Germany Student Accommodation Market Size, Share, and COVID-19 Impact Analysis, By Type (On-Campus, Purpose-Built Student Accommodation, and Private Rentals), By Rent Range (Economic, Mid-Range, and Luxury), and Germany Student Accommodation Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsGermany Student Accommodation Market Insights Forecasts to 2035

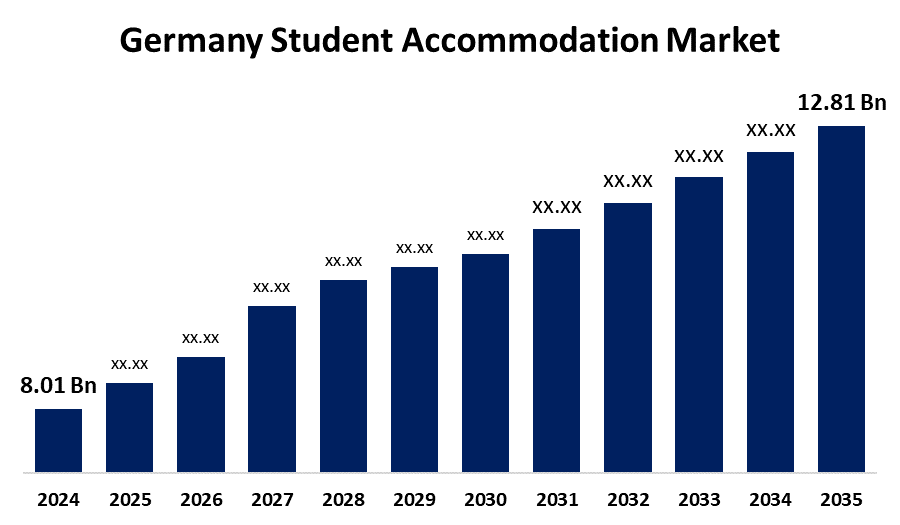

- The Germany Student Accommodation Market Size was estimated at USD 8.01 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.36% from 2025 to 2035

- The Germany Student Accommodation Market Size is Expected to Reach USD 12.81 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Student Accommodation Market Size is anticipated to reach USD 12.81 Billion by 2035, growing at a CAGR of 4.36% from 2025 to 2035. The Germany student accommodation market is driven by growing numbers of enrolled students as well as a growing number of international students. The need for high-quality student housing keeps growing as Germany continues to be a popular place to pursue higher education.

Market Overview

The Germany student accommodation market is a sector that offers a range of housing options created especially for college students, such as private market rentals, purpose-built student apartments, and subsidized public dorms. These accommodations, which range from basic subsidized options to premium facilities with enhanced amenities, are intended to be made available at various price points to accommodate a variety of student needs. Digital solutions, such as online booking platforms, virtual property tours, app-based community management, and smart building technologies, are being progressively integrated into the operations of student housing providers. In addition to meeting younger generations' technological expectations, these digital improvements are increasing operational efficiency. Furthermore, to improve student wellbeing and fight isolation, new student housing developments place a greater focus on communal areas, shared amenities, and support services. These community-focused designs are in line with studies that demonstrate the beneficial effects of social integration on mental health and academic achievement.

Report Coverage

This research report categorizes the market for Germany student accommodation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany student accommodation market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany student accommodation market.

Germany Student Accommodation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.01 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.36% |

| 2035 Value Projection: | USD 12.81 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type (On-Campus, Purpose-Built Student Accommodation, and Private Rentals), By Rent Range (Economic, Mid-Range, and Luxury) |

| Companies covered:: | Studentenwerk (Student Services Organizations), YOUNIQ, The Student Hotel, International Campus GmbH, Quarters, Nido Student, CAMPUS VIVA, Uninest Student Residences, BaseCamp Student, Deutsche Real Estate Funds (DREF), and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing student enrollment and an increasing number of international students are driving the market for student housing in Germany. The need for high-quality student housing keeps growing as Germany continues to be a popular place to pursue higher education. Furthermore, a combination of private rental options and purpose-built student housing (PBSA) defines the market. Purpose-built dorms and student apartments with integrated services, study spaces, and common areas are part of PBSA. These lodgings provide a higher degree of comfort and convenience, catering to the needs of students, and are frequently positioned in close proximity to universities.

Restraining Factors

The rising construction costs and high land prices, especially in desirable urban areas close to universities, are impeding the development of new student housing projects in Germany. Projects aimed at the mid-range student market are finding it difficult to remain financially viable due to rising development costs, which could restrict supply growth.

Market Segmentation

The Germany student accommodation market share is classified into type and rent range.

- The private rentals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany student accommodation market is segmented by type into on-campus, purpose-built student accommodation, and private rentals. Among these, the private rentals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the strong desire among students for flexible and reasonably priced housing options. Additionally, private rentals are preferred due to the scarcity of on-campus housing and growing student populations in major cities like Berlin, Munich, and Hamburg.

- The mid-range segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany student accommodation market is segmented by rent range into economic, mid-range, and luxury. Among these, the mid-range segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the harmony between quality amenities and affordability. Students favor mid-range housing options because they are more affordable than luxury lodgings and provide better living conditions than economic housing. Moreover, international students and young professionals are the main drivers of the high demand for mid-range rentals in major university cities like Berlin, Munich, and Frankfurt.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany student accommodation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Studentenwerk (Student Services Organizations)

- YOUNIQ

- The Student Hotel

- International Campus GmbH

- Quarters

- Nido Student

- CAMPUS VIVA

- Uninest Student Residences

- BaseCamp Student

- Deutsche Real Estate Funds (DREF)

- Others

Recent Developments:

- In December 2024, the Greykite European Real Estate Fund is set to acquire a vacant hotel as part of a €250 million strategy to develop purpose-built student accommodation (PBSA) in Germany, collaborating with the real estate manager and developer, Equilibria Group.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany student accommodation market based on the below-mentioned segments:

Germany Student Accommodation Market, By Type

- On-Campus

- Purpose-Built Student Accommodation

- Private Rentals

Germany Student Accommodation Market, By Rent Range

- Economics

- Mid-Range

- Luxury

Need help to buy this report?