Germany Pet Care Products Market Size, Share, and COVID-19 Impact Analysis, By Pet Type (Dog, Cat, and Others), By Product Type (Pet Food Products, Veterinary Care, and Others), and Germany Pet Care Products Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsGermany Pet Care Products Market Insights Forecasts to 2035

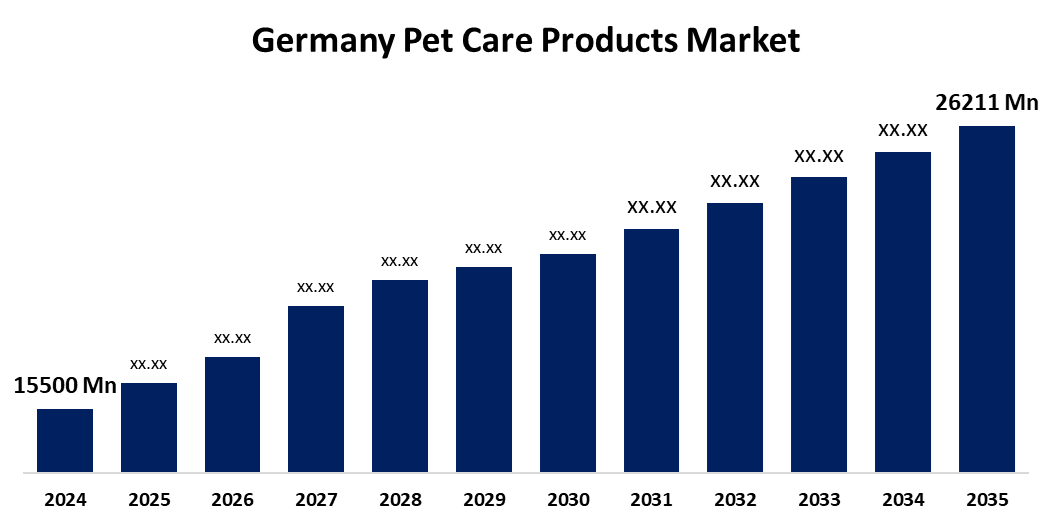

• The Germany Pet Care Products Market Size was Estimated at USD 15500 Million in 2024

• The Market Size is Expected to Grow at a CAGR of around 4.89% from 2025 to 2035

• The Germany Pet Care Products Market Size is Expected to Reach USD 26211 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Germany Pet Care Products Market Size is Expected to Grow from USD 15500 Million in 2024 to USD 26211 Million by 2035, Growing at a CAGR of 4.89% during the Forecast Period 2025-2035. The pet care products market is driven by a combination of factors including the rising trend of pet humanization, increased disposable income, and a growing demand for high-quality, premium, and sustainable pet products and services.

Market Overview

The German Pet Care Products Market Size is a vibrant and Growing area, characterized by a strong preference for high quality, natural and durable products. German consumers, who see their pets as family members, are demanding premium pet food, goods and other care products including veterinary care and smart stomach tech. The German Pet Care Products Market is one of the largest and most mature in Europe, with high rates of pet's ownership, with an increase in PET humanization trends and increasing expenses on premium and health-centered PET products. The market includes a wide range of food, including food, grooming, healthcare, accessories and hygiene products for pets such as dogs, cats, birds and small mammals. Environment-conscious options such as biodegradable grooming products, recycling packaging, and plant-based pet foods presents significant growth capacity for food-based pets. The integration value of IOT and AI in PET care through smart feeders, GPS collar and health monitoring apps provides a new dimension for additional services and brand discrimination. Pet care brands are expanding their portfolio, including VT-endorsed supplements, telegarth platforms, and behavioral products, exploiting in a broad welding economy. Retail vendors are rapidly invested in private-labeled PET care products, providing cheap options without any compromise in especially cleanliness and grooming classes without compromising on quality. This legal structure ensures high standards in pet breeding, housing and care, indirectly increases the demand for obedient, high quality PET products. Manufacturers are encouraged to reduce packaging waste and increase recycling. Companies that align with these stability rules can benefit from tax promotion and increase in brand reputation. SMEs in PET care space are benefited from federal funding programs aimed at digitalization (eg, "digital jetzt"), supporting e-commerce abilities and integration of digital marketing.

Report Coverage

This research report categorizes the market for the Germany pet care products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pet care products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany pet care products market.

Germany Pet Care Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15500 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.89% |

| 2035 Value Projection: | USD 26211 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Pet Type, By Product Type |

| Companies covered:: | Fressnapf, Das Futterhaus, Nestle Purina, Mars, Colgate-Palmolive (Hill’s), and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Germany has an important pet population, with more than 34 million pets in homes. This trend is inspired by changing lifestyle, increasing urbanization, and increasing preference for fellow animals, especially between millennium and elderly demographic. The trend of "pet humanization" further promotes the demand for premium and biological products as family members to treat pets, such as grain -free food, grooming solutions and special healthcare. Consumers are transferred to premium products with additional health benefits, such as functional foods and neutraceutics. Innovation in packaging, formulation, and delivery formats (eg, subscription-based pet boxes, freeze-dry food) are further stimulating the development of the market. Online Retail Pet is playing an important role in shaping the case scenario. Major platforms and niche e-commerce players are offering comprehensive product classification, personal offerings and door-to-door delivery, enhancing consumer feature. Increasing awareness about pet nutrition, dental hygiene, mental health and preventive healthcare is leading to maximum adopting health-focused PET care products.

Restraining Factors

The rising cost of premium and organic pet care items can limit the entry into the market, especially between value-sensitive consumers. Strict European Union and German rules on materials, product labelling and animal welfare compliance can create challenges for those entering the market. For certain products, imports on imports may be affected by trading disruption and tariffs. Consumer preferences and brand options can be affected by increasing the investigation on the carbon footprint of plastic packaging, waste production and pet food production.

Market Segmentation

The Germany pet care products market share is classified into pet type and product type.

- The cats segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany pet care products market is segmented by pet type into dog, cat, others. Among these, the cats segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is primarily due to their high number of households and adaptability to smaller living spaces. Cats account for a significant portion of pet ownership, and their low maintenance requirements make them suitable for urban environments.

- The pet food products segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany pet care products market is segmented by product type into pet food products, veterinary care, and others. Among these, the pet food products segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. t food products dominate the market, accounting for a significant share. This is primarily due to the daily feeding needs of pets, with dry food being particularly popular for its convenience and cost-effectiveness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany pet care products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fressnapf

- Das Futterhaus

- Nestle Purina

- Mars

- Colgate-Palmolive (Hill's)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany pet care products market based on the below-mentioned segments:

Germany Pet Care Products Market, By Pet Type

- Dog

- Cat

- Others

Germany Pet Care Products Market, By Product Type

- Pet Food Products

- Veterinary Care

- Others

Need help to buy this report?