Germany Rubber Molding Market Size, Share, and COVID-19 Impact Analysis, By Type (Compression Molding, Transfer Molding, and Injection Molding), By Material (Ethylene Propylene Diene Terpolymer, Natural Rubber, and Styrene Butadiene Rubber), By End-use (Automotive, Consumer Goods, Healthcare, Electrical & Electronics, Construction, and Others), and Germany Rubber Molding Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsGermany Rubber Molding Market Insights Forecasts to 2035

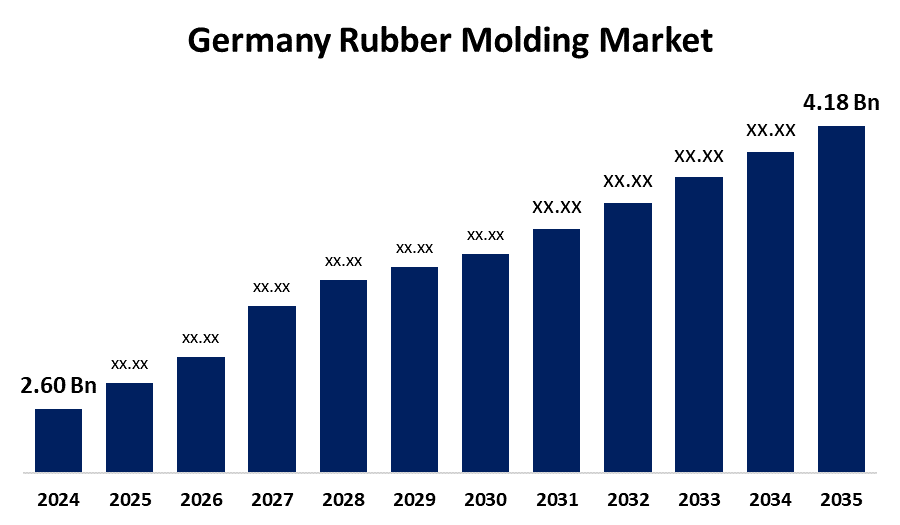

- The Germany Rubber Molding Market Size Was Estimated at USD 2.60 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.41% from 2025 to 2035

- The Germany Rubber Molding Market Size is Expected to Reach USD 4.18 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Germany Rubber Molding Market Size is anticipated to Reach USD 4.18 Billion by 2035, Growing at a CAGR of 4.41% from 2025 to 2035. Technological developments and rising demands from a variety of industrial sectors are driving notable trends in the Germany rubber molding market. The growing emphasis on lightweight materials in automotive manufacturing is one of the major market drivers, which is crucial considering Germany's thriving automotive sector.

Market Overview

The rubber molding market encompasses the sector that uses several different molding techniques to produce finished products from raw rubber materials. This includes processes that involve heating and compressing uncured rubber to cure and form to a mold cavity, including compression molding, injection molding, and transfer molding. Rubber molding allows for the manufacture of high-quality, custom rubber parts that meet specific needs and applications, increasing functionality and performance. Compared to other processes, rubber molding specifically injection molding can be more cost effective, particularly for high-volume production runs, while reducing waste. Automotive components, such as gaskets, bumpers, and seals, are a growing case of demand of molded rubber parts, especially in developing countries. The rubber molding industry includes innovative rubber molding practices that can increase manufacturing efficiency, reduce costs, and improve cycle times, such as injection

Report Coverage

This research report categorizes the market for Germany rubber molding market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany rubber molding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each Germany rubber molding market sub-segment.

Germany Rubber Molding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.60 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.41% |

| 2035 Value Projection: | USD 4.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 164 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Material and COVID-19 Impact Analysis |

| Companies covered:: | Rhm, Eisenhuth GmbH & Co KG, Veritas AG, Arburg GmbH + Co KG, Phoenix AG, Technoform GmbH, MaTec Gummiwerk GmbH, Biesterfeld Performance Rubber, Otto Werkzeugbau GmbH, Gummi Vogt GmbH & Co. KG, Continental AG, Freudenberg Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The use of rubber-molded parts, including tires, hoses, seals, and other parts, is common in the automotive industry. Demand for rubber-molded parts is being driven by increased demand for lighter and more fuel-efficient vehicles and the growth of global vehicle production. Rubber molding applications in construction are numerous and include floors, insulation, and roofing materials. Increased urbanization and infrastructure development in developing countries drive the demand for rubber products in the commercial construction industry.

Restraining Factors

The raw materials are rubber compounds, which have the potential to experience significant price fluctuations that can alter the producer's collected margin and production costs. Environmental standards and regulations can restrict market growth and increase compliance costs. The consistent enhancements and specialized work caused by technical advancements can create challenges for manufacturers in keeping pace.

Market Segmentation

The Germany rubber molding market share is classified into type, material, and end-use.

- The compression molding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany rubber molding market is segmented by type into compression molding, transfer molding, and injection molding. Among these, the compression molding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the rubber molding industry, compression molding is seeing a comeback because of its adaptability, affordability, and ability to work with intricate geometries. Rubber materials are shaped into desired shapes using this process, which gives producers more design freedom and production efficiency.

- The ethylene propylene diene terpolymer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany rubber molding market is segmented by material into ethylene propylene diene terpolymer, natural rubber, and styrene butadiene rubber. Among these, the ethylene propylene diene terpolymer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its superior electrical insulation, thermal stability, and weather resistance, ethylene propylene diene terpolymer, or EPDM, is becoming more and more popular in the rubber molding sector. With its adaptability, EPDM is a popular option for a range of applications, such as electrical insulation, roofing membranes, and automobile seals, as industries place a higher priority on long-lasting and robust rubber components.

- The automotive segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany rubber molding market is segmented by end-user into automotive, consumer goods, healthcare, electrical & electronics, construction, and others. Among these, the automotive segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market for lightweight, high-performance components is expanding in the automotive industry due to rising vehicle production. Rubber molding is increasingly being used by automakers for gaskets, seals, and vibration dampers to improve the comfort and efficiency of their vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany rubber molding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rhm

- Eisenhuth GmbH & Co KG

- Veritas AG

- Arburg GmbH + Co KG

- Phoenix AG

- Technoform GmbH

- MaTec Gummiwerk GmbH

- Biesterfeld Performance Rubber

- Otto Werkzeugbau GmbH

- Gummi Vogt GmbH & Co. KG

- Continental AG

- Freudenberg Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany rubber molding market based on the below-mentioned segments:

Germany Rubber Molding Market, By Type

- Compression Molding

- Transfer Molding

- Injection Molding

Germany Rubber Molding Market, By Material

- Ethylene Propylene Diene Terpolymer

- Natural Rubber

- Styrene Butadiene Rubber

Germany Rubber Molding Market, By End-use

- Automotive

- Consumer Goods

- Healthcare

- Electrical & Electronics

- Construction

- Others

Need help to buy this report?