Germany Xylitol Market Size, Share, and COVID-19 Impact Analysis, By Form (Powder, Liquid), By Application (Chewing Gum, Oral Care, Confectionery, Bakery & Other Foods, and Others), and Germany Xylitol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsGermany Xylitol Market Forecasts to 2035

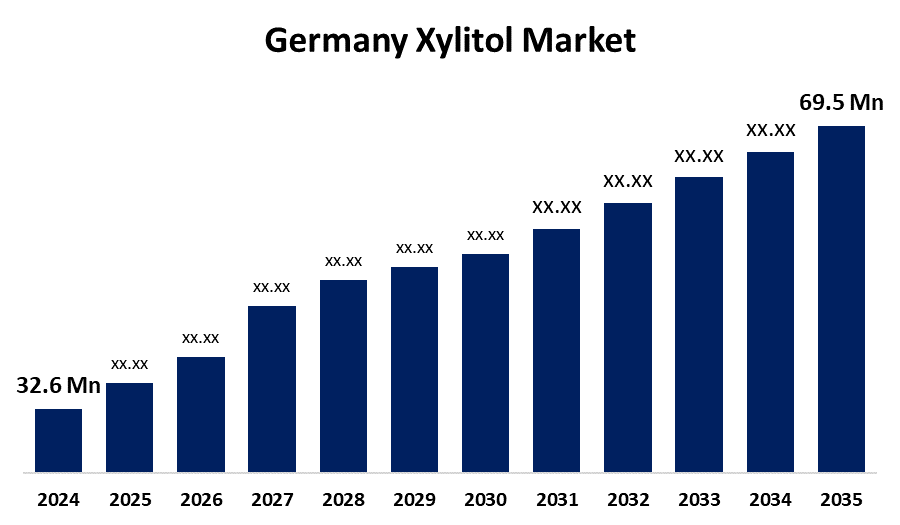

- The Germany Xylitol Market Size Was Estimated at USD 32.6 Million in 2024

- The Germany Xylitol Market Size is Expected to Grow at a CAGR of around 7.12% from 2025 to 2035

- The Germany Xylitol Market Size is Expected to Reach USD 69.5 Million by 2035

Get more details on this report -

According to a Research report published by Spherical Insights & Consulting, The Germany Xylitol Market Size is anticipated to reach USD 69.5 Million by 2035, Growing at a CAGR of 7.12% from 2025 to 2035. The Market Size is constantly developing due to a number of causes, including expanding applications in the food and beverage industry, advantageous laws and policies that favour natural sweeteners over artificial ones, and rising incidence of obesity and diabetes.

Market Overview

The Germany xylitol market focuses on xylitol, a sugar alcohol derived from fruits, vegetables, plants, and trees. Xylitol, while tasting and looking similar to sugar, does not cause insulin or blood sugar rises. It has grown in favour as a sugar substitute due to its approximately 40% lower calorie content. The growing need for natural and low-calorie sweeteners in the food, nutraceutical, and pharmaceutical industries is propelling the strong expansion of the German xylitol market. calories and a low glycaemic index, which makes it particularly appealing to diabetics and health-conscious shoppers. Because of its anti-cavity and anti-tooth decay qualities, it is frequently used as a food additive in goods like dairy, confections, baked goods, and beverages. Despite its effectiveness, the chemical process used in most industrial xylitol synthesis is energy-intensive and environmentally problematic due to its use of high-pressure hydrogen gas and hazardous catalysts. A more sustainable approach is provided by enzymatic manufacturing, which uses microorganisms like bacteria and yeast. The market is growing due to larger numbers of consumers wishing to opt for healthier sugar substitutes and an increasing awareness of natural, health-promoting substances. Moreover, corn cob xylitol is more affordable due to lower costs of production, driving faster adoption in Germany. Overall, the xylitol market is being driven by value concerns and health trends.

Report Coverage

This research report categorizes the market for the Germany xylitol market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany xylitol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany xylitol market.

Germany Xylitol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 32.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.12% |

| 2035 Value Projection: | USD 69.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Form, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Roquette Frères, Cargill, Incorporated, Ingredion Incorporated, DuPont Nutrition & Health (IFF), BASF SE, Südzucker AG, Xlear Inc., Zhenjiang Xiangyuan Sugar Alcohol Co., Ltd., Tate & Lyle PLC, Jungbunzlauer Suisse AG, Roquette Frères, Merck KGaA, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Germany market for xylitol is mostly driven by consumers' increasing awareness of health and wellbeing, which is driving them to choose natural, low-calorie sweeteners over conventional sugars. Particularly among diabetics, xylitol is well-liked because of its reduced glycaemic index and advantages for oral health. Demand is increased by its growing use in light and sugar-free food products, as well as its ability to retain moisture and extend shelf life. Additionally, by fostering the acceptance of xylitol, supporting government policies and campaigns urging a lower sugar intake further drives market growth.

Restraining Factors

Market expansion may be impeded by regulatory restrictions on the use of xylitol, which may postpone the introduction of new goods. Furthermore, raw material availability may be impacted by climate change, which would affect manufacturing as a whole. Prices have increased due to the high cost and limited supply of pure xylose, which is necessary for the synthesis of xylitol. Market growth is further constrained by variations in the supply of xylitol and the accessibility of substitute polyols such as sorbitol and mannitol. These factors hamper the xylitol market during the forecast period.

Market Segmentation

The Germany xylitol market share is classified into form and application.

- The powder segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany xylitol market is segmented by form into powder, liquid. Among these, the powder segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The product's availability, adaptability, manipulation, and storage are the main reasons for its great demand in powdered form. Gum and anhydrous dietary supplements are the primary applications for the powdered form due to its stability. Because the items don't include water, they have a longer shelf life.

- The oral care segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany xylitol market is segmented by application into chewing gum, oral care, confectionery, bakery & other foods, and others. Among these, the oral care segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Raising salivary flow and pH, preventing the growth of dangerous bacteria, and lowering plaque, inflammation, and tooth erosion, it lowers the incidence of dental caries. The oral care market is expected to expand significantly during the projected period as a result of these factors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany xylitol market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roquette Freres

- Cargill, Incorporated

- Ingredion Incorporated

- DuPont Nutrition & Health (IFF)

- BASF SE

- Südzucker AG

- Xlear Inc.

- Zhenjiang Xiangyuan Sugar Alcohol Co., Ltd.

- Tate & Lyle PLC

- Jungbunzlauer Suisse AG

- Roquette Frères

- Merck KGaA

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany xylitol market based on the below-mentioned segments:

Germany Xylitol Market, By Form

- Powder

- Liquid

Germany Xylitol Market, By Application

- Chewing Gum

- Oral Care

- Confectionery

- Bakery & Other Foods

- Others

Need help to buy this report?