Germany Rail Freight Transport Market Size, Share, and COVID-19 Impact Analysis, By Cargo Type (Containerized and Non-Containerized), By Service (Transportation and Services Allied to Transportation), and Germany Rail Freight Transport Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationGermany Rail Freight Transport Market Insights Forecasts to 2035

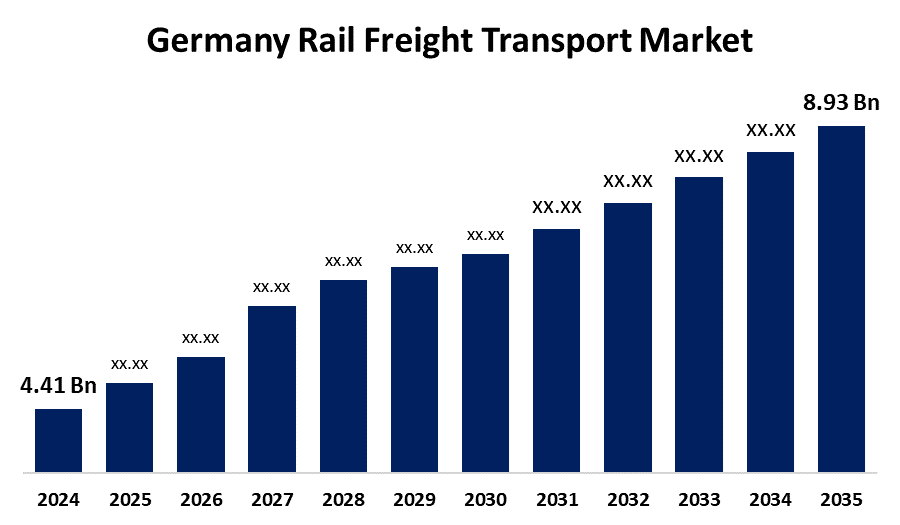

- The Germany Rail Freight Transport Market Size was Estimated at USD 4.41 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.62% from 2025 to 2035

- The Germany Rail Freight Transport Market Size is Expected to Reach USD 8.93 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Rail Freight Transport Market Size is anticipated to reach USD 8.93 Billion by 2035, Growing at a CAGR of 6.62% from 2025 to 2035. The Germany rail freight transport market is driven by growing demand for effective and economical transportation options, growing trade volumes, and government policies encouraging environmentally friendly transportation.

Market Overview

The Germany rail freight transport market is the sector segment responsible for the transport of goods by railway. This market involves revenues by entities that operate rail freight service, which involves the movement of bulk materials coal, building materials, and agricultural products, from loading points to delivery points by rail. Germany's robust manufacturing industry has a direct impact on rail freight demand. The growth of the demand for raw material transportation and the movement of finished goods through rail networks. Furthermore, the drive toward carbon neutrality and emission cuts urges rail companies to adopt energy-saving locomotives and use renewable energy. EU initiatives and government incentives toward green logistics are driving the shift toward eco-friendly rail freight transport. Additionally, Germany is investing in intermodal terminals and digital freight platforms to enhance cargo handling, decrease transit times, and minimize the use of road transportation for long-distance freight movement.

Report Coverage

This research report categorizes the market for Germany rail freight transport market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany rail freight transport market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany rail freight transport market.

Germany Rail Freight Transport Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.41 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.62% |

| 2035 Value Projection: | USD 8.93 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Cargo Type, By Service, and COVID-19 Impact Analysis |

| Companies covered:: | Deutsche Bahn Cargo, RheinCargo, Havelländische Eisenbahn (HVLE), LTE Germany, Captrain Deutschland, TX Logistik, Rail Cargo Group Germany, Eisenbahngesellschaft Ostfriesland-Oldenburg, MEG (Mitteldeutsche Eisenbahn Gesellschaft), and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The German rail freight transport market is boosted by robust industrial production, especially in the automotive, machinery, and chemical industries, which need to benefit from efficient long-distance cargo options. Sustainability concerns related to the environment are also spurring a modal shift towards rail, since rail freight has much lower emissions. Furthermore, government investment through the Federal Transport Infrastructure Plan is upgrading rail infrastructure and enhancing operational effectiveness. Moreover, the expansion of combined transport modes, combining rail with road and inland waterways, improves logistics flexibility. Germany's position in the middle of Europe also further enhances the country's status as a primary transit point, which boosts demand for secure and sustainable rail freight services across borders.

Restraining Factors

Germany's rail freight transportation suffers from outdated infrastructure, network congestion, and low capacity on key routes. Delays are created by inadequate rail connections in some areas and old signaling systems that elevate transit times and undermine efficiency. Additionally, the German rail freight industry faces competition from well-established road and inland waterway transportation.

Market Segmentation

The Germany rail freight transport market share is classified into cargo type and service.

- The containerized segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany rail freight transport market is segmented by cargo type into containerized and non-containerized. Among these, the containerized segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the expanding demand for intermodal shipping, cross-border commerce, and value-added supply chain solutions. Furthermore, the expanding role of e-commerce, just-in-time production, and global logistics has heightened demand for standard containerized freight transport.

- The transportation segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany rail freight transport market is segmented by service into transportation, services allied to transportation. Among these, the transportation segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to high volumes of freight in industrial centers and key trade corridors. Moreover, growing cross-border commerce, demand for environmentally sustainable goods transportation, and government investments in rail infrastructure all fuel the segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany rail freight transport market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deutsche Bahn Cargo

- RheinCargo

- Havelländische Eisenbahn (HVLE)

- LTE Germany

- Captrain Deutschland

- TX Logistik

- Rail Cargo Group Germany

- Eisenbahngesellschaft Ostfriesland-Oldenburg

- MEG (Mitteldeutsche Eisenbahn Gesellschaft)

- Others

Recent Developments:

- In May 2025, Netinera announced a competitive tender for 50 high-speed trains as it took steps to enter the intercity market in Germany and rival Deutsche Bahn's long-standing monopoly.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany rail freight transport market based on the below-mentioned segments:

Germany Rail Freight Transport Market, By Cargo Type

- Containerized

- Non-Containerized

Germany Rail Freight Transport Market, By Service

- Transportation

- Services Allied to Transportation

Need help to buy this report?