size was valued at USD 2.1 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.9% from 2022 to 2032

- The Worldwide Fluoropolymer Processing Aid Market Size is expected to reach USD 3.5 Billion by 2032

- Asia Pacific is Expected to Grow the fastest during the Forecast period

Get more details on this report -

The Global Fluoropolymer Processing Aid Market Size is expected to reach USD 3.5 Billion by 2032, at a CAGR of 3.9% during the forecast period 2022 to 2032.

Fluoropolymers have found a niche in the expanding demand for high-performance materials in sectors such as electronics, construction, and automotive. Processing aids are used to increase the polymers' processing efficiency so that they can be successfully moulded and shaped. This market is dynamic, driven by a number of variables including overall expansion in end-use industries, environmental laws, and technical advancements. One important driver is the growing usage of fluoropolymers in a variety of applications, including industrial coatings, electrical insulation, and automobile components. The need for fluoropolymers expands as companies look for materials with better qualities including thermal stability and chemical resistance, which in turn increases the requirement for efficient processing aids. Furthermore, developments in processing assistance technologies support industry expansion. Businesses are constantly coming up with creative ways to improve fluoropolymer processing efficiency in order to meet the changing demands of various industries. Global campaigns promoting eco-friendly and sustainable practises are also having an impact on the market. Environmentally friendly processing aid development is gaining momentum as environmental restrictions become more rigorous.

Fluoropolymer Processing Aid Market Value Chain Analysis

The supply of raw ingredients, such as fluoroethylene and other chemicals needed to make fluoropolymer processing aids, is the first link in the chain. These businesses use a variety of chemical procedures to transform the raw components into fluoropolymer processing aids. Their main goal is creating formulations that increase fluoropolymer processing efficiency. After the processing aids are produced, end users receive them through a variety of distribution routes. To guarantee prompt delivery, logistics and transportation are involved. Fluoropolymer processing aids are widely used in industries such as automotive, electronics, chemical processing, and construction. In order to improve the functionality and characteristics of goods based on fluoropolymers, these end users integrate the aids into their manufacturing processes. It is crucial to manage and dispose of waste produced during the creation and usage of processing aids properly.

Fluoropolymer Processing Aid Market Opportunity Analysis

The use of high-performance polymers, such as fluoropolymers, is increasing as sectors continue to demand materials with remarkable qualities. This gives producers of processing aids the chance to come up with creative ways to increase the processing effectiveness of fluoropolymers. The expansion of sectors including electronics, construction, and automotive presents chances for producers of processing aids to meet these industries' changing demands. Within these sectors, processing aid customization for particular applications can be a wise strategic choice. It can be a wise strategic move to investigate opportunities in developing economies and areas where the manufacturing industry is expanding. Global industry expansion may lead to a rise in the need for fluoropolymer processing aids.

Global Fluoropolymer Processing Aid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.1 Billion |

| Forecast Period: | 2022 to 2032 |

| Forecast Period CAGR 2022 to 2032 : | 3.9% |

| 2032 Value Projection: | USD 3.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Polymer, By Application, By Region, By Geographic. |

| Companies covered:: | Daikin Industries, Ltd., 3M Company, Astra Polymers, Gabriel-Chemie Group, Nova Chemicals Corporate, The Chemours Company, Solvay S.A., Tosaf Compounds Ltd., and |

| Growth Drivers: | Demand from the end-use sectors in Fluoropolymer Processing Aid Market growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Fluoropolymer Processing Aid Market Dynamics

Demand from the end-use sectors in Fluoropolymer Processing Aid Market growth

Fluoropolymers are widely used in the automotive industry for gaskets, electrical components, and fuel systems. The requirement for increased fluoropolymer-based material performance and processing efficiency is what drives the demand for processing aids in this industry. Fluoropolymers are utilised in the electronics sector as insulation for cables, connections, and electronic parts. The industry's need for processing aids stems from the requirement to guarantee accurate manufacturing procedures and superior final goods. Fluoropolymers are utilised in construction for architectural sealants, coatings, and membranes. Processing aids help fluoropolymer materials be efficiently moulded and shaped to satisfy the unique needs of building applications. Fluoropolymers find use in the oil and gas industry for linings, seals, and gaskets, among other uses.

Restraints & Challenges

The price of fluoropolymer processing aids can be influenced by the cost of production techniques and raw ingredients. Cost-effectiveness and quality must be balanced, particularly in areas with intense competition. Considerable research and development expenditures are necessary to create sophisticated and useful processing assistance systems. Sustained success requires staying ahead of both market trends and technology advancements. There are various companies fighting for market share in the competitive fluoropolymer processing aid industry. Innovative ideas, successful marketing, and tactical positioning are necessary to stand out in a congested market. It can be difficult to convince end users of the advantages of fluoropolymer processing aids and set them apart from competing products. To have the value offer accepted by the market, awareness-building is necessary. Customer preferences that shift due to sustainability and environmental friendliness, for example, may have an impact.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Fluoropolymer Processing Aid Market from 2023 to 2032. Numerous industries, including the automotive, electronics, aerospace, and chemical sectors, are based in North America. The need for high-performance materials in these industries drives the demand for fluoropolymers and, by extension, fluoropolymer processing aids. Fluoropolymers are widely used in the automotive sector in North America for parts like electrical components, gaskets, and fuel systems. The expansion and innovation in the automotive industry impact the need for processing aids. North America has a competitive fluoropolymer processing aid market, with a number of major manufacturers present. To stay strong in the market, businesses must set themselves apart by the calibre of their products, their capabilities, and their customer support.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The automotive, electronics, and construction industries are just a few of the sectors in which the Asia Pacific region is seeing tremendous economic expansion. The need for processing aids and fluoropolymers is driven by this rise. The demand for sophisticated materials in manufacturing processes is one of the factors driving the growth of the fluoropolymer processing aid market. Asia Pacific is a hub for global manufacturing. The adoption of cutting edge processing assistance technologies is fueled by the region's manufacturing capabilities. The Asia Pacific region's construction industry is expanding quickly because to large-scale infrastructure building initiatives. Applications for fluoropolymers can be found in construction, and processing aids help ensure that building materials are manufactured effectively.

Segmentation Analysis

Insights by Polymer Type

PE segment accounted for the largest market share over the forecast period 2023 to 2032. Polyethylene has widespread application in fields like building, packaging, and vehicle parts. The need for processing aids to increase manufacturing efficiency may be driven by the general increase in demand for products made using PE. PE is a polymer that is frequently used in the packaging sector because of its affordability and adaptability. The burgeoning packaging industry, propelled by consumer goods and e-commerce, may augment the need for fluoropolymer processing aids. PE is used in many parts of the automotive industry, such as interior parts and gasoline tanks. The need for processing aids to enhance PE processing in industrial processes may increase as the automobile industry grows.

Insights by Application

Cast films segment accounted for the largest market share over the forecast period 2023 to 2032. There has been an increase in demand for cast films in a number of industries, such as construction, automotive, and packaging. Cast films can be used in a variety of applications due to their adaptability, and processing aids can improve the production process' effectiveness. Stretch films, industrial packaging, and food packaging are just a few of the uses for cast films in the packaging sector. Cast film usage may rise as a result of the packaging industry's expansion, which is being fueled by e-commerce and sustainability concerns. This will raise the need for processing aids.

Recent Market Developments

- In January 2023, PFAS-free polymer processing aid 1001316-N, recently released by Ampacet Corporation, is useful for blown film extrusion in a variety of end applications.

Competitive Landscape

Major players in the market

- Daikin Industries, Ltd.

- 3M Company

- Astra Polymers

- Gabriel-Chemie Group

- Nova Chemicals Corporate

- The Chemours Company

- Solvay S.A.

- Tosaf Compounds Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Fluoropolymer Processing Aid Market, Polymer Type Analysis

- PE

- PVC

- PP

Fluoropolymer Processing Aid Market, Application Analysis

- Fiber

- Wires & Cables

- Cast Films

Fluoropolymer Processing Aid Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?