Germany Smoothies Market Size, Share, and COVID-19 Impact Analysis, By Product (Fruit-based, Dairy-based), By Distribution Channel (Restaurants, Smoothie Bars, Supermarkets & Convenience Stores), and Germany Smoothies Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesGermany Smoothies Market Forecasts to 2035

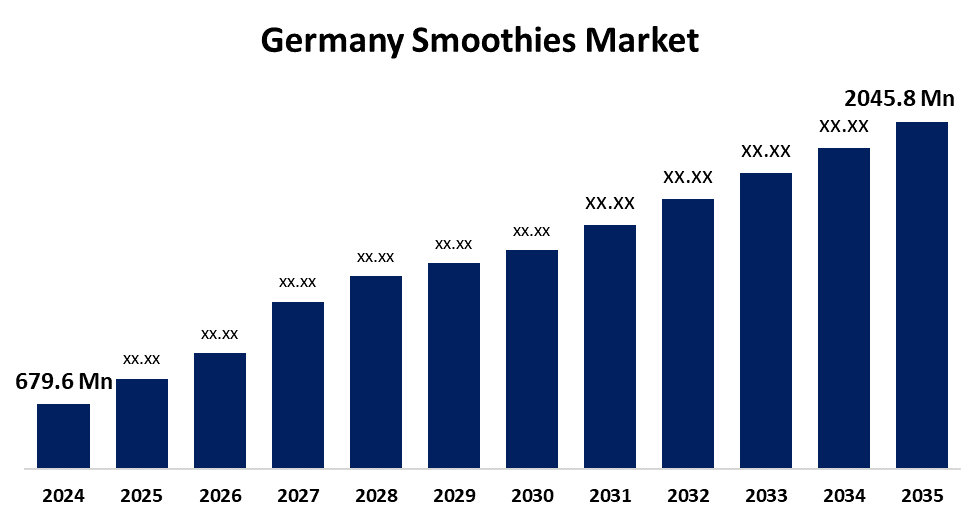

- The Germany Smoothies Market Size Was Estimated at USD 679.6 Million in 2024

- The Germany Smoothies Market Size is Expected to Grow at a CAGR of around 10.54% from 2025 to 2035

- The Germany Smoothies Market Size is Expected to Reach USD 2045.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Germany Smoothies Market Size is Anticipated to Reach USD 2045.8 Million by 2035, Growing at a CAGR of 10.54% from 2025 to 2035. The main factors driving the smoothie market share are the rising demand for organic and culinary herbal beverages, as well as the growing need for meal options that can be consumed on the move and their wide range of flavours.

Market Overview

The German smoothies market includes blended beverages produced from fruits, vegetables, dairy, and supplements, which provide a nutritious and simple choice. Smoothies are popular for their health advantages and versatility, appealing to consumers looking for flavourful, customisable drinks that meet various dietary needs and busy lifestyles. The demand for wholesome, quick food and beverage options, as well as growing consumer awareness of healthy eating, are driving the continuous rise of the smoothie market in Germany. Blends of fruits, vegetables, and vitamins are used to make smoothies, which provide a tasty and convenient method to receive vital nutrients. Due to their availability as pre-packaged goods in supermarkets, juice bars, and cafes, their appeal has grown. Rising health consciousness, flavour innovation, and customisation options that accommodate a range of palates and dietary requirements, from traditional fruit mixes to unusual combinations, are important market drivers. Increased wellness trends are an additional reason for consumers moving away from fast food and towards healthier fast options such as smoothies. Social platforms like Instagram and Pinterest provide colourful photos and healthy recipes that cater to health-conscious consumers and have enhanced smoothie awareness. Companies such as Innocent Smoothies, through interesting and wellness-oriented marketing, have leveraged this digital platform built around smoothies, created large online communities and achieved impressive sales.

Report Coverage

This research report categorizes the market for the Germany smoothies market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany smoothies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany smoothies market.

Germany Smoothies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 679.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.54% |

| 2035 Value Projection: | USD 2045.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | true fruits GmbH, granini, Voelkel GmbH, Rabenhorst, Alnatura Produktions, dmBio, REWE Group, Edeka Group, Innocent Drinks, Pfanner GmbH and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The German smoothie market is being driven by rising health consciousness, the desire for quick and healthy on-the-go solutions, and growing interest in plant-based diets. Product innovations include superfood, low-sugar, and customised blends that appeal to a variety of tastes. While social media and influencer marketing boost consumer engagement, smoothie bars and online delivery services enhance accessibility. Due to growing worries about processed food and a change in consumer attention towards cleaner, natural alternatives, smoothies are a popular choice for time-constrained and health-conscious German consumers.

Restraining Factors

There are a number of drawbacks affecting smoothie sales growth in the Germany. Some smoothies advertise themselves as "healthier" products, but include significant sugar, which puts off a number of customers. Many consumers find the premium prices too limiting, especially in a recession. Competition is being fueled by competing health drinks, label and health claims regulations, and often short shelf life periods which limit higher volume sales. These factors hamper the smoothies market during the forecast period.

Market Segmentation

The Germany smoothies market share is classified into product and distribution channel.

- The fruit-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany smoothies market is segmented by product into fruit-based, dairy-based. Among these, the fruit-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fruits have nutritional value, such as vitamins, minerals, and antioxidants. Thus, most people associate fruit smoothies with wellness and health. And fruit, being naturally sweet and hydrating, especially melons and berries, is a refreshing addition to smoothies.

- The smoothie bars segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany smoothies market is segmented by distribution channel into restaurants, smoothie bars, supermarkets & convenience stores. Among these, the smoothie bars segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Customers can choose particular fruits, veggies, bases, and add-ins to personalise their drinks at smoothie bars. Additionally, a broad variety of flavours and ingredient combinations are available on the menu at smoothie bars. Furthermore, because of the strong demand for smoothies, a lot of businesses in the smoothie industry are growing by opening bars. Consequently, during the projected period, smoothie bars will remain the market's primary sales channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany smoothies market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- true fruits GmbH

- granini

- Voelkel GmbH

- Rabenhorst

- Alnatura Produktions

- dmBio

- REWE Group

- Edeka Group

- Innocent Drinks

- Pfanner GmbH

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany smoothies market based on the below-mentioned segments:

Germany Smoothies Market, By Product

- Fruit-based

- Dairy-based

Germany Smoothies Market, By Distribution Channel

- Restaurants

- Smoothie Bars

- Supermarkets & Convenience Stores

Need help to buy this report?