Germany Ready Meals Market Size, Share, and COVID-19 Impact Analysis, By Product (Frozen, Chilled, and Canned), By Meal Type (Vegetarian and Non-vegetarian), and Germany Ready Meals Market Industry Trend, Forecasts to 2035

Industry: Consumer GoodsGermany Ready Meals Market Insights Forecasts to 2035

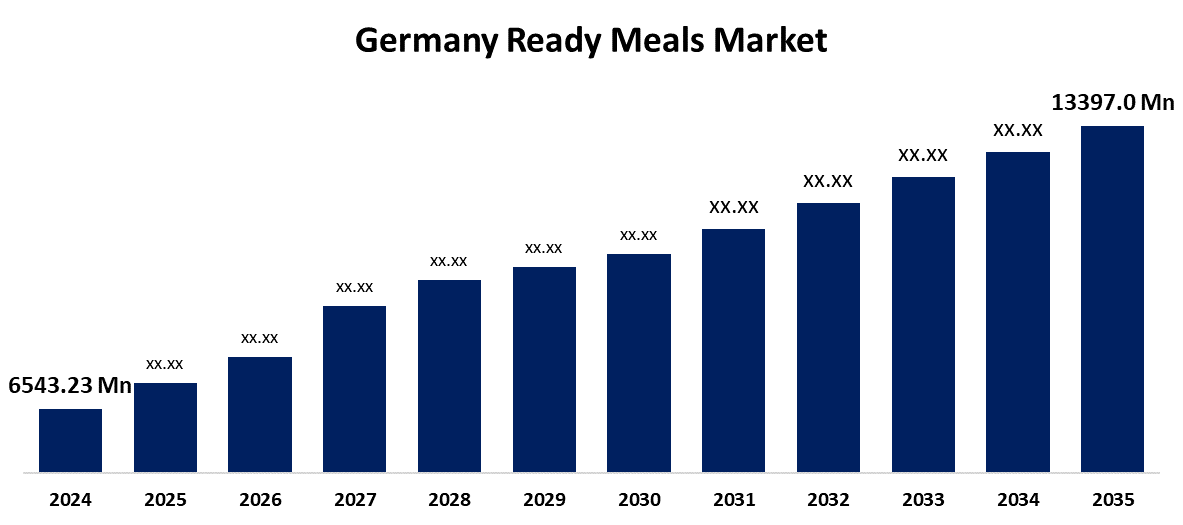

- The Germany Ready Meals Market Size Was Estimated at USD 6543.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR od around 6.73% from 2025 to 2035

- The Germany Ready Meals Market Size is Expected to Reach at USD 13397.0 Million in 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Germany Ready Meals Market Size is Expected to Grow USD 13397.0 Million by 2035, Growing at a CAGR of 6.73% from 2025-2035. Ready meals are cost-effective alternative dishes that take less time to prepare as they are precooked and are available throughout the year.

Market Overview

The Ready Meals Market Size includes pre-cooked, packaged food products that require minimal preparation, offering consumers convenience, time savings, and ease of consumption. These meals cater to the fast-paced lifestyle of urban populations and are available in frozen, chilled, or shelf-stable forms. The reduced cooking time, portion control, and extended shelf life. The rising demand for healthy, organic, and plant-based ready meals, along with technological advancements in food packaging and preservation. E-commerce growth also boosts accessibility. Government initiatives supporting food safety regulations, nutritional labeling, and investments in food processing infrastructure further drive market expansion. Additionally, subsidies and incentives for startups and MSMEs in the food sector promote innovation and domestic production of ready meals.

Report Coverage

This research report categorizes the market for Germany ready meals market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany ready meals market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany ready meals market.

Germany Ready Meals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6543.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.73% |

| 2035 Value Projection: | USD 13397.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Meal Type |

| Companies covered:: | Tricura GmbH & Co. KG (flocculants), Sachtleben Chemie GmbH, SNF Flogger (SNF Germany operations), Chemische Werke Klute GmbH, Envirocheie GmbH, PRO-ENTEC GmbH (listed as coagulants/flocculants supplier), Separ Chemie GmbH, H20rtner GmbH, Envirocheie (part of EnviroWater Group) as flocculants supplier, Kurita (Germany distribution through Kurita Kurifloc), Reiflock Abwassertechnik GmbH, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing urbanization, hectic lifestyles, and the growing demand for convenient food options. Rising disposable incomes and changing dietary habits encourage consumers to opt for quick, easy-to-prepare meals. Technological advancements in food processing and packaging enhance product shelf life and quality. Additionally, the expansion of online food retail and rising awareness of health-focused ready meals, including organic and plant-based options, contribute to market growth. Busy professionals and nuclear families are key consumer segments driving demand.

Restraining Factors

The health concerns over high levels of preservatives, sodium, and artificial ingredients commonly found in processed foods. Growing consumer awareness about fresh and home-cooked meals limits demand. Additionally, cultural preferences for traditional cooking in some regions act as barriers. Supply chain challenges, especially for frozen or perishable ready meals, can also affect market reach. High competition and price sensitivity further pressure profit margins, especially for premium or health-oriented ready meal brands.

Market Segmentation

The Germany ready meals market share is classified into product and meal type.

- The frozen segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany ready meals market is segmented by product into frozen, chilled, and canned. Among these, the frozen segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its longer shelf life, better preservation of taste and nutrients, and convenience in storage and preparation. German consumers increasingly prefer frozen options for their reliability and variety, especially amid busy lifestyles. Technological advancements in freezing techniques and packaging have improved product quality. Additionally, the rise in single-person households and demand for quick meal solutions further support growth.

- The vegetarian segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany ready meals market is segmented by meal type into vegetarian and non-vegetarian. Among these, the vegetarian segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising health consciousness, ethical concerns, and the growing popularity of plant-based diets. Consumers are increasingly shifting towards vegetarian options for sustainability and animal welfare reasons. Government support for plant-based food innovation and increased availability of high-quality vegetarian meals in retail channels also fuel demand. Additionally, the influence of vegan and flexitarian lifestyles, especially among younger demographics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany ready meals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tricura GmbH & Co. KG (flocculants)

- Sachtleben Chemie GmbH

- SNF Flogger (SNF Germany operations)

- Chemische Werke Klute GmbH

- Envirocheie GmbH

- PRO-ENTEC GmbH (listed as coagulants/flocculants supplier)

- Separ Chemie GmbH

- H20rtner GmbH

- Envirocheie (part of EnviroWater Group) as flocculants supplier

- Kurita (Germany distribution through Kurita Kurifloc)

- Reiflock Abwassertechnik GmbH

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany ready meals market based on the below-mentioned segments:

Germany Ready Meals Market, By Product

- Frozen

- Chilled

- Canned

Germany Ready Meals Market, By Meal Type

- Vegetarian

- Non-vegetarian

Need help to buy this report?