Germany Property & Casualty Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type of Insurance (Property Insurance, Casualty Insurance, Motor Insurance, and Liability Insurance), By Distribution Channel (Direct Sales, Brokers, Agents, and Online Platforms), and Germany Property & Casualty Insurance Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialGermany Property & Casualty Insurance Market Insights Forecasts to 2035

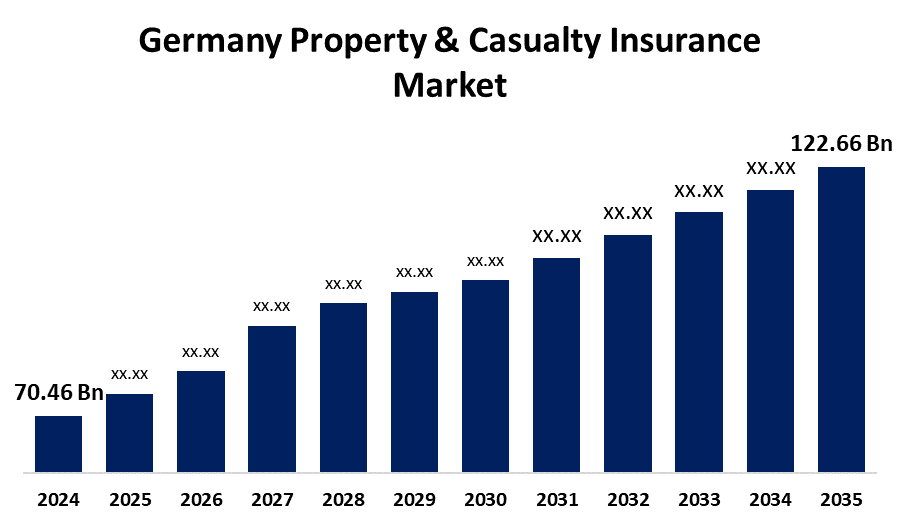

- The Germany Property & Casualty Insurance Market Size was estimated at USD 70.46 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.17% from 2025 to 2035

- The Germany Property & Casualty Insurance Market Size is Expected to Reach USD 122.66 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Property And Casualty Insurance Market Size is anticipated to reach USD 122.66 Billion by 2035, growing at a CAGR of 5.17% from 2025 to 2035. The Germany property & casualty insurance market is driven by rising risk awareness and the need for financial security. There is a need for property and casualty insurance since legal and regulatory requirements require insurance coverage for specific assets and activities.

Market Overview

The Germany property & casualty insurance market offers types of coverage that help protect your stuff and your finances against the risk of damage from something like a car accident or a natural disaster, and liability from injuries or damage to other people or their property. The digitization of Germany’s property and casualty insurance segment is moving ahead, with more insurers providing online sites and mobile applications to facilitate access to policies as well as claims. This trend is enhancing customer experiences, lowering costs of operations, and allowing for the application of insurance to a bigger and more tech-savvy audience. Furthermore, as concerns about the environment rise, many German insurance companies are adding green and sustainable insurance products. There is a demand for these products, as both consumers and businesses look to cut their environmental impact, and it is pushing insurers to create more planet-friendly products.

Report Coverage

This research report categorizes the market for Germany property & casualty insurance market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany property & casualty insurance market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany property & casualty insurance market.

Germany Property And Casualty Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 70.46 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.17% |

| 2035 Value Projection: | USD 122.66 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type of Insurance (Property Insurance, Casualty Insurance, Motor Insurance, and Liability Insurance), By Distribution Channel (Direct Sales, Brokers, Agents, and Online Platforms) |

| Companies covered:: | Allianz SE, Munich Re, AXA Germany, ERGO Group AG, Zurich Insurance Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising number of cars on the German roads is one of the main factors stimulating growth in the property and casualty insurance market, especially in auto insurance. Rising concerns about safety and protection against accidents, and the legal mandates, are some other driving factors behind comprehensive auto insurance plans. Moreover, rising property values and increased home ownership in Germany are also driving growth in property insurance. This growth in the value of property leads to greater demand for property insurance to protect these assets from damage or loss, which supports market growth. Furthermore, the robust regulatory environment and mandatory insurance laws in Germany are major drivers of the market expansion for property and liability insurance.

Restraining Factors

The profitability of German property and liability insurance companies has been hampered by the extended period of low interest rates in Europe. The high claims inflation, especially in auto insurance, is a problem for the P&C industry. Higher claim payouts have put pressure on insurers' profitability due to factors like rising labor, auto parts, and repair costs.

Market Segmentation

The Germany property & casualty insurance market share is classified into type of insurance and distribution channels.

- The property insurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany property & casualty insurance market is segmented by type of insurance into property insurance, casualty insurance, motor insurance, and liability insurance. Among these, the property insurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the high culture of asset protection, rising property values, and frequent natural disasters. Furthermore, technological advancements like smart home appliances have enhanced risk management, increased the accessibility and appeal of property insurance, and solidified their dominant position in the German insurance market.

- The direct sales segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany property & casualty insurance market is segmented by distribution channels into direct sales, brokers, agents, and online platforms. Among these, the direct sales segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to personal lines, such as auto and home insurance. Moreover, to provide clients with a smooth purchasing experience, insurers are increasingly using direct sales through their digital platforms (websites, mobile apps, etc.).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany property & casualty insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz SE

- Munich Re

- AXA Germany

- ERGO Group AG

- Zurich Insurance Group

- Others

Recent Developments:

- In July 2023, Allianz Commercial, Allianz Global Corporate & Specialty (AGCS), and regional Allianz P&C commercial insurance divisions started conducting business. This action established a single go-to-market company that provides insurance solutions for large corporations, mid-sized businesses, and specialized risks. The new identity was formally adopted by several nations, with others following suit.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany property & casualty insurance market based on the below-mentioned segments:

Germany Property & Casualty Insurance Market, By Type of Insurance

- Property Insurance

- Casualty Insurance

- Motor Insurance

- Liability Insurance

Germany Property & Casualty Insurance Market, By Distribution Channel

- Direct Sales

- Brokers

- Agents

- Online Platform

Need help to buy this report?