Germany Mobile Payment Technology Market Size, Share, and COVID-19 Impact Analysis, By Mode of Transaction (NFC, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response System, Mobile App, Others), By Type (B2B, B2C, BFSI), By Distance (Remote and on point of sales), and Germany Mobile Payment Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyGermany Mobile Payment Market Insights Forecasts to 2035

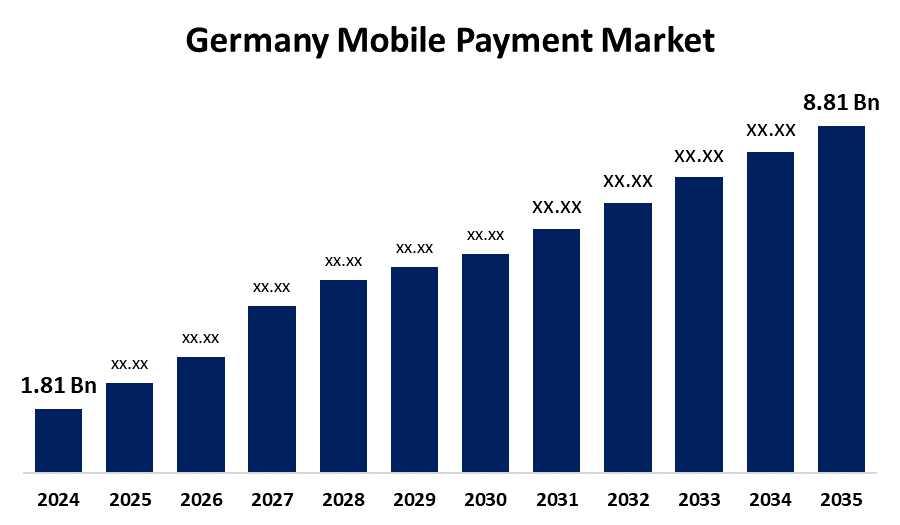

- The Germany Mobile Payment Market Size Was Estimated at USD 1.81 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.47% from 2025 to 2035

- The Germany Mobile Payment Market Size is Expected to Reach USD 8.81 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Mobile Payment Market Size is Anticipated to reach USD 8.81 Billion By 2035, Growing at a CAGR of 15.47% from 2025 to 2035. The market for mobile payment is being driven by increasing mobile penetration, technological innovations, no limitations of distance and speed and accuracy.

Market Overview:

The mobile payment market is where all transactions are made by mobile (cell phones, tablets, etc). This is a rapidly growing market post-pandemic. A mobile payment is a money payment made for a product or service through a portable electronic device such as a tablet or cell phone. Mobile payment technology can also be used to send money to friends or family members, such as with the applications PayPal and Venmo. Currently utmost consumer uses digital payment modes. In upcoming years this market will boom briskly and surpass organic payment styles. The government of Germany actively promotes building a strong and secure mobile payment market in various ways and regulations. They make efforts to enhance digital financial services, make the financial system stable and secure, and make the digital economy innovative. Also, various innovations like NFC and QR codes have been made in past years, and many more to come. Mobile payments offer a plethora of benefits that make them an attractive option for both consumers and businesses. It is very convenient option than any other payment option. It is faster and accurate. This market is money making market, and some in app purchase options boosts sales conversion ratio.

Report coverage:

This research report categorizes the market for the Germany mobile payment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany mobile payment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany mobile payment market.

Germany Mobile Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.81 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 15.47% |

| 2035 Value Projection: | USD 8.81 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Mode of Transaction, By Distance and COVID-19 Impact Analysis |

| Companies covered:: | PayPal, Google (Google Pay), Apple (Apple Pay), Samsung (Samsung Pay), Amazon (Amazon Payments), Visa, Mastercard, Deutsche Bank, Sparkasse, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Diving factors:

Mobile payment is becoming a new trend nowadays. There are no distance restrictions for digital payments. Apps and websites allow users to do both types of transactions (Point-of-sale (PoS), peer-to-peer (p2p)).Technological advancements are also driving this market smoothly in terms of data security. Increase in mobile penetrations and ecommerce payments this industry is growing rapidly.

Restraining Factors:

Data security issues, restricted internet connectivity in remote regions, regulatory obstacles, high transaction costs, and opposition from traditional financial institutions are some of the barriers that the mobile payment business must overcome.

Market Segmentation

The mobile payment market share is classified into mode of transaction, type and distance.

- The mobile web payment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on technology, mobile payment market is segmented by mode of transaction into NFC, direct mobile billing, mobile web payment, SMS, interactive voice response system, mobile app, and others. Among these, mobile web payment held significant market share in 2024 and expected to grow at good CAGR during the forecast period. In this type user can make payment from any device. They are secure as they are encrypted and fulfill security measures. They are having user friendly interface. Also allows various payment options like credit cards, wallets, debit card, etc.

- The B2B segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on technology, mobile payment market is segmented by type into B2B, B2C and BFSI. Among these, B2B holds highest market share in 2024 and expected to grow with remarkable CAGR during the forecast period. Due to its increasing use by enterprises, adoption of advanced technologies in mobile applications, and the convenience and security it offers, especially for financial transactions.

- The remote segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on distance, mobile payment market is segmented by distance into remote and on point of sales. Among these, remote type payment holds highest market share in 2024 and expected to grow with CAGR during this forecast period. This is attributable to heightened e-commerce uptake, heightened mobile penetration, and the ease of paying anywhere, anytime. Digital wallets and online apps are favored by consumers for online purchases, subscriptions, and services, accelerating growth. Technology innovations and user experience enhancement continue to propel this segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany mobile payment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- PayPal

- Google (Google Pay)

- Apple (Apple Pay)

- Samsung (Samsung Pay)

- Amazon (Amazon Payments)

- Visa

- Mastercard

- Deutsche Bank

- Sparkasse

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany mobile payment market based on the below-mentioned segments:

Germany Mobile Payment Market, By Mode of Transaction

- NFC

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Interactive Voice Response System

- Mobile App

- Others

Germany Mobile Payment Market, By Type

- B2B

- B2C

- BFSI

Germany Mobile Payment Market, By Distance

- Remote

- On point of sales

Need help to buy this report?