Germany Reinsurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Facultative Reinsurance and Treaty Reinsurance), By Application (Property & Casualty Reinsurance, Life & Health Reinsurance), and Germany Reinsurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialGermany Reinsurance Market Insights Forecasts to 2035

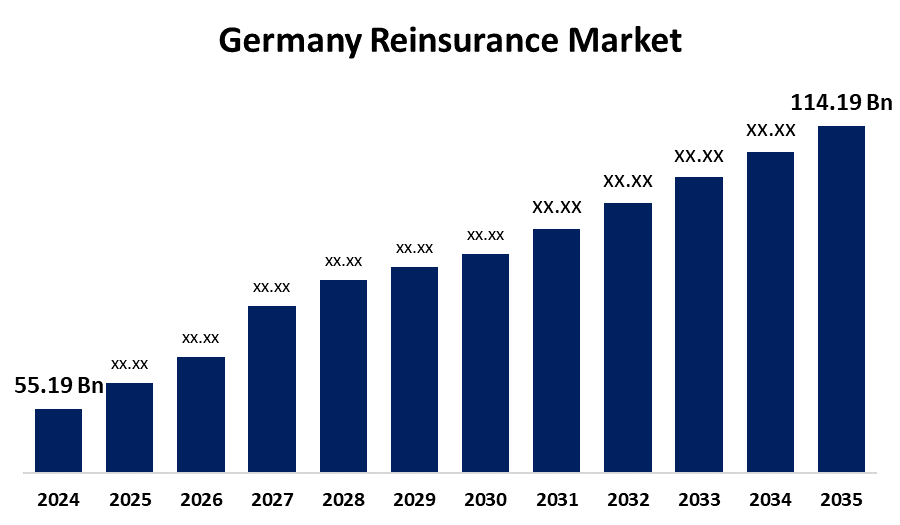

- The Germany Reinsurance Market Size was estimated at USD 55.19 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.83% from 2025 to 2035

- The Germany Reinsurance Market Size is Expected to Reach USD 114.19 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Germany reinsurance market Size is anticipated to reach USD 114.19 Billion by 2035, growing at a CAGR of 6.83% from 2025 to 2035. The Germany reinsurance market is driven by rising natural catastrophes, increasing insurance penetration, compulsory regulations, and new risks such as cyberattacks. It assists insurers in their ability to service large claims, maximize capital, and stay financially stable in the face of mounting global uncertainties.

Market Overview

The Germany reinsurance market is the sector that the international industry where insurance firms cede a percentage of their risk portfolios to other insurance firms, referred to as reinsurers, to minimize the chances of paying huge obligations arising from claims. This serves to enable insurers to manage risks, stay financially healthy, and increase underwriting capacity. Insurance securitisations are becoming very popular and are pushing out reinsurance from the market. The increasing market penetration of these instruments is putting downward pressure on premiums. Furthermore, property and casualty reinsurance generate the bulk of industry sales. This has recently exhibited rising demand as a result of increased losses from natural catastrophes, accompanied by respective premium hikes. Moreover, a rise in natural disasters and the pandemic, and still experiencing increasing demand, as natural disasters tend to translate into higher interest in insurance cover.

Report Coverage

This research report categorizes the market for Germany reinsurance market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany reinsurance market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany reinsurance market.

Germany Reinsurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 55.19 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.83% |

| 2035 Value Projection: | USD 114.19 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 273 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type and By Application |

| Companies covered:: | Munich RE, AXA SA, RGA Insurance Company, General Re Corporation, Lloyd’s, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The economic and social dislocation as such of the pandemic heightened, which resulted in insurance claims rising, and businesses have approached solutions to their customer services in a digital manner. This is attributed to an aspect that will give rise to the requirement for reinsurance in the industry. Furthermore, Germany has observed a continued rise in insurance claims in many industries, including health insurance, motor insurance, property and casualty insurance, and others. This consistent rise in insurance claims will have a direct effect on the reinsurance market.

Restraining Factors

The increasing natural disaster claims costs, there is pressure from the industry to cut reinsurance premiums. Moreover, highly prescriptive regulatory systems such as Solvency II lead to high capital and compliance demands, curtailing operational room for maneuver and amplifying admin burdens.

Market Segmentation

The Germany reinsurance market share is classified into type and application.

- The treaty reinsurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany reinsurance market is segmented by type into facultative reinsurance and treaty reinsurance. Among these, the treaty reinsurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by its cost-effectiveness, foreseeability, and capacity to insure a huge portfolio of risks under a single treaty. Furthermore, minimizes administrative effort, offers stable risk transfer, and fosters long-term cooperation between insurers and reinsurers and therefore emerges as the mode of choice for German insurance firms operating diversified risk books.

- The property & casualty reinsurance segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany reinsurance market is segmented by application into property & casualty reinsurance, life & health reinsurance. Among these, the property & casualty reinsurance segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the natural catastrophe exposure, industrial hazard exposure, and high-cost infrastructure exposure. Moreover, rising claims for floods, storms, and man-made disasters push the demand for strong reinsurance. The high industrial base and urban density of Germany demand extensive coverage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany reinsurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Munich RE

- AXA SA

- RGA Insurance Company

- General Re Corporation

- Lloyd’s

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany reinsurance market based on the below-mentioned segments:

Germany Reinsurance Market, By Type

- Facultative Reinsurance

- Treaty Reinsurance

Germany Reinsurance Market, By Application

- Property & Casualty Reinsurance

- Life & Health Reinsurance

Need help to buy this report?