Germany Seed Treatment Market Size, Share, and COVID-19 Impact Analysis, By Type (Fungicides and Biofungicides), By Application Technique (Seed Coating and Seed Dressing), and Germany Seed Treatment Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureGermany Seed Treatment Market Insights Forecasts to 2035

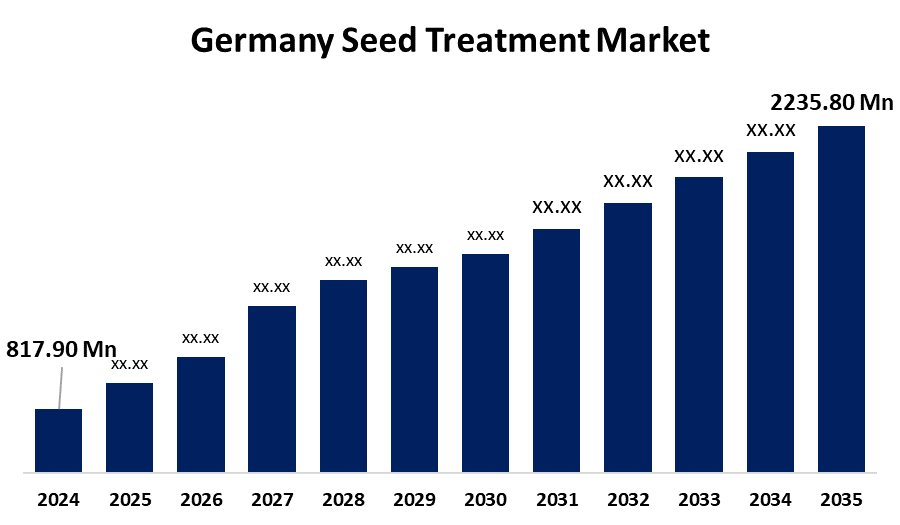

- The Germany Seed Treatment Market Size was estimated at USD 817.90 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.57% from 2025 to 2035

- The Germany Seed Treatment Market Size is Expected to Reach USD 2235.80 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Seed Treatment Market Size is anticipatefd to reach USD 2235.80 Million by 2035, growing at a CAGR of 9.57% from 2025 to 2035. The market is driven by population expansion and growing domestic and global crop demand. Seed treatment in cereals and grains is driven mainly by expanding feed needs, population expansion, and industrial uses such as animal feed, starch, and ethanol production.

Market Overview

The Germany seed treatment market refers to the industry that the application of biological, chemical, or physical treatments to seeds before planting to safeguard them against pests, diseases, and stress from the environment. Coating, pelleting, and priming are some of the methods utilized to enhance germination, vigor, and crop yield. The increasing focus on eco-friendly agriculture and the trend toward biological seed treatment are fueling growth in the German seed treatment market. Furthermore, with the European Union imposing stricter regulations on synthetic pesticides, German farmers and agribusiness companies are gravitating more toward biological and sustainable solutions to seed protection. The German Federal Ministry of Food and Agriculture reports that the application of biological seed treatment has risen by 28% from 2020 to 2023. This follows a policy of reducing chemical inputs and increasing biodiversity in agriculture in Germany.

Report Coverage

This research report categorizes the market for the Germany seed treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany seed treatment market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany seed treatment market.

Germany Seed Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 817.90 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.57% |

| 2035 Value Projection: | USD 2235.80 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Fungicides and Biofungicides), By Application Technique (Seed Coating and Seed Dressing) |

| Companies covered:: | Bayer CropScience AG, Syngenta AG, BASF SE, Corteva Agriscience, Nufarm GmbH & Co KG, Certis Belchim, Incotec, Valent BioSciences, Chemtura AgroSolutions, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for Germany seed treatment is primarily driven by population increase and growing domestic and foreign demand for crops. Demand for seed treatment of cereals and grains is largely affected by rising feed needs, population increase, and industrial uses such as animal feed, starch, and ethanol. Furthermore, a rising feed demand, population growth, and industrial applications in animal feed, starch, and ethanol. The increasing use of seed treatment practices by farmers to avoid seed and seedling disease-related yield losses has driven the growth of this segment.

Restraining Factors

Their use becomes subject to further limitation by the environmental factor. Seeds and seedlings are greatly susceptible to foliar and soil-borne pests with minimal reserves of food that can endure damage and survive stresses. Additionally, environmental factors such as intense rain, crusting of soils, deep burial of seeds, and poor aeration of soil often diminish soil and foliar applications' performance.

Market Segmentation

The German seed treatment market share is classified into type and application technique.

- The fungicides segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany seed treatment market is segmented by type into fungicides and biofungicides. Among these, the fungicides segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by wetter weather conditions, and monoculture farming methods have heightened the need for preventive seed treatments. Furthermore, German farmers are now increasingly adopting fungicide coatings as part of integrated pest management strategies to minimize yield loss and provide robust crop establishment.

- The seed coating segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

The Germany seed treatment market is segmented by application technique into seed coating and seed dressing. Among these, the seed coating segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the focus turns toward effective crop establishment and sustainable agriculture. Moreover, with tight controls on the environment and a sharp emphasis on organics and sustainability, seed coatings offer an approach to delivering active ingredients exactly where they're necessary on the seed without contaminating the soil and water systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany seed treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer CropScience AG

- Syngenta AG

- BASF SE

- Corteva Agriscience

- Nufarm GmbH & Co KG

- Certis Belchim

- Incotec

- Valent BioSciences

- Chemtura AgroSolutions

- Others

Recent Developments:

- In October 2023, Syngenta sharpened its biologicals focus with the launch of its first biologicals service center for seed treatment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany seed treatment market based on the below-mentioned segments:

Germany Seed Treatment Market, By Type

- Fungicides

- Biofungicides

Germany Seed Treatment Market, By Application Technique

- Seed Coating

- Seed Dressing

Need help to buy this report?