Germany Thermometer Market Size, Share, and COVID-19 Impact Analysis, By Product (Mercury-based and Mercury-free Thermometer), By Application (Medical, Industrial, Food, and Laboratories), and Germany Thermometer Market Industry Trend, Forecasts to 2035

Industry: HealthcareGermany Thermometer Market Size Insights Forecasts to 2035

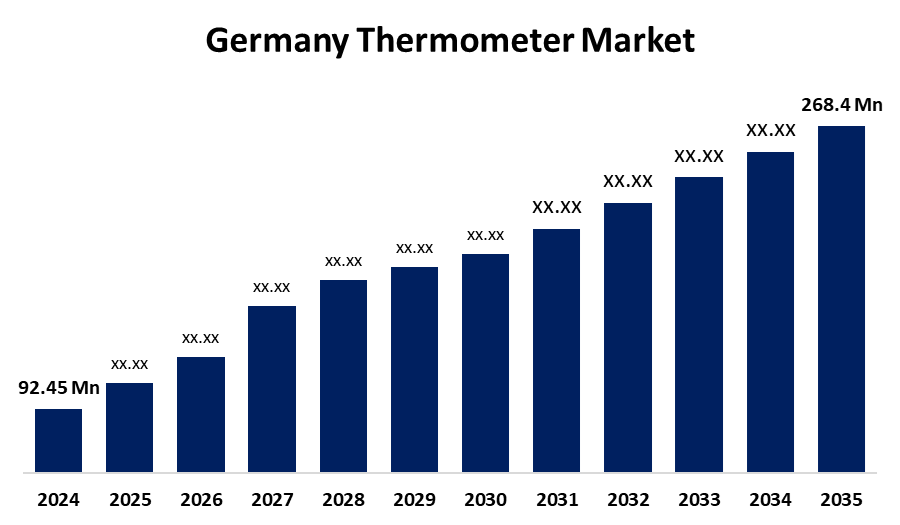

- The Germany Thermometer Market Size Was Estimated at USD 92.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.17% from 2025 to 2035

- The Germany Thermometer Market Size is Expected to Reach USD 268.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Germany Thermometer Market Size is anticipated to reach USD 268.4 million by 2035, growing at a CAGR of 10.17% from 2025 to 2035. An increase in the prevalence of infectious diseases such as COVID-19, influenza, and other medical conditions such as malaria, and dengue, as well as raising awareness about the importance of body temperature monitoring, are the major factors driving the market.

Market Overview

The thermometer market involves the production and distribution of devices used to measure temperature across various applications, including medical, industrial, food safety, and laboratories. Thermometers offer benefits such as accurate temperature monitoring, early illness detection, quality control in manufacturing, and safety compliance. The increasing healthcare awareness, technological advancements like infrared and digital thermometers, and rising demand in sectors such as food processing and pharmaceuticals. The shift toward non-contact and smart thermometers presents further growth potential. Government initiatives in Germany and the EU promote public health monitoring, support healthcare infrastructure, and regulate temperature-sensitive industries. These include funding for medical equipment modernization, digital health programs, and stricter food safety standards, all of which contribute to the thermometer market’s expansion.

Report Coverage

This research report categorizes the market for Germany thermometer market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany thermometer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany thermometer market.

Germany Thermometer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 92.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.17% |

| 2035 Value Projection: | USD 268.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Geratherm Medical AG, Testo SE & Co. KG, Amarell GmbH & Co. KG, Thermo Fisher Scientific GmbH, AFRISO-EURO-INDEX GmbH, Ahlborn MeB und Regelungstechnik GmbH, PCE, Deutschland Gmbh, WIKA (Alexander Wiegand SE & Co. KG), Ashcroft Instruments GmbH, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ageing population and high prevalence of chronic illnesses like diabetes and hypertension, there is robust demand for reliable temperature monitoring in both clinical and home care settings.The legacy of infectious disease awareness, , most recently due to COVID-19 and seasonal illnesses, has heightened focus on fever detection and temperature screening. Moreover, technological innovations such as smart, non-contact, and digital thermometers with IoT integration have driven adoption among medical professionals and consumers.

Restraining Factors

High costs associated with advanced digital and non-contact thermometer models limit adoption in price-conscious healthcare settings. Strict regulatory standards under EU’s Medical Device Regulation (MDR) and environmental directives particularly regarding mercury thermometers pose barriers to new market entrants. The saturation in traditional thermometer segments and rising competition from low-cost alternatives constrain growth opportunities.

Market Segmentation

The Germany thermometer market share is classified into product and application.

- The mercury-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany thermometer market is segmented by product into mercury-based and mercury-free thermometer. Among these, the mercury-based segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its historical reliability, high accuracy, and widespread use in medical and industrial applications. Despite growing environmental concerns, many professionals still prefer mercury thermometers for their consistency and proven performance. Their durability and ease of use in high-temperature environments support continued demand.

- The medical segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany thermometer market is segmented by application into medical, industrial, food, and laboratories. Among these, the medical segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising healthcare awareness, increased frequency of routine health checks, and the demand for accurate temperature monitoring in hospitals and homes. The COVID-19 pandemic further heightened the importance of temperature screening, boosting long-term adoption. Germany’s aging population and growing chronic disease burden also drive medical thermometer use. Technological advancements in digital and infrared thermometers enhance convenience and reliability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany thermometer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Geratherm Medical AG

- Testo SE & Co. KG

- Amarell GmbH & Co. KG

- Thermo Fisher Scientific GmbH

- AFRISO-EURO-INDEX GmbH

- Ahlborn MeB und Regelungstechnik GmbH

- PCE Deutschland Gmbh

- WIKA (Alexander Wiegand SE & Co. KG)

- Ashcroft Instruments GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany thermometer market based on the below-mentioned segments:

Germany Thermometer Market, By Product

- Mercury-based

- Mercury-free Thermometer

Germany Thermometer Market, By Application

- Medical

- Industrial

- Food

- Laboratories

Need help to buy this report?