Germany Residential Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Type (villas & Landed Houses, Condominiums, Apartments) and By Pricing (Affordable, Mid-Range, Luxury), and Germany Residential Real Estate Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialGermany Residential Real Estate Market Insights Forecasts to 2033

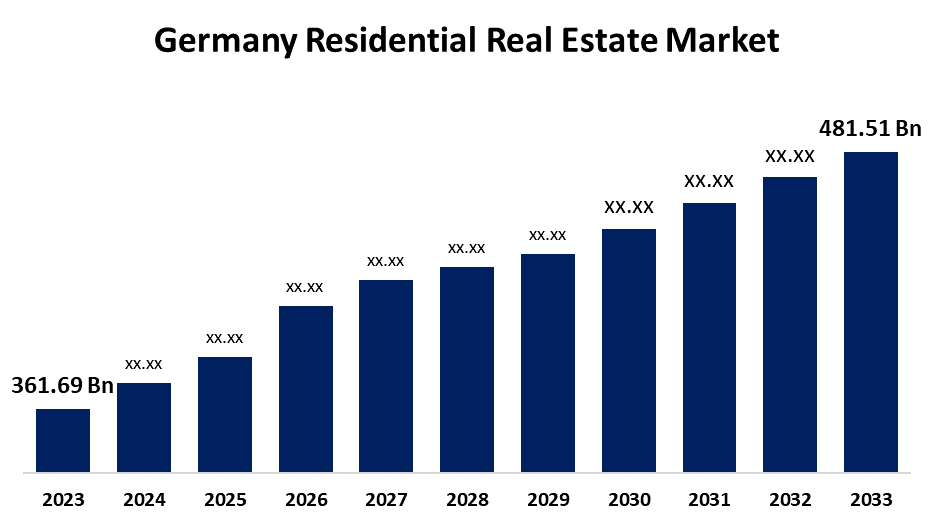

- The Germany Residential Real Estate Market Size was valued at USD 361.69 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.90% from 2023 to 2033

- The Germany Residential Real Estate Market Size is Expected to reach USD 481.51 Billion by 2033

Get more details on this report -

The Germany Residential Real Estate Market is anticipated to exceed USD 481.51 Billion by 2033, Growing at a CAGR of 2.90% from 2023 to 2033. Germany's migratory problem and economic growth drive high demand for urban properties, with demographic influences and the sharing economy driving growth. Regulations and policies that influence property values are driving the growth of the residential real estate market in Germany.

Market Overview

The significant downturn, with prices falling sharply in recent of residential real estate market. Factors contributing to this decline include higher financing costs, rising inflation, and a shift in demand towards the rental market due to increased interest rates. It includes land and any permanent buildings attached to it, whether natural or manmade. Real estate distinguishes itself from personal property by being permanently attached to the land. The market is a critical generator of economic growth, and housing starts serve as a key economic indicator. Real estate market analysis evaluates current property values by considering factors like location, size, construction time, amenities, and original price. Real estate, which includes land and permanent structures, is a significant component of economic growth, with housing starts serving as a vital indication that distinguishes it from personal property. Customer preferences in the market have shifted toward more environmentally friendly and energy-efficient houses. This trend is driven by increased environmental awareness and a desire to save money on utilities. Homebuyers and renters are increasingly opting for residences that include energy-efficient amenities like solar panels, insulation, and smart home technologies. The rise in real estate investment companies and funds in Germany, coupled with local special circumstances, has significantly impacted the residential real estate market.

Report Coverage

This research report categorizes the market for the Germany residential real estate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the residential real estate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the residential real estate market.

Germany Residential Real Estate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 361.69 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.90% |

| 2033 Value Projection: | USD 481.51 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Pricing |

| Companies covered:: | SAGA Siedlungs-Aktiengesellschaft Hamburg, Consus Real Estate, Vonovia SE, LEG Immobilien SE, Deutsche Wohnen SE, and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The migratory problem and robust economic growth have exacerbated the already high demand in the country. Thus, expected structural changes, such as demographic influences, are viewed as significant factors. The sharing economy and the rise of freelancers and remote workers are driving up demand for urban properties close to services such as stores, restaurants, and public transportation, leading to an increase in co-living and co-working spaces. Germany is experiencing growth and development due to evolving customer preferences, co-living trends, housing shortages, and macroeconomic factors like a strong economy and low-interest rates. Regulations, policies, incentives, and subsidies significantly influence property values and investment opportunities in the real estate market, with access to funds being a critical concern. Hence, these factors are significant growth of the Germany residential real estate market during the forecast period.

Restraining Factors

Germany's rising house prices are attributed to low-interest rates, increasing demand, lack of investment opportunities, and a strong economy. Construction costs have also increased, with rising prices for building materials and labor shortages in the construction industry. Hence, these factors may hamper the market growth of the Germany residential real estate market during the forecast period.

Market Segmentation

The Germany residential real estate market share is classified into type and pricing.

- The apartments segment is expected to hold a significant share of the Germany residential real estate market during the forecast period.

The Germany residential real estate market is segmented by type into villas & landed houses, condominiums, and apartments. Among these, the apartments segment is expected to hold a significant share of the Germany residential real estate market during the forecast period. The segmental growth can be attributed to the rental and ownership sectors, serving a diverse clientele that includes families, retirees, and young professionals. Accommodate high population densities without offering housing availability for a large number of occupants.

- The mid-range segment is expected to hold the largest share of the Germany residential real estate market during the forecast period.

Based on the pricing, the Germany residential real estate market is divided into affordable, mid-range, and luxury. Among these, the mid-range segment is expected to hold the largest share of the Germany residential real estate market during the forecast period. The segmental growth can be attributed to the meeting the requirements of the majority of renters and homebuyers. This demand, along with the defensive character of residential real estate investments, makes the mid-range market attractive to investors looking for regular returns and long-term growth opportunities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany residential real estate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SAGA Siedlungs-Aktiengesellschaft Hamburg

- Consus Real Estate

- Vonovia SE

- LEG Immobilien SE

- Deutsche Wohnen SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Vonovia, a German real estate corporation, is investing in gropyus, an Austrian developer of ecological dwellings. The EUR 100 million (USD 106.79 million) series B investment from Vonovia, which includes 1.5 million German nationals, will go toward developing Gropyus' prefab manufacturing factory in Richen, Austria. FAM AB, a stakeholder in Gropyus already, is also investing.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany residential real estate market based on the below-mentioned segments

Germany Residential Real Estate Market, By Type

- Villas & Landed Houses

- Condominiums

- Apartments

Germany Residential Real Estate Market, By Pricing

- Affordable

- Mid-Range

- Luxury

Need help to buy this report?