Germany Potash Market Size, Share, and COVID-19 Impact Analysis, By Product (Potassium Chloride, Potassium Sulphate, Potassium Nitrate, and Others), By End Use (Agriculture and Others), and Germany Potash Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsGermany Potash Market Forecasts to 2035

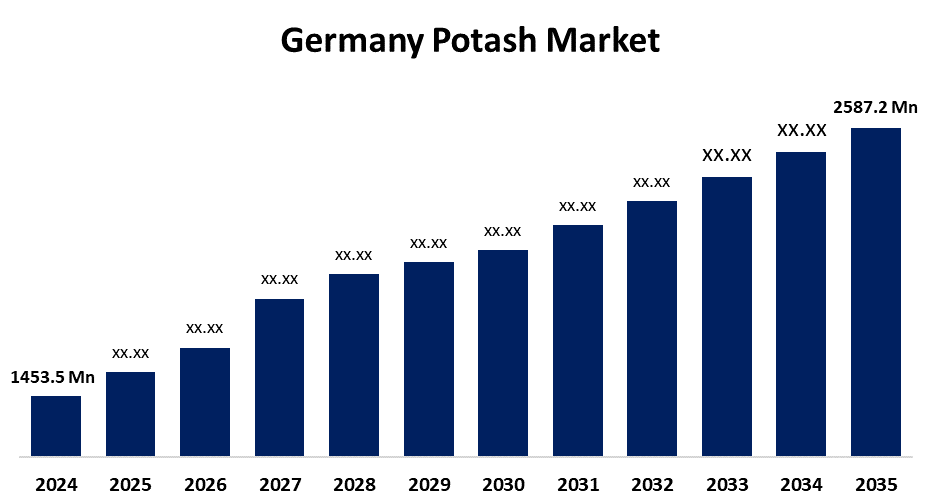

- The Germany Potash Market Size Was Estimated at USD 1458.5 Million in 2024

- The Germany Potash Market Size is Expected to Grow at a CAGR of around 5.35% from 2025 to 2035

- The Germany Potash Market Size is Expected to Reach USD 2587.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Potash Market is anticipated to reach USD 2587.2 million by 2035, growing at a CAGR of 5.35% from 2025 to 2035. Increased usage of potash fertilisers for increased crop yields is being driven by factors such as growing agricultural productivity, precision farming adoption, growing food demand, and a focus on sustainable practices.

Market Overview

The German potash market includes soluble potassium, a crucial agricultural nutrient required for plant processes such as photosynthesis, water management, and enzyme activity. Potash, which is widely used in fertilisers, is important for preserving soil fertility and increasing crop yields to meet of rising food demand. The need for improved agricultural productivity is growing as a result of German population growth and rising food consumption. A crucial source of potassium, potash is essential for enhancing crop yields, root growth, water retention, and disease and insect resistance. It is vital for intensive farming, particularly in nutrient-depleted soils, as it promotes plant growth by improving nutrient absorption and general plant health. Though demand is growing for speciality varieties like potassium sulphate (SOP) and potassium nitrate, which are better suited for high-value or chloride-sensitive crops such as fruits, vegetables, and nuts, the majority of potash is utilised as potassium chloride (KCl). Customised nutrition solutions are also becoming more popular as a result of the move towards precision and sustainable agriculture. The potash market is positioned as a vital part of contemporary agricultural systems and food security due to the rising demand and advancements in fertiliser techniques.

Report Coverage

This research report categorizes the market for the Germany potash market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany potash market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany potash market.

Germany Potash Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1458.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.35% |

| 2035 Value Projection: | USD 2587.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product, By End Use |

| Companies covered:: | K+S Aktiengesellschaft, DEUSA International GmbH, HELM AG, EuroChem Group AG, Yara International ASA, Grupa Azoty S.A. (COMPO EXPERT GmbH), ICL Group Ltd. (formerly Israel Chemicals Ltd.), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for potash increasing, economies of scale, and strategic location are some of the contributing factors to market consolidation in the potash market. Potash is an essential fertilizer component, and demand and prices of potash have an impact on mergers and acquisitions. Market consolidation can provide additional product options, enjoy greater bargaining power, reduce volatility in the market, and provide complementary resources. In addition, strategic partnerships can enhance competition and stability in the market. However, trade barriers, anti-trust legislation, and government regulation can have significant effects on the future and viability of consolidation initiatives in the industry.

Restraining Factors

Currency fluctuations can have a major effect on the potash market because they change production expenses, especially for producers importing foreign materials or equipment. Currency levels and, hence, potash market conditions will also be influenced from a broader view of macroeconomic variables, such as inflation, interest rates, and geopolitical events. These factors hamper the potash market during the forecast period.

Market Segmentation

The Germany potash market share is classified into product and end use.

- The potassium chloride segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany potash market is segmented by product into potassium chloride, potassium sulphate, potassium nitrate, and others. Among these, the potassium chloride segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The primary uses of potassium chloride, also known as muriate of potash (MOP), are as a source of potassium and as a raw material for industrial processes, including the manufacturing of nitrogen, phosphorus, and potassium (NPK) fertiliser. Food production will rise as a result of the growing population and the need for more food to sustain that population. As a result, potash products are rapidly gaining importance in agriculture to encourage higher crop yields.

- The agriculture segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany potash market is segmented by end use into agriculture and others. Among these, the agriculture segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Food security, yield, and crop development must all be improved in the agriculture industry. The development of roots, plant growth, and plant health are all aided by this vital nutrient. Potash has become a crucial component of contemporary agricultural operations and is now a crucial component of fertiliser blends used to boost agricultural production in order to satisfy rising demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany potash market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- K+S Aktiengesellschaft

- DEUSA International GmbH

- HELM AG

- EuroChem Group AG

- Yara International ASA

- Grupa Azoty S.A. (COMPO EXPERT GmbH)

- ICL Group Ltd. (formerly Israel Chemicals Ltd.)

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and

Research Firm - Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany potash market based on the below-mentioned segments:

Germany Potash Market, By Product

- Potassium Chloride

- Potassium Sulphate

- Potassium Nitrate

- Others

Germany Potash Market, By End Use

- Agriculture

- Others

Need help to buy this report?